3 Swedish Dividend Stocks With Yields Starting At 3.8%

As global markets navigate through fluctuating inflation rates and interest rate adjustments, Sweden's economic landscape remains a point of interest for investors seeking stable dividend yields. Amidst these conditions, Swedish dividend stocks present an appealing option for those looking to balance their portfolios with assets that offer potential for regular income. In the current market environment, a good dividend stock typically combines a history of reliable payouts with the robustness to withstand economic shifts. This resilience is particularly valuable in times when global economic indicators show mixed signals, making stability and consistent yield key attributes of attractive investments.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.18% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.65% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.49% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.07% | ★★★★★☆ |

Duni (OM:DUNI) | 4.42% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.56% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.33% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.04% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.47% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 3.86% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

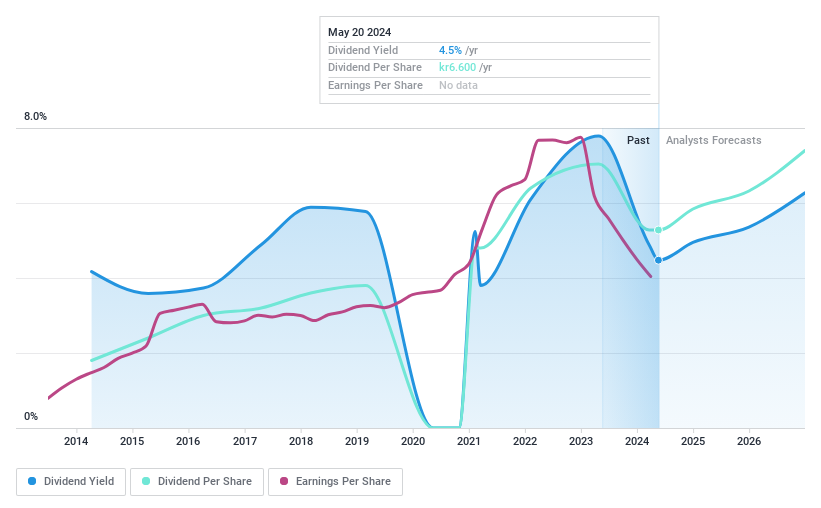

Bilia

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership operating in Sweden, Norway, Luxembourg, and Belgium, with a market capitalization of SEK 13.57 billion.

Operations: Bilia AB generates its revenue primarily through car sales and services, with SEK 19.28 billion from Car - Sweden, SEK 7.16 billion from Car - Norway, SEK 3.61 billion from Car - Western Europe, and additional service revenues of SEK 6.16 billion in Sweden, SEK 2.16 billion in Norway, and SEK 0.65 billion in Western Europe.

Dividend Yield: 4.5%

Bilia's recent performance and dividend history present a nuanced picture for investors. Currently trading at 59.2% below estimated fair value, the company offers a seemingly attractive entry point. However, its profit margins have decreased from last year (3.5% to 2.2%), and its dividend payments, although in the top 25% of Swedish market payers at 4.47%, have been inconsistent over the past decade with significant annual fluctuations exceeding 20%. Recent financials reflect a downturn with Q1 sales dropping to SEK 9,371 million from SEK 9,871 million year-over-year and net income falling to SEK 156 million from SEK 251 million. Moreover, despite an earnings forecast growth of approximately 15.42% per annum, Bilia's dividends are poorly covered by cash flow (cash payout ratio at an unsustainable high of approximately five times), indicating potential challenges in maintaining current dividend levels without adjustments in operations or financial strategies.

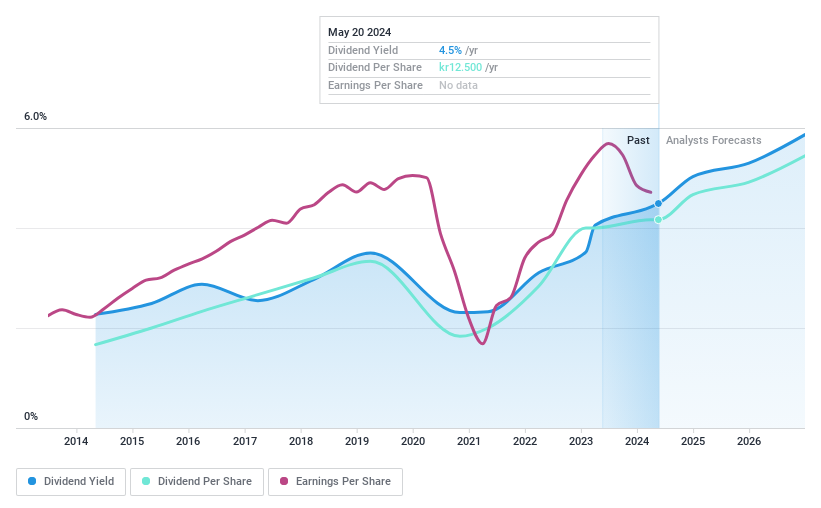

Loomis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB operates in providing comprehensive solutions for the handling, storage, recycling, and distribution of cash and other valuables, with a market capitalization of approximately SEK 19.59 billion.

Operations: Loomis AB generates its revenue primarily through two segments: Europe and Latin America, which brought in SEK 13.86 billion, and the United States of America, contributing SEK 15.17 billion.

Dividend Yield: 4.5%

Loomis AB, despite a recent dividend increase to SEK 12.50 per share, exhibits volatility in its dividend history with inconsistent growth over the past decade. The company's dividends are supported by a reasonable payout ratio of 61.2% and cash flow coverage at 32.6%. However, Loomis faces challenges from a legal setback in Denmark potentially impacting financial stability. Recently, Loomis initiated a share repurchase program valued up to SEK 200 million, aiming to adjust its capital structure and support acquisitions, reflecting proactive financial management amid uncertainties.

Navigate through the intricacies of Loomis with our comprehensive dividend report here.

Our valuation report unveils the possibility Loomis' shares may be trading at a discount.

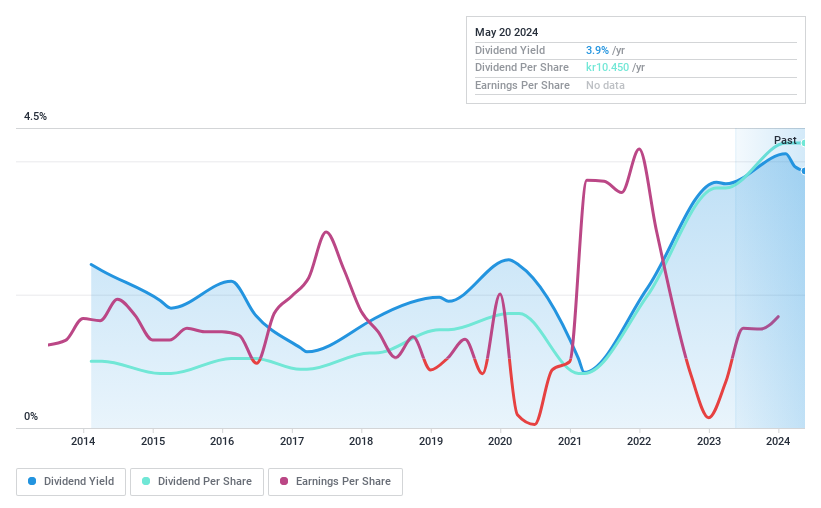

AB Traction

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB Traction is a private equity firm focusing on various investment strategies including distressed assets and buyouts, with a market capitalization of approximately SEK 4.01 billion.

Operations: AB Traction, a private equity firm, does not have detailed revenue segments provided in the text.

Dividend Yield: 3.9%

AB Traction's dividend history shows inconsistency with significant fluctuations over the past decade. Despite this, dividends are currently well-supported, with a payout ratio of 57.3% and a cash payout ratio of 82.9%, indicating coverage by both earnings and cash flows. Recently, AB Traction reported a decrease in net income to SEK 128.2 million from SEK 211 million year-over-year as of the first quarter ending March 31, 2024. The firm's dividend yield stands at 3.86%, which is below the top quartile of Swedish dividend stocks at 4.25%.

Click to explore a detailed breakdown of our findings in AB Traction's dividend report.

Our expertly prepared valuation report AB Traction implies its share price may be too high.

Key Takeaways

Reveal the 21 hidden gems among our Top Dividend Stocks screener with a single click here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BILI A OM:LOOMIS and OM:TRAC B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance