3 Top-Ranked Companies With Supercharged Dividend Growth

Stocks extended their strength in last week’s session, with the indexes penciling in their second consecutive weekly close in green territory.

Although Friday’s better-than-expected Employment Situations Report brought some volatility and uncertainty to the market, investors can, at least, celebrate the recent streak of green.

In the historically-volatile market we’ve been accustomed to in 2022, dividends have quickly become a precious item for investors, helping to soften the impact of drawdowns in other positions.

And over the years, several companies have grown their dividend payouts notably.

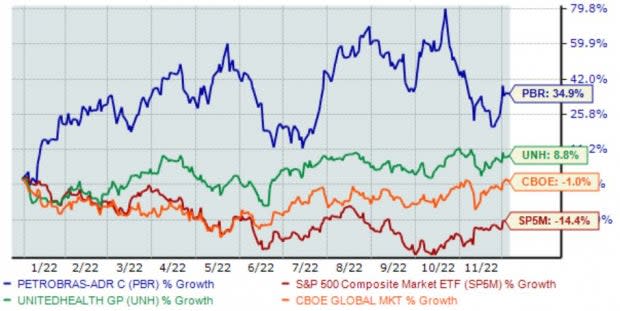

Three top-ranked companies that have increasingly rewarded their shareholders – Petroleo Brasileiro S.A. PBR, Cboe Global Markets CBOE, and UnitedHealth Group, Inc. UNH – could all be considerations for investors with an appetite for income.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

On top of strong dividend growth, all three stocks have displayed remarkable relative strength in 2022, outperforming the general market handily. Let’s take a closer look at each one.

Petroleo Brasileiro S.A.

Petroleo Brasileiro S.A. (or Petrobras S.A.) is Brazil’s largest integrated energy firm, with operations in the exploration, production, and distribution of oil and gas. The company sports a favorable Zacks Rank #2 (Buy).

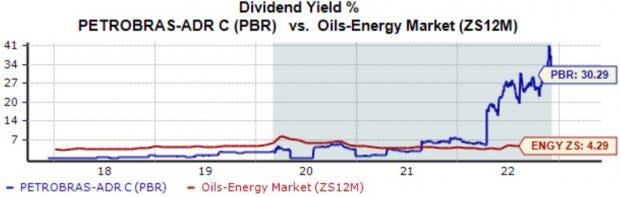

The company’s annual dividend currently yields a staggering 30.3%, crushing its Zacks Oils and Energy sector average of an already impressive 4.3%.

Further, the company has upped its dividend payout 11 times over the last five years, translating to a 145% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

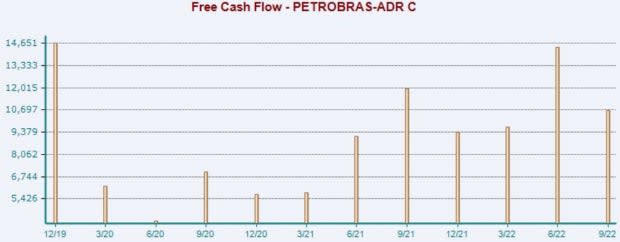

PBR’s free cash flow has recovered nicely from 2020 lows of $4.1 billion, reported at $10.6 billion in its latest earnings release.

Image Source: Zacks Investment Research

UnitedHealth Group, Inc.

UnitedHealth provides a wide range of healthcare products and services, including health maintenance organizations (HMOs), point of service plans (POS), preferred provider organizations (PPOs), and managed fee-for-service programs. UNH sports a Zacks Rank #2 (Buy).

UNH’s annual dividend currently yields approximately 1.2%, a tick below its Zacks Medical sector average of 1.3%.

While the yield is lower than its sector’s average, the company’s 17.5% five-year annualized dividend growth rate picks up the slack in a big way.

Image Source: Zacks Investment Research

Like PBR, UnitedHealth’s free cash flow growth is hard to ignore; UNH reported free cash flow of $17.8 billion in its latest release, good enough for a 150% Y/Y uptick and an even more impressive 180% sequential increase.

Image Source: Zacks Investment Research

And for the cherry on top, UnitedHealth carries a strong growth profile, with earnings forecasted to soar nearly 16% in its current fiscal year (FY22) and a further 13% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 12.5% in FY22 and 10.3% in FY23.

Image Source: Zacks Investment Research

Cboe Global Markets, Inc.

By volume, Cboe Global Markets is one of the largest stock exchange operators in the United States and a leading market globally for ETP trading.

Analysts have taken a bullish stance on the company’s earnings outlook as of late, pushing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

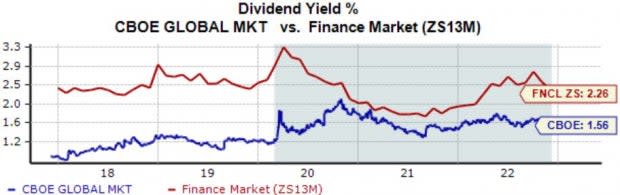

Image Source: Zacks Investment Research

As it stands, CBOE’s annual dividend currently yields roughly 1.6%, modestly below its Zacks Finance sector average of 2.3%.

Still, CBOE has been dedicated to growing its payout, bolstered by its 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

We’re all very aware that it’s been a challenging market landscape in 2022, with a hawkish Fed, geopolitical issues, and lingering COVID-19 uncertainties spoiling the fun.

It’s common for investors to target dividend-paying stocks during times of heightened volatility, as the payouts provide a passive income stream and cushion drawdowns in other positions.

Of course, it’s beneficial to target companies with a track record of increasing their payouts, such as what Petroleo Brasileiro S.A. PBR, Cboe Global Markets CBOE, and UnitedHealth Group, Inc. UNH have all done over the last five years.

In addition, all three stocks carry a favorable Zacks Rank, indicating that their near-term business outlook has turned positive, undoubtedly a strong pairing.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Petroleo Brasileiro S.A. Petrobras (PBR) : Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance