3 Value Stocks at 52-Week Highs Still Worth Buying

Just because a stock has hit a new 52-week high doesn't mean it can't go on to loftier levels. Sometimes, stocks will even pull back a little bit before resuming their run-ups again.

We asked three Motley Fool investors to identify a value stock that recently hit a new high. They chose Amgen (NASDAQ: AMGN), Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), and Avis Budget Group (NASDAQ: CAR), and tell us why these company's stocks, which have receded from those peaks, shouldn't be able to hit new highs.

Image source: Getty Images.

An investing trifecta

Brian Feroldi (Amgen): "Biotech," "value," and "52-week high" are words that you might not think would ever go together. However, I think that all of these words nicely summarized Amgen's recent stock-price action.

Amgen has been around for nearly four decades, making it one of the oldest biotechs on the planet. The company's success has been driven by a handful of megablockbuster drugs that include Epogen, Neupogen, Enbrel, and Neulasta. However, sales of these drugs have come under pressure as of late, because the biosimilar floodgates are finally starting to open. That fact helps to explain why Amgen's stock is trading around 17 times earnings -- which makes it a value play.

However, shares rallied to new highs lately thanks to strong growth in a handful of next-generation drugs. This includes Prolia, Kyprolis, Blincyto, and Repatha, the latter of which is believed to hold blockbuster potential. When you combine this with Amgen's late-stage pipeline, you have many reasons to believe that its new crop of drugs should more than offset the revenue declines from its legacy medicines.

Lastly, Amgen's balance sheet is packed with more than $40 billion in cash and the company continues to crank out billions in free cash flow each year. That gives the company plenty of ammunition to make a splashy acquisition, buy back stock, and continue to aggressively grow its dividend payment, all at the same time. When this is combined with Amgen's modest valuation, I see plenty of reasons to be bullish on this biotech's future.

It may have pulled back from its peak, but expect those trends to lead it to make a new run at an even higher high.

Image source: Getty Images.

A tech giant with room to grow

Travis Hoium (Alphabet): A handful of tech companies have built such a big competitive advantage that it's hard to imagine any small company or start-up toppling them. One of those tech companies is Alphabet, which is trading within earshot of its 52-week high, but is still a good buy for investors.

Alphabet's main business is search and related advertising that dominates the internet. Not only does Google search turn up advertisements when you search for something, but it has a profile on you, and serves up ads that you might like as you're browsing the internet.

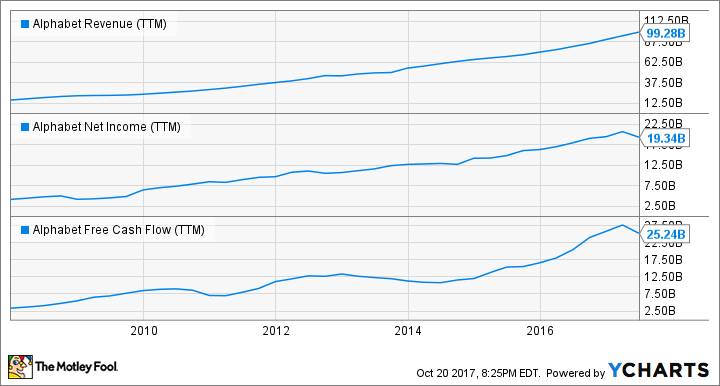

Layered on top of the search and ad foundation are products that engage consumers and provide Google and Alphabet with more information about users. Products like Gmail, Android, and Google Maps feed the cash machine that Alphabet has created, which, in the last year alone, has generated over $25 billion in free cash flow.

GOOG Revenue (TTM) data by YCharts.

The great foundation of Google's products allows other Alphabet subsidiaries to invest in growth projects like self-driving cars, internet from drones, and smart energy. Given the dominant position Alphabet has in core technologies like search and online advertising, and the growth projects it's investing in, I think this stock is still a good buy near its 52-week high.

Image source: Getty Images.

Still trying harder

Rich Duprey (Avis Budget Group): Car-rental agency Avis Budget Group was run off the road by a collapse in used-car pricing and the continued popularity of ridesharing services Uber and Lyft. Yet in every cloud, there's apparently a silver lining.

Hurricanes Harvey and Irma, which ripped through the South and Southeastern part of the country, damaged upwards of 500,000 cars, according to some estimates, which ought to cause used-car prices to rise. The rental agencies had been squeezed by the U.S. auto industry coming off a record-high year for new car sales last year. As leases on these cars are coming to an end, dealer lots are being flooded with a glut of used cars. Avis (and Hertz) are benefiting from the actual flooding that damaged vehicles.

While there are skeptics who believe that Avis can maintain the momentum it's built up that's allowed it to hit a new 52-week high, there are still factors that can push shares higher. It remains a heavily shorted stock, though not as many shares are sold short as there were last month. Still, days to cover has soared to almost 16, a level not seen since last year, and anything over seven is considered a lot. With Avis shares hitting new highs, its stock could be the beneficiary of a short squeeze that sends it surging even higher.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Brian Feroldi owns shares of Alphabet (A shares) and Alphabet (C shares). Rich Duprey has no position in any of the stocks mentioned. Travis Hoium has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares) and Alphabet (C shares). The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance