3 Superior German Dividend Stocks Offering Minimum 3.1% Yield

The German market has been experiencing a mix of ups and downs amidst geopolitical tensions and economic fluctuations. Despite this, certain sectors continue to offer opportunities for investors seeking steady income streams. Dividend stocks, especially those offering yields of 3.1% or more, can be an attractive option in such times as they provide regular payouts that can help buffer against market volatility. However, it's crucial to choose companies with solid fundamentals and a strong track record of dividend payments to ensure the sustainability of these yields.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.25% | ★★★★★★ |

FORTEC Elektronik (XTRA:FEV) | 3.94% | ★★★★★☆ |

Talanx (XTRA:TLX) | 3.40% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 5.68% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.42% | ★★★★★☆ |

Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 7.14% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.23% | ★★★★★☆ |

Bayerische Motoren Werke (XTRA:BMW) | 5.67% | ★★★★★☆ |

K+S (XTRA:SDF) | 5.04% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

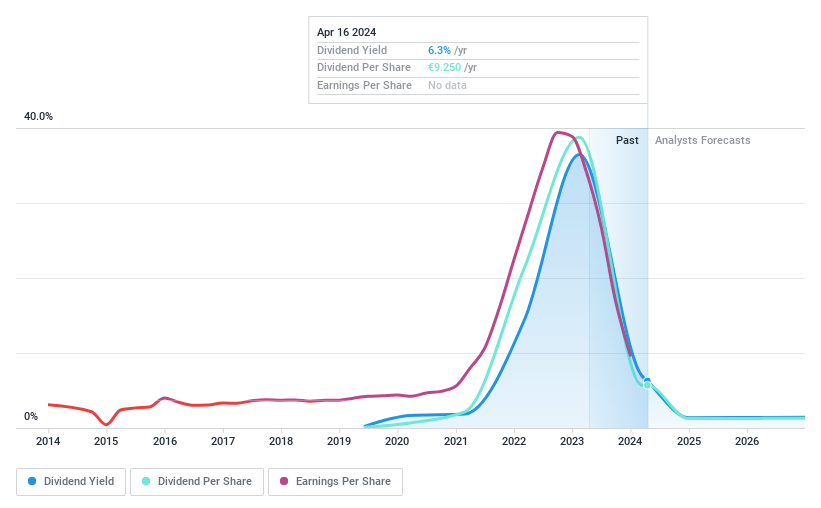

Hapag-Lloyd

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hapag-Lloyd Aktiengesellschaft is a global liner shipping company, with its subsidiaries operating across the world, and it has a market cap of €27.65 billion.

Operations: Hapag-Lloyd Aktiengesellschaft generates its revenue primarily from two segments: Liner Shipping, which brings in €17.76 billion, and Terminal & Infrastructure, contributing €187.1 million to the company's income.

Dividend Yield: 5.9%

Hapag-Lloyd's dividend yield of 5.88% places it in the top 25% of German dividend payers, with payments covered by both earnings (55.4%) and cash flows (49.8%). However, its track record is unstable with volatile payments over the past five years. In recent news, Hapag-Lloyd proposed a €9.25 per share dividend for 2023 totalling €1.6 billion, despite a significant decrease in sales and net income from previous year's figures to €17,929.5 million and €2,935.4 million respectively.

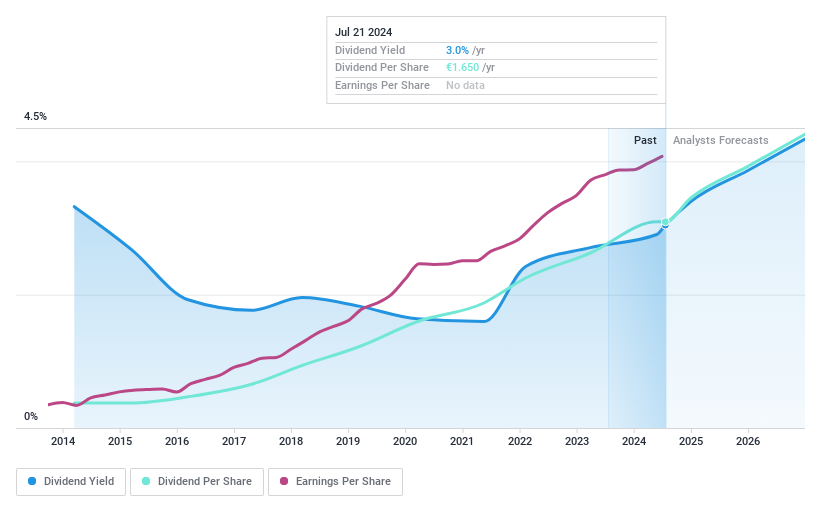

Mensch und Maschine Software

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mensch und Maschine Software SE is a global company that offers solutions in computer-aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management with a market cap of €883.14 million.

Operations: Mensch und Maschine Software SE generates its revenue primarily from two segments: M+M Software, which contributes €106.19 million, and M+M Digitization, bringing in a larger portion of €213.93 million.

Dividend Yield: 3.1%

Mensch und Maschine Software's (MUM) dividend payments have shown stability and growth over the past decade, with a recent Q1 net income of €10.62 million, up from €9.82 million a year ago. However, its high payout ratio of 93.5% raises concerns about the sustainability of dividends as they are not well covered by earnings or cash flows. Despite this, MUM is trading at 42.6% below estimated fair value and analysts forecast a stock price rise of 35.2%.

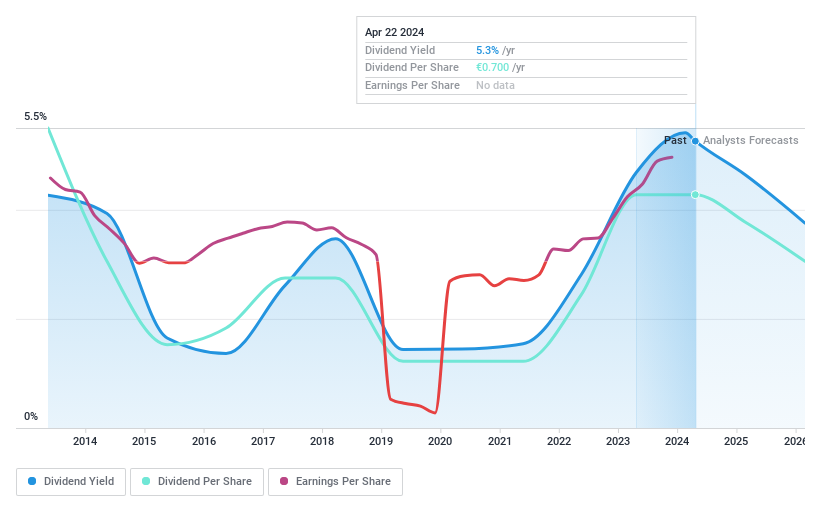

Südzucker

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Südzucker AG is a globally operating company that specializes in the production and sale of sugar products, with a significant presence in Germany, the European Union, the United Kingdom and other international markets, boasting a market capitalization of €2.72 billion.

Operations: Südzucker AG, a global sugar product producer, generates its revenue from various segments including Fruit (€1.57 billion), Sugar (€4.18 billion), Starch (€1.23 billion), CropEnergies (€1.23 billion) and Special Products excluding Starch (€2.42 billion).

Dividend Yield: 5.3%

Südzucker's recent delisting tender offer for CropEnergies shares at €11.50 each signifies a strategic move, potentially impacting its future dividends. The company's dividend payments are well-covered by both earnings (22.4% payout ratio) and cash flows (52.4% cash payout ratio), while trading at 46.9% below estimated fair value, offering potential for capital gains alongside dividends. However, Südzucker's unstable dividend track record and forecasted earnings decline of 45.2% per year over the next three years warrant caution.

Click here and access our complete dividend analysis report to understand the dynamics of Südzucker.

Our valuation report here indicates Südzucker may be undervalued.

Make It Happen

Investigate our full lineup of 29 Top Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:HLAG XTRA:MUM and XTRA:SZU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance