3 Top Stocks Already Up More Than 10% In December

Stocks have cooled off in the last few sessions, with inflation and talks of a recession on the horizon heavily impacting sentiment within the market.

Still, relatively less-hawkish comments from the Fed last week gave the market a much-needed jolt, with investors widely expecting a slowdown in the tightening pace.

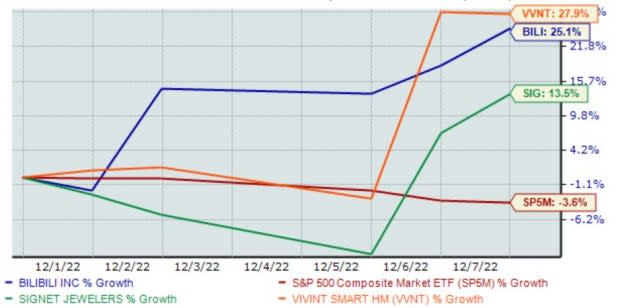

While the S&P 500 currently resides in the red for December, several top-ranked stocks – Bilibili BILI, Signet Jewelers SIG, and Vivint Smart Home Inc. VVNT – have been on cruise control, all climbing more than 10% month-to-date. This is shown in the chart below.

Image Source: Zacks Investment Research

As we can see, all three stocks have displayed remarkable relative strength in December, crushing the S&P 500’s performance. Could these runs continue? Let’s take a deeper dive into each one.

Bilibili

Bilibili provides a video streaming and sharing platform focused on user-generated content. Essentially, this is China’s YouTube. Analysts have raised their earnings outlook across all timeframes over the last several months, landing the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

The company last reported on November 29th; BILI exceeded the Zacks Consensus EPS Estimate by nearly 6% but modestly fell short of revenue expectations.

Still, the bottom-line beat was undoubtedly a positive, snapping a streak of back-to-back negative surprises and fueling shares for a nice run. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

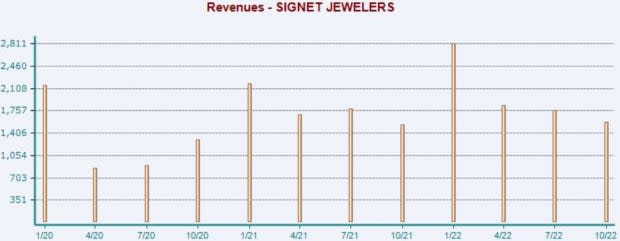

Signet Jewelers

Signet Jewelers is the world’s largest retailer of diamond jewelry, with its locations primarily operating under the banners of Kay Jewelers, Zales, and Jared, to name a few. Signet Jewelers sports a highly-favorable Zacks Rank #1 (Strong Buy).

The company has seen its earnings outlook for its current and next fiscal year improve notably over the last several months.

Image Source: Zacks Investment Research

The company posted a blockbuster Q3; SIG exceeded the Zacks Consensus EPS Estimate by more than 140% and posted a 7.6% sales surprise. Signet has a long history of positive surprises, exceeding earnings and revenue estimates in ten consecutive quarters.

Image Source: Zacks Investment Research

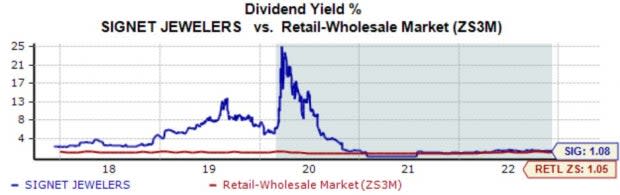

And for the cherry on top, SIG pays a dividend, currently yielding a modest 1%.

Image Source: Zacks Investment Research

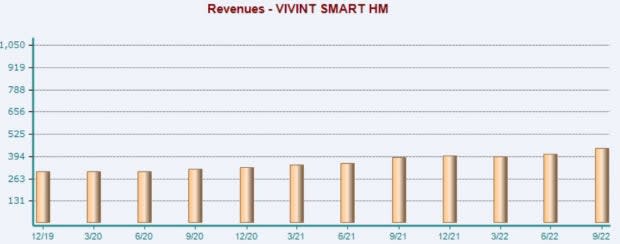

Vivint Smart Home Inc.

Vivint Smart Home delivers an integrated smart home system with in-home consultation, professional installation, and support delivered by its Smart Home Pros and 24/7 customer care and monitoring. The company boasts a Zacks Rank #2 (Buy).

VVNT’s earnings outlook has vastly improved across all timeframes.

Image Source: Zacks Investment Research

Vivint has been on a blazing-hot earnings streak, exceeding the Zacks Consensus EPS Estimate by at least 30% in four consecutive releases.

Just in its latest print (November 8th), VVNT registered a 39% bottom-line beat paired with a 7% revenue surprise.

Image Source: Zacks Investment Research

Further, the company carries a strong growth profile; earnings are forecasted to soar 70% in its current fiscal year (FY22) and a further 20% in FY23. The projected earnings growth comes paired with forecasted revenue increases of 13% in FY22 and 7.4% in FY23.

Bottom Line

Although the S&P 500 resides in the red month-to-date, there have been several stocks displaying relative strength in December, including Bilibili BILI, Signet Jewelers SIG, and Vivint Smart Home Inc. VVNT.

All three stocks are up more than 10% in December alone, indicating significant positive momentum. Further, all three companies are coming off a strong earnings beat, undoubtedly providing fuel for the runs.

And to top it off, all three have witnessed positive earnings estimate revisions over the last several months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI) : Free Stock Analysis Report

Vivint Smart Home, Inc. (VVNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance