3 Top Stocks With High Dividend Yields

The world's best investors know buying and holding high-quality dividend stocks is the most effective method for predictably creating wealth over the long term. But not all dividend payers are created equal, and finding such stocks worthy of a place in your portfolio is easier said than done.

So we asked three top Motley Fool contributors to each choose a high-yield dividend stock they believe investors would do well to consider today. Read on to learn why they like Tanger Factory Outlet Centers (NYSE: SKT), VEREIT (NYSE: VER), and IBM (NYSE: IBM).

IMAGE SOURCE: GETTY IMAGES.

This REIT is a dividend factory

Steve Symington (Tanger Factory Outlet Centers): With the broader retail industry enjoying its strongest growth in six years this past holiday season, according to a recent report from Mastercard SpendingPulse, I suspect the impending earnings season could realize significant upside from the market's strongest retail names.

But Tanger Factory Outlet Centers should benefit regardless of which retail brands rise to the top. After all, while some investors might rightly worry that traditional brick-and-mortar retail is being pressured by e-commerce, Tanger's factory outlet model offers retailers a high-quality, cost-effective distribution channel that still resonates with consumers.

Until the broader market pulled back hard in December, shares of the shopping center real estate investment trust were enjoying positive momentum on the heels of its encouraging third-quarter 2018 report in early November. In that report, Tanger demonstrated modest top-line growth, flat adjusted funds from operations, and a solid portfolio occupancy rate of 96.4% despite the negative traffic impact of Hurricane Florence during the quarter. Tanger also modestly increased the bottom end of its full-year funds from operations guidance, albeit with the caveat that it may need to selectively adjust rents with certain productive tenants in the interest of fostering longer-term growth.

For patient shareholders willing to collect Tanger's juicy 6.2% annual dividend as that strategy plays out, I think the stock is one of the most appealing dividend names our market has to offer.

Almost at the end of the tunnel

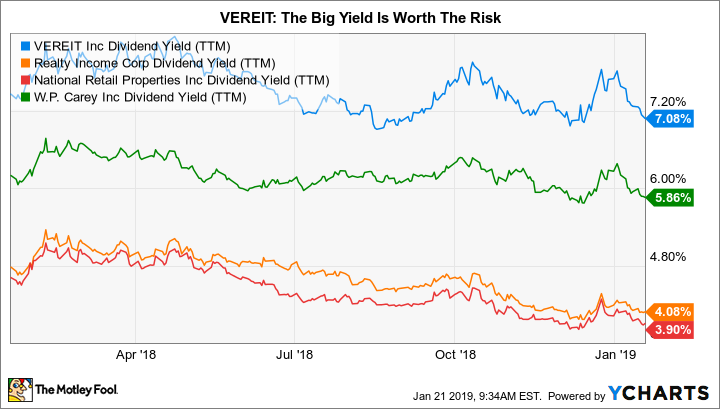

Reuben Gregg Brewer (VEREIT Inc.): Real estate investment trust VEREIT is among the largest and most diversified owners of single-tenant properties in the United States. It offers investors a yield of roughly 7%. That dividend takes up only 76% of adjusted funds from operations, in line with peers like Realty Income and National Retail Properties. So why is VEREIT's yield so much higher than the roughly 4% offered by these peers?

VER Dividend Yield (TTM) data by YCharts.

The reason: VEREIT is working through the legal issues left behind from an accounting misstep made under previous leaders. At the time, the REIT was focused on expanding at virtually any cost. After the accounting error was disclosed, the dividend was cut and the leadership team was changed, with respected industry veteran Glenn Rufrano brought on as CEO.

Rufrano laid out a plan for turning things around, including streamlining the portfolio, reducing leverage, and restoring the dividend. The CEO and his team have executed well on every front. VEREIT finally looks ready to get back on the growth track after years of selling less-desirable assets left behind from the aggressive acquisition binge of former management.

The last hurdle is the legal mess left after the accounting issue. But Rufrano and his team are working to solve this issue, too. So far VEREIT has settled with 31% of shareholders for a total of roughly $218 million. That suggests that the full tally will be around $1 billion, which VEREIT has the liquidity to absorb. Yes, there's uncertainty, but it looks like the bad news is pretty well defined at this point. And that makes this REIT -- and its well-covered dividend -- a high-yield opportunity today.

Big Blue generates lots of green

Leo Sun (IBM): IBM currently pays a forward dividend yield of 4.7%, and it's raised that payout annually for 23 straight years. It spent just 48% of its free cash flow (FCF), or $5.7 billion, on those dividends -- which leaves it plenty of room for future hikes.

IBM's stock also trades at 10 times this year's earnings after tumbling about 20% over the past 12 months. That decline can be attributed to concerns about IBM's stagnant revenue growth and competition from cloud competitors like Amazon and Microsoft. Warren Buffett's decision to sell Berkshire Hathaway's stake in IBM and the broader market sell-off exacerbated that pain.

IBM's revenue fell year over year for two straight quarters, but it showed flickers of life in its fourth-quarter report. Its Cognitive Solutions revenue rose 2% on a constant currency basis, marking a rebound from its 5% drop in the third quarter, thanks to stronger demand for its Transaction Processing Software, analytics and AI tools, and private cloud services.

Its Global Business Services (GBS) revenue also rose 6% on higher demand for its AI and automation solutions for enterprise customers. Its acquisition of Red Hat, which should close in the second half of the year, should also boost its closely watched cloud revenues again.

IBM's revenues and stock price won't rise significantly anytime soon, but its high yield and low valuation should limit its downside. This makes Big Blue a fairly safe dividend stock for conservative investors.

The bottom line

Nobody can guarantee that these three promising stocks will go on to deliver market-beating returns from here. But between the relative strength in retail benefiting Tanger Factory Outlet Centers, the ongoing turnaround at VEREIT, and IBM's long history of dividend increases and low valuation, these contributors believe all three businesses will go on to do exactly that. And they think long-term, dividend-seeking investors should put their money to work accordingly.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Leo Sun owns shares of Amazon and Tanger Factory Outlet Centers. Reuben Gregg Brewer owns shares of IBM, Tanger Factory Outlet Centers, and VEREIT. Steve Symington has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Amazon and Berkshire Hathaway (B shares). The Motley Fool owns shares of Microsoft. The Motley Fool recommends Tanger Factory Outlet Centers. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance