3 Top Rated Stocks to Buy After Q1 Earnings Beat Estimates

Several top-rated Zacks stocks are starting to look more attractive after reporting favorable first quarter results on Tuesday.

Reconfirming their attractive earnings outlook, these companies were able to surpass Q1 bottom line expectations making now a suitable time to invest.

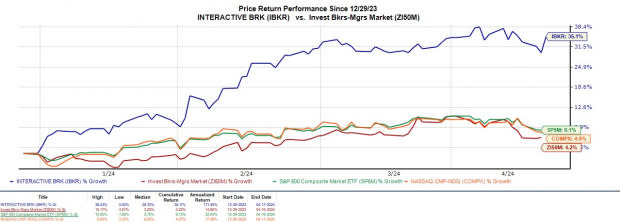

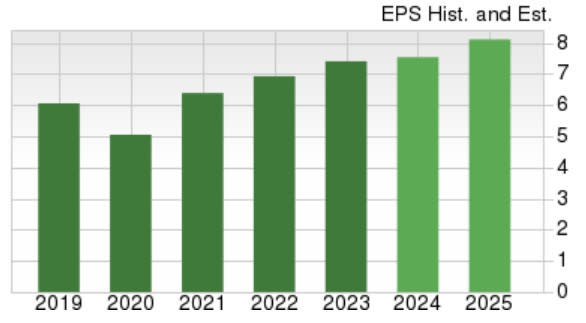

Interactive Brokers IBKR

Going into its Q1 report, Interactive Brokers stock was bumped up to a Zacks Rank #1 (Strong Buy) and the global electronic market broker was able to deliver. First quarter earnings of $1.64 per share slightly beat Q1 EPS estimates of $1.63 and climbed 21% from $1.35 a share in the comparative quarter.

Interactive Brokers beat top line estimates by 1% with Q1 sales at $1.2 billion which was a 14% increase from a year ago. Notably, IBKR has soared +35% year to date with annual earnings now expected to rise 10% in fiscal 2024 to $6.36 per share.

Furthermore, while Interactive Brokers’ EPS is projected to slightly dip next year to $6.32, earnings estimate revisions are noticibally higher over the last 30 days for both FY24 and FY25.

Image Source: Zacks Investment Research

Northern Trust NTRS

Also standing out among the finance sector is Northern Trust which boasts a Zacks Rank #1 (Strong Buy) as well. As a leading provider of wealth management services, Northern Trust impressively exceeded its bottom line expectations with Q1 EPS at $1.70 and 15% higher than the Zacks Consensus of $1.47 a share. First quarter earnings rose 7% from the prior year quarter despite Q1 sales of $1.64 billion missing estimates by -8% and dipping from $1.74 billion last year.

Image Source: Zacks Investment Research

Still. the asset manager’s annual earnings are forecasted to rise 5% in FY24 and another 6% EPS growth is expected in FY25 with projections at $6.96 per share. More appealing is that Northern Trust’s stock trades at a reasonable 12.1X forward earnings multiple which is making the -4% YTD drop in NTRS look like a long-term buying opportunity.

Plus, FY24 and FY25 EPS estimates are up 4% and 3% in the last 60 days respectively. It’s also noteworthy that NTRS has a 3.77% annual dividend that is roughly on par with its industry average and nicely above the S&P 500’s 1.34%.

Image Source: Zacks Investment Research

Omnicom Group OMC

We’ll pivot to the consumer discretionary sector for the last stock in Omnicom Group, one of the largest global advertising firms. Sporting a Zacks Rank #2 (Buy), Omnicom’s first quarter earnings of $1.67 per share exceeded estimates by 10% and rose 7% from Q1 2023. Quarterly sales of $3.63 billion beat by 1% and rose 5% year over year.

Omnicom’s increased profitability is compelling with OMC trading at an 11.7X forward earnings multiple. Fiscal 2024 earnings are expected to increase 4% with FY25 EPS projected to rise another 7% to $8.27 per share. Omnicom’s stock is down -2% YTD but earnings estimate revisions for both FY24 and FY25 have remained modestly higher over the last 60 days. Plus, OMC offers a 3.08% annual dividend yield to bolster its steady expansion and enticing valuation.

Image Source: Zacks Investment Research

Bottom Line

The positive trend of rising earnings estimate revisions looks likely to continue for these top-rated stocks after exceeding their Q1 bottom line expectations. Interactive Brokers, Northern Trust, and Omnicom’s stock should also be viable investments for 2024 and beyond making now an ideal time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Northern Trust Corporation (NTRS) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance