3 Undervalued Real Estate Stocks to Consider as Mortgage Applications Spike

In a previous article, I noted that the number of new homes being sold each week in the U.S. began to pick up again in early March after initial declines related to the Covid-19 pandemic and high unemployment rates. At the time, the media buzz found this data point surprising, with some expecting it to quickly reverse again.

However, with the Federal Reserve keeping the base interest rate at record lows of around zero to 0.25%, it is possible that many who had the goal of buying a home at some unspecified point in the future have been lured into entering the market earlier than expected in order to lock in a favorable mortgage rate.

According to the latest numbers from the Mortgage Bankers Association as of June 17, the average 30-year fixed mortgage rate has fallen to 3.3%, which is the lowest level in the survey's history. There has also been a 10% spike in refinancing applications.

Home mortgage applications have now risen 4% to an 11-year high since the week before last. This marks the ninth week of gains in a row, and also likely represents some pent-up demand from those who put off new home purchases for the first few weeks after the Covid-19 pandemic officially spread to the U.S.

With the Fed expected to keep the base rate near zero at least through 2021, investors may want to consider the following three homebuilding and real estate stocks, as they present potential value opportunities. These companies have a combination of low valuations, high profitability and strong balance sheets.

Meritage Homes

Meritage Homes Corp. (NYSE:MTH) is a home construction and real estate company based in Scottsdale, Arizona. It mainly constructs single-family detached homes, active adult communities and luxury real estate in Arizona.

On June 17, shares of Meritage traded around $75.39 for a market cap of $2.83 billion and a price-earnings ratio of 9.92, which is lower than its 10-year median price-earnings ratio of 11.31. According to the Peter Lynch chart, the stock is trading below its intrinsic value.

The company has a GuruFocus rating of 6 out of 10 for its financial strength and 7 out of 10 for its profitability. The cash-debt ratio of 0.3 is average for the industry, while the Altman Z-Score of 2.78 indicates that the company is not likely to go bankrupt. The return on invested capital is higher than the weighted average cost of capital, indicating strong profitability.

Lennar

Lennar Corp. (NYSE:LEN) is the second-largest homebuilder in the U.S. Headquartered in Miami, the company is a national leader in the construction of new homes with a focus on the most desirable real estate markets. It also owns an international arm, which it launched in 2014.

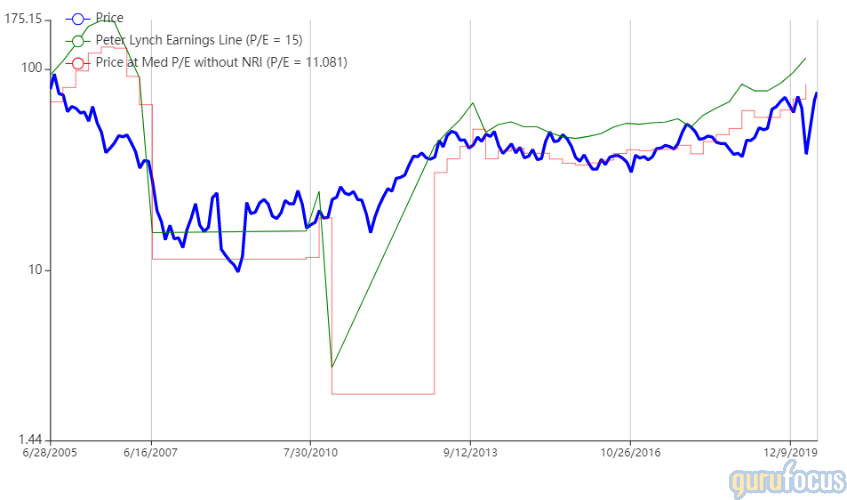

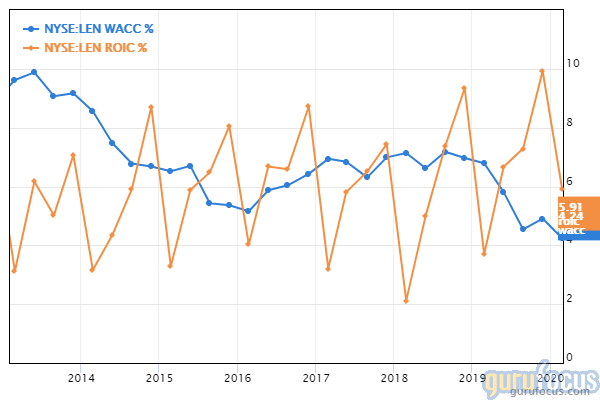

On June 17, Lennar's shares traded around $63.45 for a market cap of $19.29 billion and a price-earnings ratio of 10.14, which is below the 10-year median price-earnings ratio of 15.05. The Peter Lynch chart places current price levels below the company's intrinsic value.

GuruFocus gives the company a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10. While the cash-debt ratio of 0.12 is lower than 81.42% of competitors, the Altman Z-Score of 3.22 indicates that the company is not likely at risk of bankruptcy. The ROIC is higher than the WACC, indicating strong profitability.

Jones Lang LaSalle

Based in Chicago, Jones Lang LaSalle Inc. (NYSE:JLL) is a commercial real estate company that also provides a range of investment management services. Unlike the other two companies on this list, Jones Lang LaSalle is not a homebuilder, making it less subject to the volatility of raw materials costs.

On June 17, shares of the company traded around $106.40 for a market cap of $5.53 billion and a price-earnings ratio of 10.49, which is lower than the 10-year median price-earnings ratio of 18.07. The Peter Lynch chart indicates that the stock is undervalued.

Jones Lang LaSalle has financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10 from GuruFocus. The cash-debt ratio of 0.18 and Altman Z-Score of 2.35 indicate relatively stable financials near the industry averages. However, the ROIC is lower than the WACC, indicating that despite strong earnings growth, profitability may be set to deteriorate in the future unless the company can grow without taking on more debt.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research and/or consult registered investment advisors before taking action in the stock market.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance