3 Top Dividend Stocks On The UK Exchange

The UK market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China, highlighting the interconnectedness of global economies. In such volatile conditions, dividend stocks can offer a measure of stability and consistent income, making them an attractive option for investors seeking reliable returns amidst uncertainty.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.67% | ★★★★★★ |

4imprint Group (LSE:FOUR) | 3.06% | ★★★★★☆ |

OSB Group (LSE:OSB) | 8.35% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.38% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.08% | ★★★★★☆ |

Man Group (LSE:EMG) | 5.92% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.69% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.98% | ★★★★★☆ |

DCC (LSE:DCC) | 3.81% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.54% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Alumasc Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £105.52 million, manufactures and sells building products, systems, and solutions across the United Kingdom and internationally.

Operations: The Alumasc Group's revenue is derived from three main segments: Water Management (£48.32 million), Building Envelope (£37.60 million), and Housebuilding Products (£14.81 million).

Dividend Yield: 3.7%

Alumasc Group's dividend yield of 3.66% is below the top UK payers but is well-covered by earnings and cash flows, with payout ratios of 44.2% and 36.9%, respectively. Despite historical volatility in payments, recent increases indicate growth potential; a final dividend of 7.3 pence per share was recommended for 2024. Earnings improved significantly, with net income rising to £8.75 million from £6.6 million year-on-year, reflecting strategic growth initiatives amidst leadership changes in its Water Management division.

James Halstead

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses across the UK, Europe, Scandinavia, Australasia, Asia, and internationally with a market cap of £760.64 million.

Operations: The company's revenue primarily comes from the manufacture and distribution of flooring products, totaling £274.88 million.

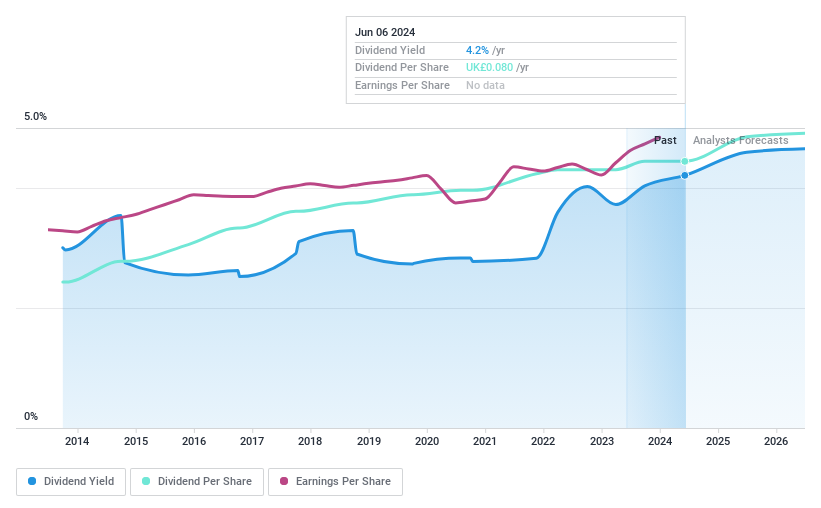

Dividend Yield: 4.7%

James Halstead's dividend yield of 4.66% is lower than the top UK payers but remains well-supported by earnings and cash flows, with payout ratios of 85.3% and 77%, respectively. The company has consistently increased dividends for 49 years, proposing a record final dividend of 6 pence for a total annual payout of 8.5 pence in 2024. Despite a slight decline in sales to £274.88 million, earnings stability supports its reliable dividend strategy amidst leadership changes.

Macfarlane Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Macfarlane Group PLC, with a market cap of £179.13 million, designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe through its subsidiaries.

Operations: Macfarlane Group PLC generates revenue through its Packaging Distribution segment, contributing £231.89 million, and its Manufacturing Operations segment, which adds £42.06 million.

Dividend Yield: 3.2%

Macfarlane Group's dividend yield of 3.19% is below the top UK payers, but dividends are well-covered by earnings and cash flows, with payout ratios of 39% and 22.8%, respectively. The interim dividend increased to 0.96 pence per share despite a slight decline in sales to £129.6 million for H1 2024. Although historically volatile, recent increases suggest improved stability in payouts amidst upcoming board changes with David Stirling's appointment as non-executive director.

Key Takeaways

Explore the 59 names from our Top UK Dividend Stocks screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:ALU AIM:JHD and LSE:MACF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com