3 Stocks You Can Safely Own Until 2030

What's better than a fantastic investment for today? One that will keep rewarding you over the long run, of course. Compounding returns over many years, or even decades, is the magic wand that turns today's modest investments into tomorrow's millionaires.

So we asked a few of your fellow investors here at The Motley Fool to share their best ideas for stocks that will keep on giving for many years to come. Here's why our panelists would trust Walt Disney (NYSE: DIS), American Tower (NYSE: AMT), and Starbucks (NASDAQ: SBUX) to deliver market-beating returns for at least the next 12 years.

Image source: Getty Images.

Coffee is a safe bet

Demitri Kalogeropoulos (Starbucks): People have been sipping coffee for centuries, and I'd say it's a safe bet that Starbucks will still be a leading player in the industry well into the next decade.

That's not to say that the beverage titan's business will look the same in 2030 as it does today. Most of Starbucks' future growth will likely come from its international segment, after all. Its China segment is especially attractive, given that its latest class of stores is setting customer traffic and profitability records. Executives see that market growing to many times the size of the U.S. over time, and they couldn't be more bullish on their prospects there. "No western consumer brand is better positioned than Starbucks in China," CEO Kevin Johnson recently said to investors.

Sure, the chain is facing major challenges in the U.S. market, where customer traffic has stalled. That slowdown has persisted despite management's best efforts to jump-start afternoon traffic over the last year. Starbucks has made the necessary adjustments to recapture its growth momentum in the past, though, and there's no reason to believe it can't do the same thing here. However, even if sluggishness continues in the U.S., there's little danger of this world-class business losing its prime market position in the years ahead.

You just don't get more brand value

Anders Bylund (Walt Disney): If there's one brand I'm sure will have legs for the next decade or two (or three, or...), that would be Disney. With great brand power comes...great long-term investor returns, so Walt Disney is an easy answer to this question -- downright obvious, even.

It's simple to find a current example of my brand-power adage: Just take a look in Disney's rearview mirror. Over the last 12 years, Disney investors have pocketed a market-beating 266% return:

This surge was powered by Disney's unmatched library of family-friendly characters and stories.

The Marvel Cinematic Universe played a big part, building up the Avengers franchise out of some lesser-known superhero names. Now, every Marvel movie is a near-guaranteed smash hit with billion-dollar potential at the box office.

Lucasfilm's Star Wars saga is an even safer cash machine, since even spinoff titles such as Rogue One: A Star Wars Story can hit that coveted billion-dollar mark globally. And don't forget about eternal hit factory Pixar.

Disney's own burnished brand holds the power to break all animation records, with an unheralded film loosely inspired by H.C. Andersen's The Snow Queen. Disney churns out megahits in its sleep, and I see no signs of the bandwagon slowing down.

The same old story will keep on playing in 2019 and beyond, with some additional twists. And the pending buyout of Twenty-First Century Fox (NASDAQ: FOX) (NASDAQ: FOXA) should offer another adrenaline shot in the Marvel/Lucasfilm/Pixar vein.

Next year Disney is pulling away from a successful partnership with Netflix (NASDAQ: NFLX) to launch its own digital streaming platform around the world. Getting back to that top-shelf brand, the mouse ears alone should let Disney hit the ground running in the streaming video market.

And Disney is a master of exploiting and monetizing its brand. From movie tickets to theme park passes, from hotel resorts to themed cruise lines, from Mickey Mouse footwear to Cinderella dolls, there's no corner of the consumer market that Disney can't or won't dominate. This is the largest and most successful licensing vendor in the world, and that's a sustainable business advantage.

In a nutshell, that's why I'm more comfortable recommending Disney for the next decade-and-change than any other stock in today's market and my own portfolio -- including Netflix. The Disney brand provides predictable staying power for the very long haul.

Don't let the name fool you

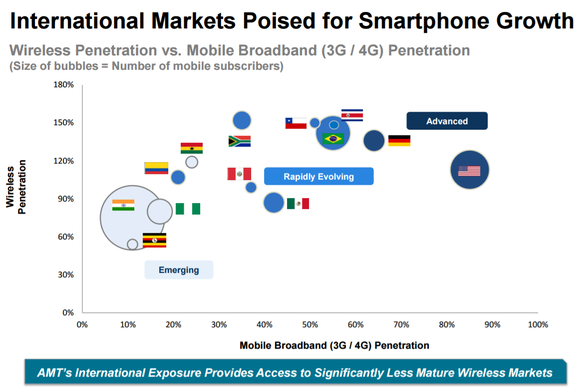

Tyler Crowe (American Tower): "American Tower" is a bit of a misnomer for this real estate investment trust. Despite its name including the word "American," the company's business of owning and leasing space on cellular towers to telecommunications companies is international. Of the 149,000 or so towers in its portfolio, more than 108,000 are outside the U.S. And the company expects that number to grow even more, as it plans to close a deal for another 20,000 towers in India in the first half of this year.

American Tower's focus on the international market is a smart one because of the shifting needs of telecom companies. As more mature cellular networks (like those in the U.S.) deploy 4G and 5G capability, more equipment is required per unit of area. As these mature networks become denser, telecom companies turn to less conventional places for their equipment, using distributed antenna systems -- think equipment on light poles and rooftops.

While American Tower has some distributed antennas in its portfolio, management has elected to invest in less mature telecom markets, where total cellphone use is high but the use of data by cellphones is still low:

Source: American Tower investor presentation.

In countries where 3G and 4G networks are still developing and broadband use is low but growing, there is immense opportunity to grow the business in the coming years. As telecom companies outside the U.S. see the value in renting space on a tower instead of constructing and owning their own towers, American Tower should have an incredibly stable revenue source and growth platform. That should entice any investor looking over a multidecade time horizon.

More From The Motley Fool

Anders Bylund owns shares of Netflix and Walt Disney. Demitrios Kalogeropoulos owns shares of Netflix, Starbucks, and Walt Disney. Tyler Crowe owns shares of American Tower and Walt Disney. The Motley Fool owns shares of and recommends American Tower, Netflix, Starbucks, and Walt Disney. The Motley Fool has the following options: short April 2018 $130 calls on American Tower and long January 2019 $80 calls on American Tower. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance