3 Top Stocks That Aren't on Wall Street's Radar

It seems tough to find hidden gems in today's market, where analysts and investors constantly filter out the most promising stocks. However, there are still solid companies that are sparsely covered by Wall Street, and these stocks could rally once they attract more attention. Here are three stocks that aren't on Wall Street's radar yet -- Qutoutiao (NASDAQ: QTT), TransDigm Group (NYSE: TDG), and Fluidigm (NASDAQ: FLDM).

A growing Chinese social platform

Leo Sun (Qutoutiao): Qutoutiao, which means "Fun Headlines" in Chinese, is one of the top news-aggregator apps in China. Its daily active users (DAUs) rose 229% annually and 69% sequentially to 21.3 million last quarter, and its DAUs spent 55.9 minutes on the platform daily --- compared to 34 minutes a year earlier. Its primary competitor is ByteDance's Jinri Toutiao, which has more than 120 million DAUs.

Image source: Getty Images.

Qutoutiao's revenue surged 520% annually and 103% sequentially to 977.3 million RMB ($142 million) last quarter. It expects its revenue to rise 23% to 28% sequentially during the fourth quarter. The platform generates most of its revenue from online ads.

Qutoutiao isn't profitable. It posted a non-GAAP net loss of 298 million RMB ($43.5 million) last quarter, compared to a loss of 10.7 million RMB a year earlier. Its sales and marketing expenses surged 660% annually to 1.05 billion RMB ($152 million) as it spent more cash acquiring users and expanding its loyalty program.

That business model looks shaky, but Qutoutiao is still a young company with an established foothold in the high-growth market for "social news" platforms. This makes it a lucrative takeover target for companies like Tencent, which already owns a major stake in Qutoutiao.

Qutoutiao is still a very risky stock, but it's only covered by five analysts -- three of whom rate it as a buy. If Qutoutiao's growth stabilizes as it narrows its losses, more analysts and institutional investors could start to take this underdog -- which has an enterprise value of just $1.5 billion -- more seriously.

Fly higher with this stock

Dan Caplinger (TransDigm Group): Most investors on Wall Street are well aware of the boom in the aerospace industry. Blue-chip names like Boeing (NYSE: BA) have seen their shares soar into the stratosphere as demand from cash-rich airlines trying to modernize their fleets and operate more efficiently has led to massive orders that have left aircraft manufacturers scurrying to keep up with ambitious delivery schedules.

But where many investors have failed to look is the array of suppliers of components, systems, and parts that go into modern aircraft. TransDigm Group is a big player in that business, delivering everything from pumps, valves, motors, actuators, and sensors to avionics, cockpit security systems, and batteries. You'll find plenty of TransDigm products on typical aircraft, and the company's done a good job of growing through acquisition to become an even more integral part of the manufacturing process.

Quietly, TransDigm's stock has doubled in price in just two years. And many see even more upside ahead for the company, because so far, there's been little slowdown in the prospects for the major aircraft manufacturers that rely on TransDigm for key components and parts. That's not a total guarantee of success, but with conditions in the aerospace industry remaining favorable, the future still looks bright for TransDigm Group.

A small-cap lab instrument provider hitting its stride

Maxx Chatsko (Fluidigm): At a market cap of just $450 million, Fluidigm is a small player in the enormous laboratory instruments industry. To compete against the likes of Illumina, Agilent Technologies, and Thermo Fisher Scientific, the small-cap hardware manufacturer absolutely has to crush its niche. It's been a long and trying road in recent years, but full-year 2018 operating results show the business is on a promising trajectory.

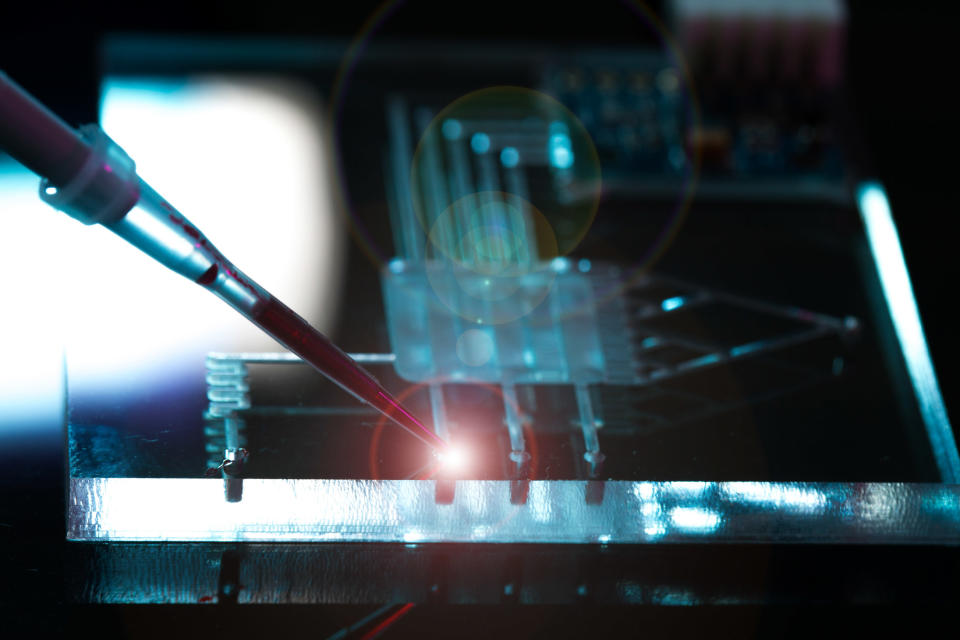

Image source: Getty Images.

Fluidigm is a leader in microfluidics. It designs and manufactures integrated fluidic circuits, which are silicon chips with tiny channels carved out that allow for the control and manipulation of liquid samples. Those circuits have been the basis for each instrument in its crowded portfolio over the years, although two applications appear to be the company's future.

The first is specialized real-time genomic analysis. Fluidigm estimated an active installed base of 550 machines in this category at the end of 2018, down from 585 in 2016. The slide isn't a great trend, but the company was a little early on the opportunity. Considering the techniques used are only now being widely used by researchers studying living things and that the business sells $47,000 in consumables (the chemical reagents needed to operate the instrument) per machine each year, investors can expect this segment to become an important source of growth soon.

The second application is a technique to study complex biological samples called mass cytometry. Don't get too overwhelmed by the name; after all, if Illumina had never come along, the term "DNA sequencing" might sound just as baffling. Fluidigm reported an installed based of 240 mass cytometry machines at the end of 2018, up from 160 in 2016. It expects to sell $75,500 in consumables per machine in 2019. And the high-margin opportunity single-handedly drove revenue growth and margin improvement in 2018.

Fluidigm reported an operating loss of $48 million in 2018 (nearly half of which was noncash expenses), an improvement from a $73.1 million loss in 2016, thanks to healthy demand for mass cytometry machines. Considering they're used to study and develop everything from CAR-T immuno-oncology therapies to CRISPR-based gene-editing tools, that demand shouldn't disappear anytime soon. The business is still a few years away from profitability, but it's quickly heading in that direction, making this one top stock to watch.

More From The Motley Fool

Dan Caplinger owns shares of Boeing. Leo Sun owns shares of Tencent Holdings. Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Illumina, Tencent Holdings, and TransDigm Group. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance