3 Stocks Up Over 25% in 2017 That Could Head Higher

So far, 2017 has been a good year for investors. The major indices are all up at least 15%, well above the long-term historical return for the stock market. But within this large pool of stocks, some have performed markedly better.

In fact, three of our Motley Fool investors have picked out a stock that's up at least 25% so far this year, but that they believe has the potential to return much more over the rest of the year... and far beyond. Read below to see why they believe shares of Shopify (NYSE: SHOP), Skechers (NYSE: SKX), and NVR (NYSE: NVR) all have lots of room to grow... even though 2017 has already treated shareholders quite well.

Image source: Getty Images

Don't be scared away by Shopify's valuation

Brian Stoffel (Shopify): There's no doubt that this has been a year to remember for Shopify. Through the end of October, shares were trading over 120% higher on the year. And yet, I recently added even more shares of the company -- which helps small- and medium-sized businesses develop their Internet presence -- to my own portfolio.

Why would I do that? Because it has everything I look for in an investment: a powerful mission, wide moat, healthy balance sheet, and management with significant skin in the game.

Shopify's mission is, "To make commerce better for everyone." Already, that mission has been tested, and Founder/CEO Tobias Lutke ensured that it passed with flying colors. Critically, this mission has the three things I always look for: the simplicity to help guide an employee's decisions, an inspirational message, and the possibility to succeed in multiple ways. Already, the company has expanded beyond just subscription services to success-based Merchant Solutions.

Because the businesses that use Shopify integrate all of their mission-critical data into the company's platform, switching costs can be very high. Additionally, as more third-party app developers flock to the site to gain access to Shopify's 500,000 merchants, a network effect is taking hold: more third-party apps attracts more merchants, which in turn attracts even more third-party app developers.

The company isn't profitable on an annual basis yet, but that doesn't concern me at all. It has $920 million in cash and investments on hand, with negligible debt. And perhaps most important, Lutke and his fellow executives own over 14 million shares of the company -- worth over $1.5 billion and representing nearly 60% of voting rights in the company.

Making a comeback

Tim Green (Skechers): Shares of footwear company Skechers are still well below their all-time high, reached in 2015 amid an impressive streak of growth. Growth has slowed since then, but Skechers' recent third-quarter report showed that it could still put up impressive numbers. Revenue rose 16.2% year over year on the back of strong international growth, and net income soared more than 40%.

Skechers stock rocketed higher following the report, and it's kept most of those gains intact since then. Shares are up about 32% year to date, but the run may not be over. The international wholesale business is booming, growing by more than 25% during the third quarter, with sales in China increasing by nearly 50%. The global retail business is also performing well, with comparable sales at company-owned stores growing by 4.4%. In an era of retail upheaval, that's an impressive feat.

If Skechers can keep up this type of performance, the stock could continue grinding higher in the coming quarters. The bottom line is starting to perk up, and analysts are expecting a 20% earnings increase in 2018.

Based on analyst estimates for this year, Skechers trades for about 19 times earnings. That may not look like a bargain, but with the company's potential for double-digit revenue and earnings growth, the stock may still be undervalued.

Riding the wave of the next generation of homeowners

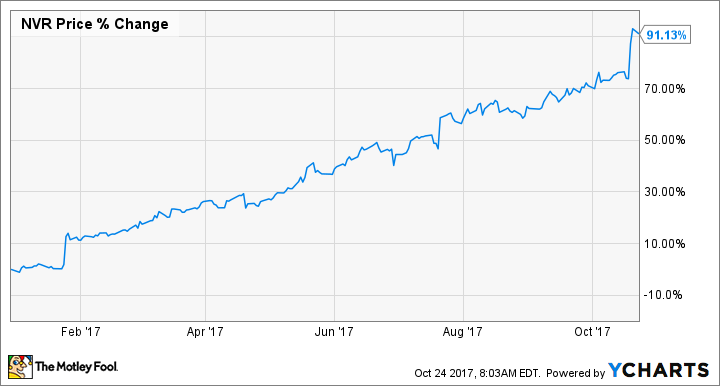

Tyler Crowe (NVR): Homebuilder NVR has had an incredible run thus far in 2017, thanks to a healthy amount of housing starts. Those housing starts are backed up by some encouraging macro trends that heavily influence homebuying: low unemployment, modestly rising wages, and a low-interest-rate environment that encourages borrowing sooner than later.

This particular housing market looks especially attractive because a large age demographic -- millennials -- are entering a point in their lives where they're buying homes. Also, the supply of homes has been kept down because of people holding onto their houses for longer and homebuilders taking a more measured approach to building, as memories of the housing collapse are still seared into their memories.

All of these factors work in NVR's favor, but that could be said about all homebuilders. What makes NVR's strategy unique and highly lucrative is that the company is currently targeting its new homes for first-time buyers -- the average selling price for the prior quarter was $382,800 -- while keeping overhead costs low, and more cash on hand than total debt outstanding.

Even though NVR's stock is up 90% so far this year, there are reasons to think that there's still room for this stock to run. All of those macroeconomic trends mentioned above are still in place, and the company continues to see growth in new home orders and overall backlog. This may be a cyclical market, but NVR looks to be a ways away from the top.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Brian Stoffel owns shares of Shopify. Timothy Green owns shares of Skechers. Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Shopify and Skechers. The Motley Fool owns shares of NVR. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance