3 Stocks You Can Safely Own Until 2030

Years come and go pretty fast. We're almost through 2017, but it seems like no time ago when everyone was celebrating the New Year. The end of the decade will be here soon. For that matter, so will the end of the next decade.

While you might not want to think about time passing by so quickly, time is one of the best friends to an investor. Buying and holding great stocks for a long period can yield huge returns. With this in mind, we asked three Motley Fool investors to identify stocks that you can safely own until 2030. Here's why they picked Kinder Morgan (NYSE: KMI), Microsoft (NASDAQ: MSFT), and Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B).

Image source: Getty Images.

Energy independence changes everything

Maxx Chatsko (Kinder Morgan): Kinder Morgan hasn't exactly been the poster child for safe haven investments, but few companies are better positioned to take advantage of the long-term trends just getting under way in North American energy. After being dismissed as a pipe dream about 10 years ago, energy independence is finally within reach. In fact, it's a near certainty.

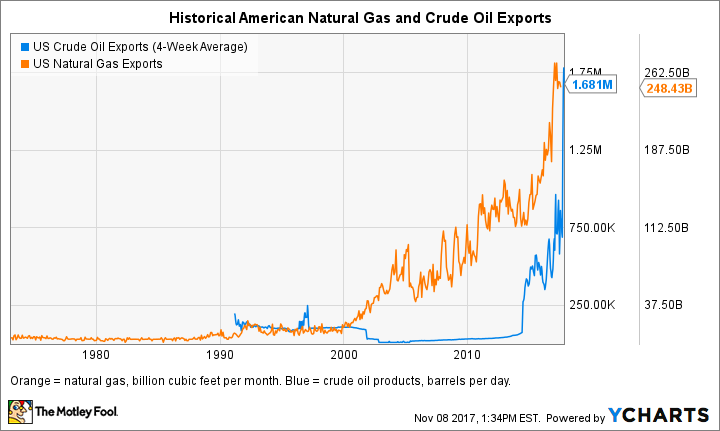

Not only is North America racing toward energy independence, but the continent is quickly becoming a leading global energy exporter, too. The United States exported an average of 1.7 million barrels per day (mbpd) of crude oil in October, which could swell to 3.2 mbpd or higher as production grows in the coming years.

That doesn't even factor in natural gas exports. The United States became a net exporter of natural gas this year for the first time since 1958 -- and that's mostly thanks to land-based pipelines. But the most growth will be driven by liquified natural gas (LNG). By 2019, the United States is projected to have 9.5 billion cubic feet per day (Bcf/d) of LNG export capacity, up from just 1.4 Bcf/d at the end of 2016.

US Crude Oil Exports (4-Week Average) data by YCharts

Quickly growing energy production and exports is amazing news for Kinder Morgan. The world's largest pipeline owner and operator should see its fee-based business model reach new heights with regular consistency for the foreseeable future. More production translates to more products needing to be moved to processing centers, storage facilities (it owns those, too), and export terminals on the country's shores. That makes management's job relatively easy.

An adapting tech giant

Tim Green (Microsoft): Technology changes so quickly that leading tech companies can, and often do, get swept away into the dustbin of history, unable to evolve and adapt. Success today in no way guarantees success tomorrow, a fact that investors need to always keep in the back of their minds.

One tech company that's proving it can change with the times is Microsoft. The decades-old tech giant, long dependent on its Windows PC operating system and Office productivity software, is making waves in the cloud. It's Azure cloud platform, a strong No. 2 player behind Amazon.com's Web Services, is nearly doubling sales year over year, and the cloud-based subscription version of Office is growing fast as well.

Microsoft's fiscal first-quarter results demonstrated its progress. Revenue was up 12% year over year, and net income soared 16%. The parts of Microsoft growing the fastest -- Azure, Office 365, Dynamics 365 -- are all cloud-based. Other business, including Windows, Surface hardware, and gaming, produced growth, but not to the same extent as Microsoft's cloud businesses.

Cloud computing only went mainstream in the past few years, and other technologies will almost certainly follow suit between now and 2030. Microsoft's aggressive cloud computing push should give investors some confidence that the company can keep up with whatever changes lie ahead.

Lots of eggs in one basket

Keith Speights (Berkshire Hathaway): There's a lot to be said in favor of diversification. With Berkshire Hathaway, you can get a significant amount of diversification with just one stock. At last count, the company had over 60 different subsidiaries. These businesses included homebuilders, insurers, manufacturers, railroads, restaurants, retailers, and more.

But Berkshire Hathaway's diversification doesn't stop there. It also owns stakes, both large and small, in over 40 other publicly traded companies. These investments also span multiple industries, from airlines and banks to telecommunication companies and wholesale retailers.

Of course, diversification isn't the only thing you want as an investor. You expect the stocks you buy to generate returns. Berkshire Hathaway is a superstar in that department, achieving compounded average growth of more than 20% annually since 1965. By comparison, the S&P 500 returned an average of less than 10% during that period -- with dividends included.

Perhaps the biggest question about buying Berkshire Hathaway stock and holding it through 2030, though, is that its leader, Warren Buffett, would turn 100 years old that year. Buffett appears to be fit as a fiddle, but it's likely that he will retire before 2030. Would that jeopardize the stock? I don't think so. He has done an admirable job of bringing in executives who share his philosophy. The Buffett way at Berkshire should continue through 2030 and beyond.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Keith Speights has no position in any of the stocks mentioned. Maxx Chatsko has no position in any of the stocks mentioned. Timothy Green owns shares of Berkshire Hathaway (B shares). The Motley Fool owns shares of and recommends Amazon, Berkshire Hathaway (B shares), and Kinder Morgan. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance