4 Computer Peripheral Stocks to Watch From a Prospering Industry

The Zacks Computer-Peripheral Equipment industry has been benefiting from the rising demand for remote working tools amid the hybrid work trend and accelerated digital transformation. Industry participants like LG Display Company LPL, Mercury Systems MRCY, Stratasys SSYS and Vuzix Corporation VUZI are well poised to benefit from the growing demand for professional gaming accessories, touchscreen devices, smart glasses, and RFID (Radio Frequency Identification) solutions. Moreover, the solid demand for 3D-printed health equipment like face shields, nasal swabs and ventilator parts has been a tailwind. Nevertheless, the industry participants are suffering from the lingering effects of the pandemic, challenging macroeconomic conditions, including raging inflation that has induced sluggishness in IT spending. Declining PC sales are also negatively impacting the demand for computer peripheral equipment.

Industry Description

The Zacks Computer-Peripheral Equipment industry comprises companies offering computer input, output and storage devices. These include keyboards, mouse, LCD panels, smart glass, analog to digital imaging solutions, touch sensors, 3D printers & additive manufacturing, and transaction-based printer products, among others. Moreover, video gaming accessories, including gaming mouse, wired gaming headsets, in-ear gaming headphones and controllers for Xbox One and Playstation, are offered by these companies. Notably, the highly competitive nature of the industry is encouraging participants to come up with innovative and relevant products to meet the current demand trend. This is strengthening their product portfolios.

4 Trends Shaping the Future of the Computer-Peripheral Equipment Industry

Shift in Consumer Preference a Key Catalyst: The gradual shift in consumer preference from mobile gaming to a more professional gaming experience is a major growth driver. The launch of advanced gaming devices and the rising popularity of e-sports leagues are likely to boost the prospects. Markedly, e-sports will also likely continue aiding the total addressable market in the gaming peripherals industry. In addition, the 3D printing market presents a favorable long-term investment opportunity, as a large number of engineers, designers, architects and entrepreneurs are resorting to 3D solutions for primary designing and product modeling. Also, the coronavirus outbreak is resulting in massive demand for gaming equipment and 3D-printed medical equipment, which is a major driving force for this industry during these trying times.

Expanding Global Footprint: The expansion of the total addressable market bodes well for the industry participants. Deepening penetration into price-sensitive regions like the Asia Pacific and the Middle East & Africa through low-cost quality products boosts growth prospects.

Macroeconomic Headwinds Might Hurt IT Spending: Enterprises may postpone their large IT spending plans due to a weakening global economy amid ongoing macroeconomic and geopolitical issues. Per the latest Gartner report, worldwide IT spending is likely to have increased 0.8% in 2022 on a year-over-year basis. The research firm’s report highlights that 2022 IT spending growth has been much slower than 2021 due to spending cutbacks across devices, software, IT services and communication services areas. Furthermore, considering the recessionary situation hovering around the world, we do not expect any strong rebound in IT spending at least in the first half of 2023. This does not bode well for the Computer-Peripheral Equipment market’s prospects in the near term.

Elevated Operating Expenses to Hurt Profitability: To survive in the highly competitive computer peripheral market, each player is aggressively investing in research and development to enhance their product portfolio and broaden their capabilities. Moreover, companies are looking to enhance their sales and marketing capabilities, particularly by increasing their sales force. Therefore, elevated operating expenses to capture more market share are likely to dent margins in the near term.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Computer-Peripheral Equipment industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #27, which places it in the top 11% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates solid near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Before we present a few stocks that you may want to consider for your portfolio, let us look at the industry’s recent stock-market performance and valuation picture.

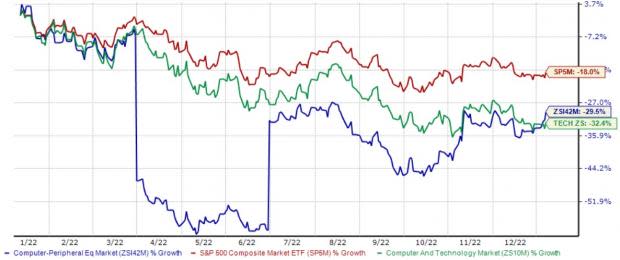

Industry Outperforms the Sector but Lags S&P 500

The Zacks Computer-Peripheral Equipment industry has outperformed the broader Zacks Computer and Technology sector in the trailing 12 months but underperformed the S&P 500 composite during the same time frame.

The industry lost 29.5% during this period. The S&P 500 and the broader sector have declined 18% and 32.4%, respectively, over the same time frame.

One-Year Price Performance

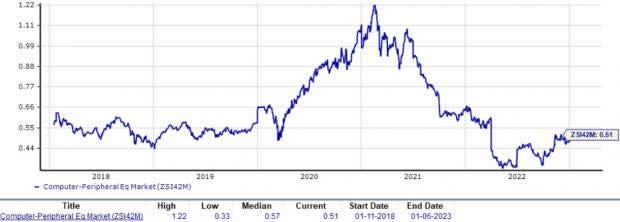

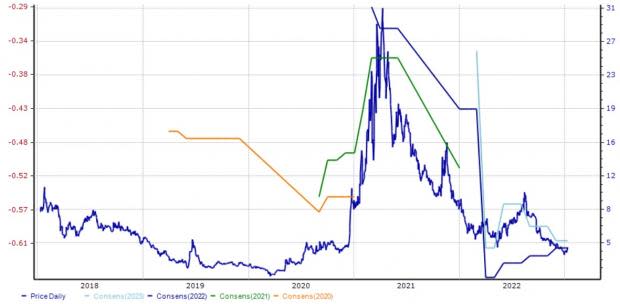

Industry's Current Valuation

On the basis of the trailing 12-month P/S, which is a commonly-used multiple for valuing computer peripheral stocks, we see that the industry is currently trading at 0.51X compared with the S&P 500’s 3.44X and the Zacks Computer and Technology sector’s 3.05X.

Over the last five years, the industry has traded as high as 1.22X, as low as 0.33X and at the median of 0.57X, as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

4 Stocks to Watch

Mercury Systems: It is gaining from the modernization in radar, electronic warfare and C4I that is opening up new opportunities in weapon systems, space, avionics processing, and mission computing and embedded rugged service for the company. Its domain expertise in analog and digital integration has helped this Zacks Rank #2 (Buy) company build a solid long-term relationship with prime defense contractors. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Additionally, Mercury Systems’ embedded computing servers, including the suite of EnsembleSeries blades, have delivered processing solutions with long lifecycles, high performance, environmental resiliency, interoperability and SWaP optimization for 35 years. Also, the accelerated usage of parallel processing and high-performance computing is prompting companies like Mercury Systems to capitalize on AI for solving real-world problems across industries.

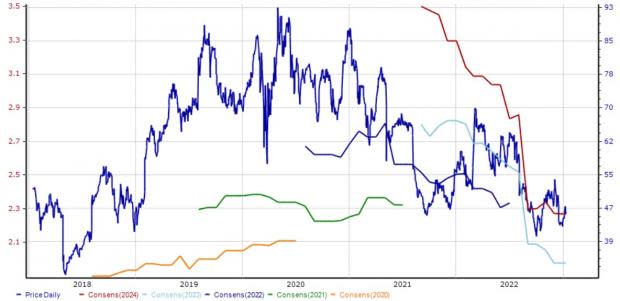

The Zacks Consensus Estimate for fiscal 2023 earnings has been revised downward by 6 cents in the past 60 days to $2.03 per share. Shares of the company have plunged 18.2% over the past year.

Price and Consensus: MRCY

LG Display: This Seoul, Republic of Korea-based company primarily manufactures and sells thin-film transistor liquid crystal display panels in a range of sizes and specifications, primarily for use in televisions, notebook computers and desktop monitors, as well as for handheld application products, such as mobile phones; and medium and large-size panels for industrial and other applications, including entertainment systems, portable navigation devices, e-paper, digital photo displays and medical diagnostic equipment.

LG Display is riding on the healthy demand for its display panels from PC vendors. The PC vendors are witnessing heightened demand for commercial notebooks and desktops as economies around the world are reopening and enterprises are investing in building a hybrid work environment. The solid sales of smartphones are also likely to spur demand for this Zacks Rank #3 (Hold) company’s display panels.

The company supplies products to original equipment manufacturers and multinational corporations. The Zacks Consensus Estimate for its 2023 bottom line is pegged at a loss of $1.63 per share, 18 cents narrower than a loss per share of $1.81 projected seven days ago. The stock has declined 45.4% in the past year.

Price and Consensus: LPL

Stratasys: This Eden Prairie, MN-based company is benefiting from an increase in demand for 3D-printed medical equipment. Notably, the adoption of PolyJet and FDM printers has been encouraging. Markedly, Stratasys’ machines facilitate prototyping within a few hours, reducing development time and upfront costs. Also, the company’s spool-based system compares favorably with UV polymer systems. For these reasons, we think the company maintains a leading position in RP machines. Apart from these, the company’s RedEye RPM is the world's largest RP and part-building service.

Furthermore, this Zacks #3 Ranked 3D printing company has made strategic partnerships with the likes of Schneider Electric, Boeing, Ford Motor, Siemens, Boom Supersonic and United Launch Alliance in recent times. These collaborations are aimed at introducing advanced 3D printing technologies in the aerospace and automotive industries. Additionally, the company’s cost-control initiatives are anticipated to reflect positively on the bottom line.

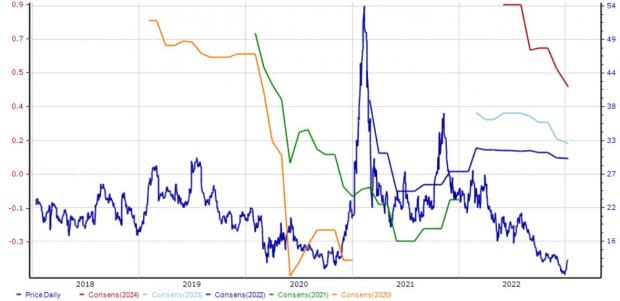

The consensus mark for 2023 earnings has been revised downward by 2 cents in the past 30 days to 20 cents per share. The stock has depreciated 43.9% in a year’s time.

Price and Consensus: SSYS

Vuzix: It is a leading supplier of Smart-Glasses and Augmented Reality (AR) technologies and products for the consumer and enterprise markets. This Zacks Rank #3 company's products include personal displays and wearable computing devices that offer users a portable high-quality viewing experience, provide solutions for mobility, wearable displays and augmented reality.

Vuzix is benefiting from continued strong demand for its smart glasses, particularly the M400 series, from enterprise customers and healthcare providers to overcome operational challenges caused by COVID-19 across a variety of market verticals. Furthermore, the latest ISO class 2 certification received for its M400 glasses would allow the device to be used in clean room environments, thereby enhancing its adoption across electronics, pharmaceuticals, medical devices, optics, solar and aerospace/defense end-markets.

The Zacks Consensus Estimate for 2023 is pegged at a loss per share of 61 cents, which is a couple of cents wider than a loss of 59 cents projected 60 days ago. Vuzix’s shares have declined 48.8% in the past year.

Price and Consensus: VUZI

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LG Display Co., Ltd. (LPL) : Free Stock Analysis Report

Stratasys, Ltd. (SSYS) : Free Stock Analysis Report

Mercury Systems Inc (MRCY) : Free Stock Analysis Report

Vuzix Corporation (VUZI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance