3 Tech Stocks to Buy Now Before Thanksgiving with the Bulls in Control

Today’s episode of Full Court Finance at Zacks explores the market rally that has the bulls seemingly sitting in the driver’s seat heading into the final weeks of 2023. The episode then explores three top-ranked Zacks technology-centric stocks—Vertiv (VRT), LegalZoom (LZ), and Pinterest (PINS)—that investors might want to buy now for both near-term and long-term upside as we close out November and 2023.

Wall Street took a much-deserved break from its white-hot rally during the back half of last week. The relativity sideways sessions after the huge post-CPI surge should be viewed as a positive for the bulls since it showcased that there is not much appetite to sell and take profits even after that huge rebound off the late October lows.

The bulls are seemingly in full control heading into Thanksgiving, with the S&P 500 and the Nasdaq solidly above their 50-day and 200-day moving averages. The bears, many of which have been flushed out of their positions, don’t want to get caught on the wrong side of a potential rally that could possibly see the benchmark slowly climb back up toward its all-time highs in the coming months.

Now that more big money is comfortable calling for the start of rate cuts in the back half of 2024, the inflows into stocks could continue. Even if the U.S. falls into a recession (and one will occur at some point), Wall Street cares more about lower interest rates and aggerate earnings growth—currently driven by tech.

With this in mind, let’s dig into the three Zacks Rank #1 (Strong Buy) tech-focused stocks investors might want to consider buying ahead of Thanksgiving.

LegalZoom.com, Inc. (LZ)

LegalZoom’s core digital-focused business provides its customers with various products and services across legal, tax, compliance, and more. Legal Zoom also aims to help people get their businesses off the ground, offering services to start LLCs, corporations, nonprofits, and beyond.

The firm provides legal help for wills and trusts, real estate, divorce, and more. More recently, Legal Zoom rolled out small business accounting software called LZ Books.

Image Source: Zacks Investment Research

Legal Zoom topped our Q3 estimates on November 7 and boosted its guidance. LZ’s EPS outlook has improved since then, with its most accurate/most recent estimate for fiscal 2024 coming in 11% above consensus to help it land a Zacks Rank #1 (Strong Buy).

LZ has climbed 45% YTD yet it still trades around 70% below its highs and 28% under its average Zacks price target. Legal Zoom is also back above its 50-day and 200-day moving average. Legal Zoom’s valuation level is rather appealing, with a PEG ratio of 0.93 vs. the Zacks Tech sector’s 1.9.

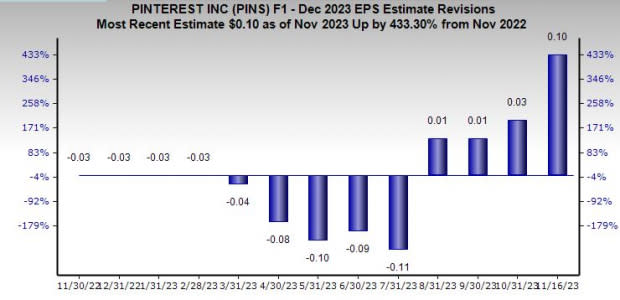

Pinterest (PINS)

Pinterest shares soared after it topped estimates in late October and provided upbeat guidance once again to help it grab a Zacks Rank #1 (Strong Buy). Pinterest remains a hit with advertisers, small businesses, and others because paid content and ads fit effortlessly into the platform.

The company refers to itself as a “visual discovery engine” where users come to find and share ideas for everything from clothing and date nights to vacations and home remodels.

Image Source: Zacks Investment Research

PINS has spent the last two years boosting its ad tech and video features and rolling out more e-commerce and shopping features while also cutting costs. Pinterest grew its global monthly active users by 8% YoY in Q3 to 482 million, and its outlook for sales and earnings growth is strong for 2023 and 2024.

Despite its 20% surge in the last three months that has it back above key moving averages, PINS trades 63% below its all-time highs and 12% under its average Zacks price target. Pinterest also has a stellar balance sheet and it operates in a potentially compelling growth segment within digital content far away from Meta’s various platforms.

Vertiv Holdings Co (VRT)

Vertiv’s portfolio of power, cooling, and IT infrastructure solutions operate behind the scenes to keep its clients’ various technology running smoothly. Vertiv is crucially benefitting from the broader AI investment cycle, with countless companies and entire industries spending to boost their computing capacity. Vertiv posted a strong beat and raise quarter on October 25, ending the period with a record-high $5 billion backlog.

Image Source: Zacks Investment Research

Vertiv’s FY23, FY24, and FY25 EPS estimates have surged to help it land a Zacks Rank #1 (Strong Buy). Vertiv stock has topped Meta (META) over the last 12 months and nearly matched Nvidia (NVDA). Despite its run and outperformance of the tech sector over the last three years, Vertiv trades at a 36% discount to its industry, roughly 15% below the Zacks Tech sector, and 18% beneath its own highs at 20.0X forward 12-month earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LegalZoom.com, Inc. (LZ) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance