3 Stocks That Are Absurdly Cheap Right Now

At any given moment in the market -- no matter how expensive the market may be -- there are always some stocks that trade at incredibly cheap valuations. So for investors who really like to dive deep into financial statements and valuation metrics, there are always great deals to be had.

We asked three of our investing contributors to each highlight a stock they see as incredibly cheap in today's rather expensive market. Here's why they think General Motors (NYSE: GM), American Outdoor Brands (NASDAQ: AOBC), and National Oilwell Varco (NYSE: NOV) look like great value investments.

Image source: Getty Images.

An automaker built to last

Travis Hoium (General Motors): The market is treating General Motors as if it's going to be pulverized by Tesla, Uber, or some other start-up looking to disrupt the automotive business. But GM is surprisingly advanced in both electric vehicles (EVs) and autonomous vehicles, and investors should start treating it as the visionary company that it is.

On the EV side, GM was the first to launch a long-range EV priced for the masses, the Chevy Bolt. According to Inside EVs, the Chevy Bolt is the No. 2 selling EV in the U.S., with 17,083 sold compared to 20,750 Tesla Model S sales. The Chevy Volt is No. 3, with 16,710 sales.

GM is no slouch in autonomous technology either. The Cruise Automation division announced that it is ready to mass-produce fully autonomous vehicles, and CEO Mary Barra said it's a matter of "quarters, not years" before driverless cars will be on the streets.

On top of the advanced technology GM is developing, the company is profitable and has strong free cash flow. You can see in the chart below that GM's net income, while down recently, has averaged $6.9 billion over the last five years:

GM Free Cash Flow (TTM) data by YCharts.

The solid free cash flow from the legacy car business is not only trading at a value -- GM's Enterprise value to EBITDA is a modest 5.7 times -- it will fund the next generation of technological advances. That's why I think GM is still absurdly cheap today.

Unrealized long-term potential

Rich Duprey (American Outdoor Brands): Few companies present as good an investment profile as that of American Outdoor Brands, owner of the Smith & Wesson firearms brand; it has recently expanded into the rugged outdoors market. The business has huge long-term potential, yet it is being priced by the market as if it's about to be melted down for scrap.

The firearms industry is in the midst of a sales slump. American Outdoor Brands reported that gun sales plunged 48% last quarter while industry peer Sturm, Ruger said its sales were down 35%. Shares of the former are down 38% over the past year; the latter is actually up almost 2%.

Yet after two recent mass shooting tragedies, their respective stocks have hardly moved. While that might appear cold and cynical, it does indicate the mood of gun owners and enthusiasts: that despite the incidents, their fear of significant legislation restricting gun rights is negligible.

Regardless, the gun industry does continue to grow, and FBI criminal background checks of potential gun buyers -- an admittedly inexact proxy for demand -- continues to hew to historical trends over a two-year period. What that means is that people aren't being moved to buy firearms in response to horrific incidents, but they're still buying.

And when you look at American Outdoor Brands' valuation, it is ridiculously cheap. It trades at just 8 times earnings and next year's estimates; at a fraction of its projected long-term earnings growth rate; and at only 14 times the free cash flow it produces. For a business that remains unusually strong in the face of industry adversity (and has a whole other market to tackle), it's priced too cheap to ignore.

A rarely seen valuation for a top-notch energy stock

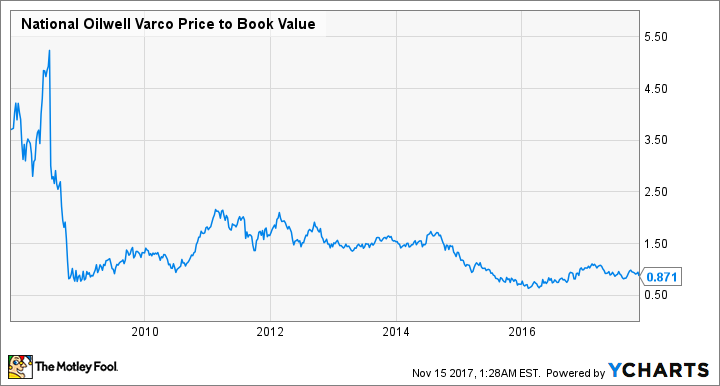

Tyler Crowe (National Oilwell Varco): You can count on one hand the number of times National Oilwell Varco's stock has traded at a price-to-book-value ratio of less than 1:

NOV Price to Book Value data by YCharts.

Besides this recent decline, the other one came at the depths of the Great Recession. It's understandable that the stock isn't trading at a premium today. The company's biggest revenue generator is big-ticket items like supplying all of the drilling equipment for an offshore rig, but companies aren't building new rigs right now. That said, it has too many other sources of revenue to justify a valuation that low.

National Oilwell Varco manufactures equipment for just about every part of the oil and gas value chain, so when one part of the business struggles, another is likely doing well enough to offset it. That has been the case lately, as the Wellbore Technologies and Completion & Production Systems segments are growing thanks to increased demand from North American shale producers. Though earnings have been elusive for several quarters, the company still generates enough cash to cover its spending needs, and has padded its cash reserves for the past few quarters in a row. Eventually, companies are going to wear out their existing equipment and will have to open up their wallets for larger-price-tag items, and National Oilwell Varco is likely to be the supplier of that equipment.

The signs of an oil recovery are starting to show. Underinvestment in new sources has led to faster depletion rates at existing reservoirs around the world, and North American shale can only offset those declines for so long. As this trend continues and oil prices start to tick up as a result, don't be surprised if National Oilwell Varco's business picks up in a big way, and takes its stock price with it.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Rich Duprey has no position in any of the stocks mentioned. Travis Hoium has no position in any of the stocks mentioned. Tyler Crowe owns shares of, and The Motley Fool owns shares of and recommends, National Oilwell Varco and TSLA. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance