3 Solid Stocks to Play the International Upstream Industry

While the commodity benchmarks have retreated from their multi-year highs on recession fears, they are strong enough for the Zacks Oil and Gas - Exploration and Production - International industry to notch substantial gains in the final quarter of this year. In this context, investors might want to focus on Vermilion Energy VET, Tullow Oil TUWOY and EnQuest PLC ENQUF for attractive cash flow and shareholder returns.

Industry Overview

The Zacks Oil and Gas - International E&P industry consists of companies primarily operating outside the United States and focused on the exploration and production (E&P) of oil and natural gas. These firms find hydrocarbon reservoirs, drill oil and gas wells, and produce and sell these materials to be refined later into products such as gasoline, fuel oil, distillate, etc. The economics of oil and gas supply and demand is the fundamental driver of this industry. In particular, a producer’s cash flow is primarily determined by the realized commodity prices. In fact, all E&P companies are vulnerable to historically volatile prices in the energy markets. A change in realizations affects their returns on drilling inventory and causes them to alter production growth rates. These operators are also exposed to exploration risks where drilling results are uncertain.

4 Key Investing Trends to Watch in the Oil and Gas - International E&P Industry

Backdrop of a Tightening Market: Fears revolving around high inflation and slowing growth somewhat cloud the outlook for the energy market. Even then, it has continued to be the best S&P 500 sector this year. The space has generated a total return of almost 37% in 2022 compared with the S&P 500’s loss of around 20%. Apart from a constructive fundamental picture, the sector is enjoying support from geopolitical uncertainty amid Russia’s military operations in Ukraine. In March, crude prices surged to multi-year highs of $130 on concerns about supplies from Russia, which is one of the world's largest producers of the commodity. While oil has pulled back from those lofty levels, there is no sign of a quick resolution to the conflict, the risk of dwindling inventory and chances of the influential oil exporters’ group OPEC agreeing on a production curtailment. These give the commodity enough reasons to stay elevated in the near to medium term. Meanwhile, natural gas recently hit $10 per MMBtu for the first time since 2008 on the back of a hotter-than-normal summer, a slack domestic output and strong LNG shipments. Importantly, commodity prices appear to be at levels where the operators can generate free cash flow through their drilling activities.

Commitment to Low-Cost Initiatives: The energy companies have changed their approach to spending capital. Over the past few years, producers have worked tirelessly to cut costs to a bare minimum and look for innovative ways to churn out more oil and gas. And they managed to do just that by improving drilling techniques and extracting favorable terms from the beleaguered service providers. Moreover, driven by operational efficiencies, most E&P operators have been able to reduce unit costs, while the coronavirus-induced collapse in crude has forced them to adopt a more disciplined approach to spending capital. These actions might restrict short-term production but are expected to preserve cash flow, support balance sheet strength, and help the companies eventually emerge stronger. In particular, despite continued inflation and supply-chain challenges, cash from operations is on a sustainable path as revenues improve and companies slash capital expenditures from the pre-pandemic levels amid sharply higher commodity prices.

Increased Shareholder Returns: The sharp increase in crude prices has allowed the upstream operators to deliver a solid financial performance. In particular, cash from operations should be on a sustainable path as revenues improve and companies slash capital expenditures from the pre-pandemic levels amid sharply higher commodity realizations. To put it simply, the environment of strong prices has helped the E&P firms to generate significant “excess cash,” which they intend to use to boost investor returns. In fact, more and more energy companies are allocating their increasing cash pile by way of dividends and buybacks to pacify the long-suffering shareholders.

Economic Uncertainties: The Fed’s latest move to raise its core interest rate by another 0.75% has cast a pall over the stock market. It has led to a precipitous drop in the equity indices (including energy stocks), which have fallen to lows not seen since July. What stands out is that the rates may not have peaked yet, and more toughness could be in store for the remainder of this year and 2023. This is because attempts are being made to cool the 40-year high inflation and prevent it from becoming entrenched. As such, trading is expected to be choppy for the U.S. stock markets ahead, even as investors have been witnessing extreme volatility since the beginning of 2022. Risks stemming from recession fears, geopolitical tensions and dwindling liquidity may also lead to a rough road for oil/gas equities. In particular, worries about weaker energy demand due to the threat of recession might jeopardize the post-pandemic rebound in commodity consumption.

Zacks Industry Rank Reflects Upbeat Outlook

The Zacks Oil and Gas – International E&P industry is a 10-stock group within the broader Zacks Oil - Energy sector. It currently carries a Zacks Industry Rank #78, which places it in the top 31% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates improving near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are highly optimistic on this group’s earnings growth potential. While the industry’s earnings estimate for 2022 have surged 218.4% in the past year, the same for 2023 have risen by an astounding 1,488.5% over the same timeframe.

Considering the encouraging near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

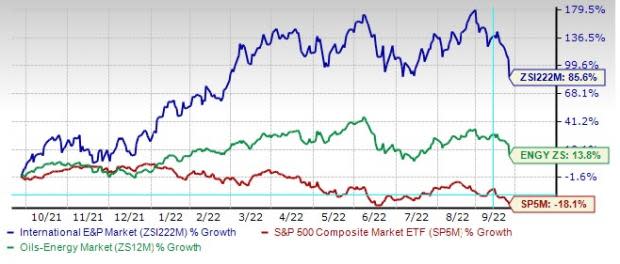

Industry Outperforms Sector & S&P 500

The Zacks Oil and Gas - International E&P industry has fared much better than the broader Zacks Oil - Energy Sector as well as the Zacks S&P 500 composite over the past year.

The industry has rocketed 85.6% over this period compared with the broader sector’s increase of 13.8%. Meanwhile, the S&P 500 has lost 18.1%.

One-Year Price Performance

Industry's Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of non-cash expenses.

On the basis of the trailing 12-month enterprise value-to EBITDA (EV/EBITDA) ratio, the industry is currently trading at 3.18X, significantly lower than the S&P 500’s 11.33X. However, it is slightly above the sector’s trailing-12-month EV/EBITDA of 3.13X.

Over the past five years, the industry has traded as high as 22.14X, as low as 2.19X, with a median of 7.30X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

3 Oil and Gas - International E&P Stocks to Watch For

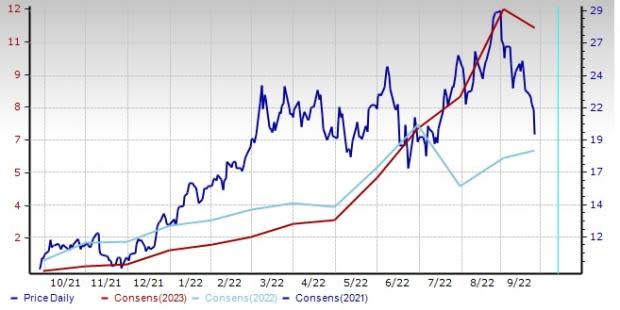

Vermilion Energy: Vermilion Energy is an oil and gas explorer with producing properties in Europe, North America and Australia. The energy explorer’s diversification across different continents provides it with certain advantages relative to the other upstream players. VET, with its unique portfolio of high-margin, low-decline assets, is currently focused on cost reductions and positive free cash flow generation.

Valued at around $3.2 billion, Vermilion Energy has a projected earnings growth rate of 142.1% for 2022. VET currently carries a Zacks Rank #1 (Strong Buy). Vermilion Energy’s shares have soared around 116.2% in a year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Price and Consensus: VET

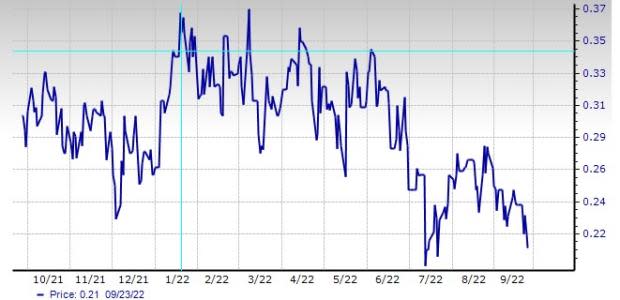

EnQuest: This London-based upstream operator has key operations in the UK North Sea and Malaysia. The company’s impressive production efficiency across the portfolio is at the crux of ENQUF’s growth story. EnQuest has adjusted its capital plans to the prevailing market conditions, resulting in strong operating cash flows. ENQUF also possesses an active hedging program that provides further downside protection from commodity price fluctuations.

The 2022 Zacks Consensus Estimate for EnQuest Energy indicates 53.9% earnings per share growth over 2021. The Zacks Rank #2 (Buy) ENQUF’s shares are up 7.2% in a year.

Price and Consensus: ENQUF

Tullow Oil: Tullow Oil is a London-based hydrocarbon producer and explorer, focusing mainly on Africa. TUWOY’s significant positions in discovered and emerging basins and focus on capital discipline should result in a noticeable improvement in profitability. In particular, the oil and gas finder’s operational excellence and technical expertise stand it in good stead.

In addition to the favorable fundamentals, TUWOY enjoys a Zacks Value Style Score of A and Growth of B. Tullow Oil carries a Zacks Rank #3 (Hold). TUWOY’s shares have lost 29.9% in a year.

Price and Consensus: TUWOY

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vermilion Energy Inc. (VET) : Free Stock Analysis Report

Tullow Oil PLC (TUWOY) : Free Stock Analysis Report

EnQuest (ENQUF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance