3 UK Dividend Stocks Offering Yields From 3.6% To 4.6%

As global markets experience fluctuations, with the FTSE 100 poised to open lower and broader economic indicators showing mixed signals, investors are closely monitoring developments. In such a climate, dividend stocks in the United Kingdom can offer a relatively stable avenue for those looking to generate income from their investments amidst prevailing market volatility and economic uncertainty.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.00% | ★★★★★★ |

Dunelm Group (LSE:DNLM) | 7.58% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.95% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 6.06% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.01% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.70% | ★★★★★☆ |

NWF Group (AIM:NWF) | 3.58% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.01% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.41% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 4.01% | ★★★★★☆ |

Click here to see the full list of 54 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

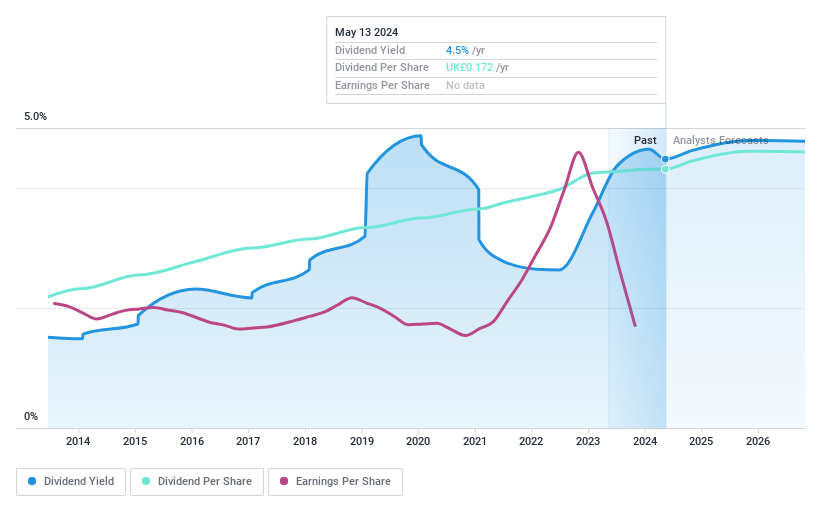

Wynnstay Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wynnstay Group Plc is a UK-based company that manufactures and supplies agricultural products, with a market capitalization of approximately £88.53 million.

Operations: Wynnstay Group Plc generates its revenue primarily through two segments: Agriculture, which brought in £584.31 million, and Specialist Agricultural Merchanting, contributing £151.48 million.

Dividend Yield: 4.5%

Wynnstay Group offers a stable dividend yield of 4.48%, which is lower than the top UK dividend payers. The dividends are well-supported, with a payout ratio of 56.1% and cash payout ratio of 34.6%, indicating sustainability from both earnings and cash flow perspectives. However, recent executive changes with CEO Gareth Davies taking leave could introduce some uncertainty in leadership stability, potentially impacting future performance and strategic decisions.

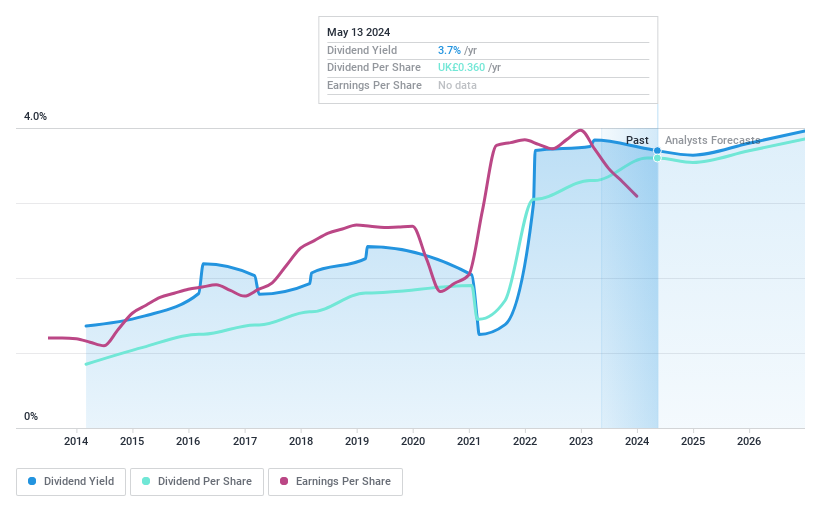

Grafton Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Grafton Group plc operates in distribution, retailing, and manufacturing across Ireland, the Netherlands, Finland, and the United Kingdom with a market capitalization of approximately £1.95 billion.

Operations: Grafton Group plc generates revenue through various segments including UK Distribution (£818.11 million), Ireland Distribution (£631.03 million), Netherlands Distribution (£351.47 million), Finland Distribution (£139.78 million), Retailing (£258.20 million), and Manufacturing (£135.30 million).

Dividend Yield: 3.7%

Grafton Group recently approved a final dividend of 26.0 pence per share, reflecting a stable payout with an increase from the previous year. Despite a slight decline in revenue to £669.2 million for early 2024 and changes in executive roles, the dividends are well-supported by earnings and cash flows, with coverage ratios of 51.8% and 32.8% respectively. The stock trades at a P/E ratio of 13.1x, below the UK market average, suggesting value relative to peers despite its modest yield of 3.7%.

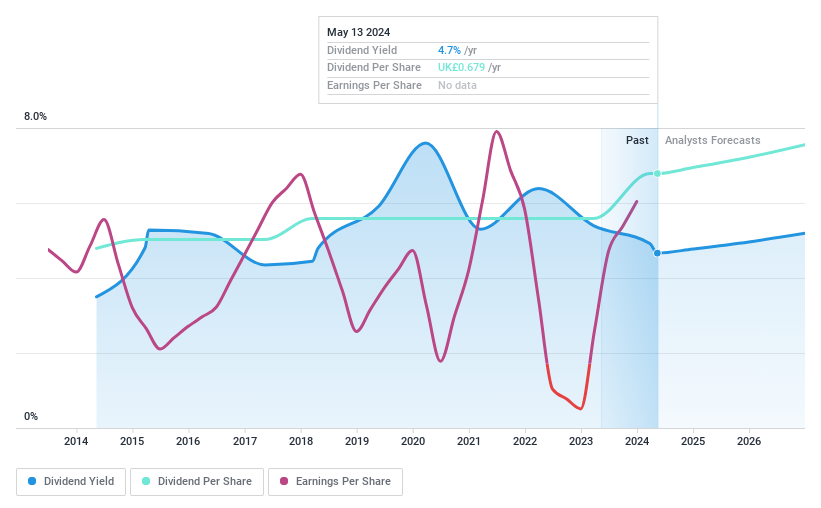

Ocean Wilsons Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited, operating primarily in Brazil, is an investment holding company that provides maritime and logistics services with a market capitalization of approximately £514.53 million.

Operations: Ocean Wilsons Holdings Limited generates $486.65 million in revenue from its maritime services in Brazil.

Dividend Yield: 4.7%

Ocean Wilsons Holdings turned profitable in 2023, with a net income of US$67.05 million, rebounding from a previous loss. The company proposed raising its annual dividend to US$0.85 per share, up from US$0.70, payable on June 14, 2024. This increase is supported by earnings and cash flow coverage ratios of 44.8% and 48.1%, respectively, indicating sustainable payouts despite a dividend yield (4.66%) that trails the top UK dividend payers (5.65%).

Make It Happen

Dive into all 54 of the Top Dividend Stocks we have identified here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:WYNLSE:GFTU and LSE:OCN

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance