3 Stocks Silently Outperforming Energy in 2022

It’s no secret that energy has been the best place to hide out in 2022, with many stocks in the realm outperforming the general market and providing investors with impressive gains.

While the relative strength that stocks in the Zacks Oils and Energy sector have displayed is undoubtedly impressive, some investors may be surprised that there are plenty of stocks outperforming the sector in 2022, including McKesson Corp. MCK, Cardinal Health, Inc. CAH, and Super Micro Computer, Inc. SMCI.

Below is a chart illustrating the year-to-date performance of all three stocks, with the Zacks Oils and Energy sector blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, all three stocks have outperformed the sector by fair margins (especially SMCI), entirely shrugging off the general market’s woes. Let’s take a closer look at each one.

Cardinal Health, Inc.

Cardinal Health is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. The company has two reporting segments: Pharmaceutical and Medical.

Undoubtedly a major positive, Cardinal Health belongs to the elite Dividend Aristocrat group; Dividend Aristocrats are classified as companies with at least 25 consecutive annual dividend increases.

CAH’s annual dividend currently yields roughly 2.5%, above its Zacks Medical sector by a fair margin. In 2022, dividends have become a hot topic, helping shield investors.

Image Source: Zacks Investment Research

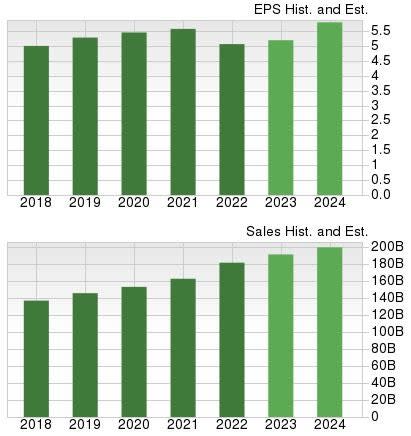

The company has a solid growth profile as well, with earnings forecasted to climb 4.2% in its current fiscal year (FY23) and a further 14% in FY24.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 9% in FY23 and 7.3% in FY24.

Image Source: Zacks Investment Research

McKesson Corp.

McKesson Corp. is a healthcare services and information technology company operating through two segments: Distribution Solutions and Technology Solutions.

Analysts have modestly upped their earnings outlook across all timeframes over the last several months, helping land MCK into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company does pay a small dividend; MCK’s annual dividend yield currently comes in at 0.6%, below its Zacks Medical sector by a fair margin.

Still, it’s worth noting that the company’s payout has grown by nearly 8% over the last five years, helping pick up the slack.

Image Source: Zacks Investment Research

Super Micro Computer, Inc.

Super Micro Computer designs, develops, manufactures, and sells energy-efficient, application-optimized server solutions based on the x86 architecture.

Like MCK, analysts have taken a bullish stance on the company’s earnings outlook as of late, pushing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

It’s hard to ignore the company’s earnings performance; SMCI has exceeded revenue and earnings estimates in ten consecutive quarters.

Just in its latest release, the company registered a 9.3% earnings beat paired with a 2.9% sales surprise. SMCI has a favorable revenue trend, as shown in the chart below.

Image Source: Zacks Investment Research

Bottom Line

While the general market has struggled in 2022, the Zacks Oils and Energy sector has undoubtedly been the brightest spot, rewarding investors with considerable gains.

Still, there are many stocks outside of the sector snapping the overall bearish trend, including McKesson Corp. MCK, Cardinal Health, Inc. CAH, and Super Micro Computer, Inc. SMCI.

All three have outperformed energy in 2022, indicating that bulls have roamed freely after getting shut out by the rest of the market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance