3 Things to Watch in the Stock Market This Week

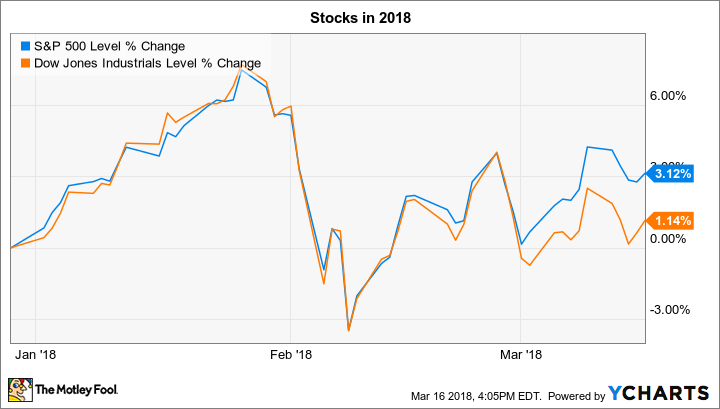

Both the Dow Jones Industrial Average (DJINDICES: ^DJI) and the S&P 500 (SNPINDEX: ^GSPC) declined last week, with each index shedding a bit more than 1%. Markets remained in positive territory for the year, though they are still down from the highs set in late January.

Winnebago (NYSE: WGO), Five Below (NASDAQ: FIVE), and Nike (NYSE: NKE) are set to publish some of the most anticipated earnings reports over the next few days. Here's what investors can expect from these announcements.

Winnebago's industry outlook

Winnebago announces its quarterly results on Wednesday morning, and the numbers are likely to show continued gains in this high-performing business. At its last outing, the recreational vehicle giant posted an 83% sales spike as its industry approached its ninth consecutive year of expansion.

A big chunk of those gains came from its recent acquisition of Grand Design, but Winnebago also enjoyed healthy organic growth in its core motorized RV niche .

Image source: Winnebago.

The tilt toward sales of high-margin towable trailers in the Grand Design fleet has lifted Winnebago's profitability to new highs while filling out its portfolio. The company's main challenge now is to scale up its production pace to meet rising demand without overextending itself. Its new class of motorhomes and travel trailers, meanwhile, must deliver on the promising industry response they received in late 2017 by showing robust sales at dealerships in the new fiscal year.

Five Below's 2018 forecast

Teen retailer Five Below is looking to extend its market-thumping 2017 momentum into the new year with fiscal fourth-quarter results due out after the market closes on Wednesday, March 21. Investors already know a few important details about that holiday performance thanks to a press release that in early January revealed healthy revenue growth during the period. "Multiple merchandise categories outperformed," CEO Joel Anderson said in that report, "once again demonstrating the broad-based strength of our business ."

The success means comparable-store sales likely rose by a robust 6% in the fourth quarter and by 6.5% for the full year. We'll find out on Wednesday just how much of that boost came from customer traffic gains, and whether Five Below needed to employ price cuts to keep its trendy inventory moving. Assuming the business didn't take a turn lower in February, Anderson and his team should issue an aggressive 2018 forecast that predicts significant sales growth as the retailer takes another step toward the 2,000 locations it aims to operate across the country, up from just 600 today.

Nike's U.S. sales

Nike releases its results after the market closes on Thursday, March 22. Its global business has many moving parts, but investors will likely focus on any signs of a potential rebound in the struggling U.S. market. The sports apparel and footwear giant's overall sales inched higher in the prior quarter, but only because healthy international gains offset a discouraging 5% drop in the domestic segment.

Image source: Getty Images.

CEO Mark Parker and his team said at in its second-quarter earnings call that the North America segment should stabilize soon, and the company is doing what it can to hasten that shift by managing inventory and scaling up the pace of new product introductions. After all, Nike needs at least a steady domestic division if it's going to achieve management's long-term goals of rising profitability, high-single-digit sales growth, and return on invested capital of at least 30% over the next five fiscal years.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of Nike. The Motley Fool owns shares of and recommends Nike. The Motley Fool recommends Five Below. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance