These 3 Stocks Popped Following Quarterly Results

We’ve got an action-packed week in the market, with earnings season shifting into a higher gear. So far, Q3 results have been primarily positive, helping to keep sentiment in check and again elude the ‘earnings apocalypse’ many had feared.

So far, there have been several notable reports that caught the market’s attention, including those from Amazon AMZN, Verizon Communications VZ, and Netflix NFLX. All three saw their shares pop post-earnings.

But what was there to like in each release? Let’s take a closer look.

Verizon Communications

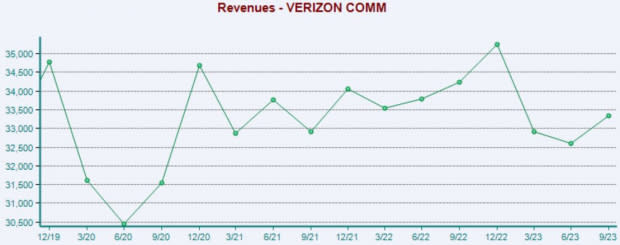

Verizon posted a bottom line beat but modestly fell short of revenue expectations, with both items lower than the same period last year. Still, YTD free cash flow totaled $14.6 billion, well above the $12.4 billion last year.

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

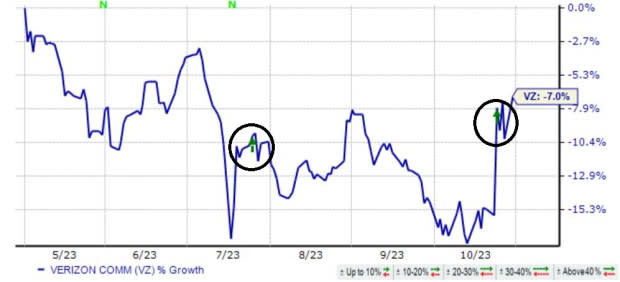

Verizon raised its FY23 free cash flow guidance following the results, expected at $18 billion vs. prior views of $17 billion. Verizon shares also got a nice boost following the release, reflecting that market participants were pleased with the results despite a top line miss.

The positive share reaction is further illustrated below, a notable difference compared to the response following the prior release.

Image Source: Zacks Investment Research

Amazon

Amazon posted a sizable 47% EPS beat, with earnings improving notably from the year-ago period amid a more favorable operating environment. Quarterly revenue totaled $143.1 billion, modestly ahead of expectations and well above year-ago quarterly sales of $127.1 billion.

Amazon’s revenue growth has remained strong, as we can see below.

Image Source: Zacks Investment Research

Still, what had market participants excited was the company’s AWS results. AWS sales totaled $23.1 billion throughout the period, up 12% year-over-year as cloud momentum stabilizes. Further, AWS operating income totaled $7 billion, well above the year-ago figure of $5.4 billion.

A record-setting Prime event also provided tailwinds, with U.S. Prime members alone purchasing more than 25 million items with Same-Day or Next-Day delivery. Shares popped following the release, as we can see below.

Image Source: Zacks Investment Research

Netflix

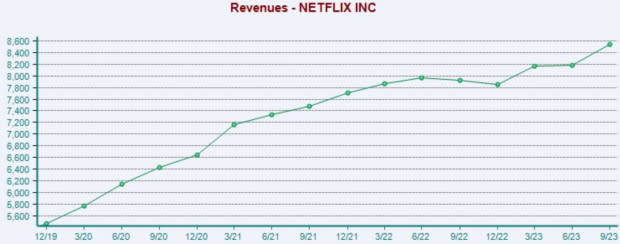

Netflix reported quarterly EPS of $3.73, beating the Zacks Consensus EPS Estimate of $3.46 and improving 20% year-over-year. Quarterly revenue totaled $8.5 billion, improving 8% from the year-ago quarter and above the company’s previous forecast due to better-than-expected membership growth.

Image Source: Zacks Investment Research

Paid Net Membership additions totaled 9 million, crushing expectations and boosted by the adoption of the company’s new ad-supported plans. Impressively, ad-supported memberships grew 70% quarter-over-quarter.

To top it off, Netflix provided solid guidance, raising its free cash flow outlook and announcing more price hikes for US, UK, and France membership plans. The company’s Basic plan will now cost $11.99, and Premium plans will be raised to $22.99.

Investors cheered on the news of price hikes and better-than-expected membership growth, with Netflix shares popping post-earnings.

Image Source: Zacks Investment Research

Bottom Line

With earnings season in full swing, there are sure to be surprises lurking beneath.

And so far, all three companies above – Amazon AMZN, Verizon Communications VZ, and Netflix NFLX – have positively surprised, with shares of each seeing buying pressure post-earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance