3D Systems' (DDD) Q4 Loss Narrower Than Expected, Sales Down

3D Systems DDD reported fourth-quarter 2022 non-GAAP loss of 6 cents per share, narrower than the Zacks Consensus Estimate of a loss of 8 cents. The bottom line compared unfavorably with the prior-year quarter’s earnings of 9 cents per share.

In the fourth quarter of 2022, 3D Systems reported revenues of $132.7 million, down 12% from the year-ago quarter, which outpaced the consensus mark of $132.3 million. Excluding the impact of business divestments in 2022 and on a constant currency basis, revenues decreased 7.6% year over year.

3D Systems’ fourth-quarter performance reflected impacts of inflationary pressure, foreign exchange risks and supply chain disruptions, among other ongoing macroeconomic constraints.

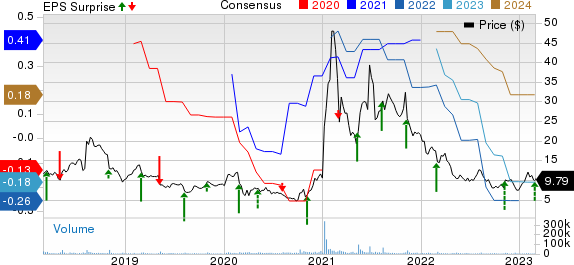

3D Systems Corporation Price, Consensus and EPS Surprise

3D Systems Corporation price-consensus-eps-surprise-chart | 3D Systems Corporation Quote

Quarter in Detail

In the fourth quarter, product revenues represented 71.4% of the total revenues and decreased 19.4% to $94.7 million. Revenues from Services, which accounted for 28.6% of revenues, climbed 14.1% year over year to $38 million.

Revenues from the Healthcare segment fell 18.5% year over year to $60.7 million. The figure decreased 5.5% from the prior quarter. Excluding the impact of business divestments, the segment’s revenues decreased 16.6% year over year.

The Industrial Division revenues decreased 5.7% year over year to $72 million while it went up by 5.7% sequentially. Excluding the impact of business divestments, the unit’s revenues increased 1.1%. The unit witnessed solid demand for products as well as materials.

Operating Details

During the fourth quarter of 2022, 3D Systems’ non-GAAP gross profit decreased 18.6% year over year to $54.2 million. Consequently, the non-GAAP gross profit margin contracted 320 basis points (bps) to 40.9%. This decrease was because of year-over-year product mix changes, due to divestitures and increased supply chain disruptions.

Non-GAAP operating expenses flared up 18% to $64.1 million. The increase was driven by spending related to future growth, which includes expenses from acquisitions, research and development and corporate infrastructure.

Non-GAAP operating loss was $9.9 million against the year-ago operating income of $12.4 million.

Adjusted EBITDA was negative $4.8 million. The margin of negative 3.6% reflected the inflationary impact on input costs and gradual investments for portfolio & business growth.

Balance Sheet Details

The company exited the fourth quarter with cash, cash equivalents and short-term investments of $568.7 million, lower than the prior quarter's $609.4 million. As of Dec 31, 2022, 3D Systems had a total debt of $449.5 million, up from the previous quarter’s $448.9 million.

In 2022, the company utilized $68.4 million of cash from operational activities.

Full-Year Highlights

For the full-year 2023, 3D Systems reported revenues of $538 million, indicating a slump of 12.6% year over year. However, excluding the impact of business divestments, annual revenues jumped 3.3% year over year. The year-over-year increase in top-line results reflect continued strength in the Industrial segment, growing demand from Healthcare customers, offset by reduced sales to specific dental market customers.

The company reported non-GAAP loss of 23 cents per share compared with earnings of 45 cents reported year ago.

Non-GAAP gross margin contracted 270 bps to 39.8%. Non-GAAP operating expenses increased 22.1% to $241.1 million.

Non-GAAP operating loss was $26.9 million in 2022 against operating income of $33.5 million a year ago. Adjusted EBITDA was negative $5.8 million for the full-year 2023. The margin stood at negative 1.1%.

Guidance

3D Systems expects 2023 revenues to be between $545 million and $575 million.

The company projects non-GAAP gross margin to be 40-42%.

Zacks Rank & Key Picks

3D Systems carries a Zacks Rank #3 (Hold). Shares of DDD have lost 42.4% over the past year.

Some top-ranked stocks from the broader Computer and Technology sector are Airbnb ABNB, Baidu BIDU, and Fabrinet FN, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Airbnb’s first-quarter 2023 earnings has been revised northward from breakeven to 14 cents per share over the past 30 days. For 2023, earnings estimates have moved up by 52 cents to $3.38 per share in the past 30 days.

ABNB's earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 57.2%. Shares of the company have declined 21.7% in the past year.

The Zacks Consensus Estimate for Baidu’s first-quarter 2023 earnings has been revised 15 cents northward to $2.43 per share over the past 60 days. For 2023, earnings estimates have rose by 6.4% to $11.62 per share over the past 60 days.

BIDU’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 45.5%. Shares of the company have lost 14.2% in the past year.

The Zacks Consensus Estimate for Fabrinet's third-quarter fiscal 2023 earnings has been revised 7 cents upward to $1.90 per share over the past 30 days. For fiscal 2023, earnings estimates have moved north by 24 cents to $7.71 per share in the past 30 days.

FN’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, missing once, the average surprise being 5.1%. Shares of the company have jumped 21.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Baidu, Inc. (BIDU) : Free Stock Analysis Report

3D Systems Corporation (DDD) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

Airbnb, Inc. (ABNB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance