4 Low-Beta Tech Stocks to Hedge Against the Volatile Market

Wall Street has been witnessing high volatility due to several economic issues throughout the year. Such crucial factors include Federal Reserve’s aggressive interest rate hikes, the Russia-Ukraine war-led energy crisis and persistent inflation over the last year.

Major stock market indices in the United States like the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 have plunged 16.9%, 31.8% and 22.8%, respectively, year to date. The Zacks Computer and Technology sector has slumped 38.2% in the same time frame.

The latest announcement of another sharp interest rate hike of 0.75% by the Federal Reserve in its Federal Open Market Committee meeting held in September to combat inflation is intensifying vulnerability in the tech space. On top of that, the ongoing supply-chain disruptions from the acute shortage of chips and other input components, and currency fluctuations are further likely to impact the near-term prospects of the tech sector, continuously affecting the price performances of most of the stocks in the space.

Now, the question is, should potential investors stay away from investing in the technology space? The answer is “no.” We believe, investing in low-beta tech stocks like TMobile US TMUS, Amdocs Limited DOX, Harmonic HLIT, and Bandwidth BAND can aid investors in hedging against the current highly volatile market environment.

Beta measures a stock's systematic risk or volatility compared with the market. Therefore, a stock with a beta of less than 1.0 will be less sensitive to the market’s movements than a stock with a more than 1.0 beta.

Picking the Right Low-Beta Stocks

We have run the Zacks Stocks Screener to identify stocks with a beta between 0.50 and 0.95. We have narrowed our search by considering stocks with a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Our Picks

TMobile is a national wireless service provider offering services under the T-Mobile, Metro by T-Mobile and Sprint brands. The company was formed after the merger of T-Mobile USA Inc. and MetroPCS Communications. TMobile is extensively deploying 5G and 4G LTE (Long-Term Evolution) networks at present. It is expanding its footprint of T-Mobile 5G Home Internet across new areas, which is currently available to nearly 5 million homes in the United States.

This Zacks Rank #2 company has a beta of 0.50. Shares of TMUS have gained 15.4% year to date.

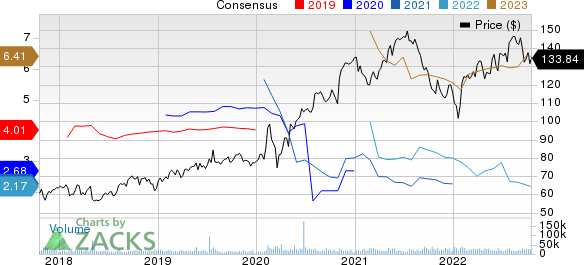

TMobile US, Inc. Price and Consensus

TMobile US, Inc. price-consensus-chart | TMobile US, Inc. Quote

Headquartered in Bellevue, TMobile offers mobile voice, messaging and data services in the postpaid, prepaid and wholesale markets. It also provides wireless devices, such as smartphones, tablets, and other mobile communication devices and accessories manufactured by various suppliers. In second-quarter 2022, the company reported Service revenues of $15.3 billion, representing 77.7% of the total revenues.

The Zacks Consensus Estimate for TMUS’s 2022 earnings is pegged at $2.17 per share, implying a decrease of 16.2% from the year-ago reported figure. For 2023, the consensus mark for earnings has been revised upward to $6.41 per share over the past 90 days, indicating a whopping 195.5% year-over-year surge.

Amdocs is one of the leading providers of customer care, billing and order management systems for communications and Internet services. The company offers amdocsONE, a line of services designed for various stages of a service provider's lifecycle. It also provides advertising and media services for media publishers, TV networks, video streaming providers, advertising agencies and service providers.

This Zacks Rank #2 company has a beta of 0.68. Shares of DOX have jumped 7.2% year to date.

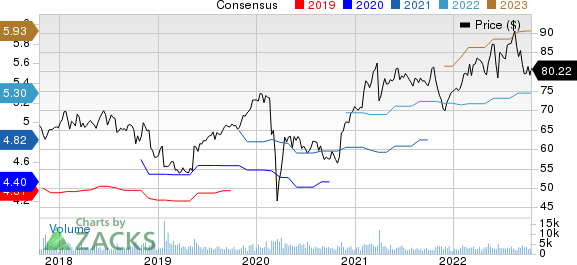

Amdocs Limited Price and Consensus

Amdocs Limited price-consensus-chart | Amdocs Limited Quote

The company is currently benefiting from its recurring revenue business model. Customer additions and solid demand for managed services are its primary growth drivers. Amdocs’ growth momentum is expected to continue due to its initiatives to aid digital, media, network and cloud transformations of its clients. The acquisition of Openet in 2020 has rapidly expanded the company’s footprint in 5G cellular networks. Its solutions have been selected by the likes of AT&T and T-Mobile to bolster their 5G footprint.

The consensus mark for DOX’s fiscal 2022 earnings has been revised upward to $5.30 per share from $5.28 over the past 60 days, indicating a 10.2% year-over-year rise. For fiscal 2023, the Zacks Consensus Estimate for earnings increased to $5.93 per share from $5.92 over the past 30 days, indicating year-over-year growth of 11.9%.

Harmonic enables media companies and service providers to deliver ultra-high-quality broadcast and over-the-top video services to consumers globally. The company has also revolutionized cable access networking via the industry's first virtualized Climate Change Action Plan (CCAP) solution, enabling cable operators to more flexibly deploy gigabit internet service to consumers' homes and mobile devices.

Harmonic currently carries a Zacks Rank #2. It has a beta of 0.85. Shares of HLIT have gained 18.8% year to date.

Harmonic Inc. Price and Consensus

Harmonic Inc. price-consensus-chart | Harmonic Inc. Quote

In September, Harmonic unveiled the Single Illumination System solution to ensure greater interoperability and cost savings for broadcast operators with digital terrestrial television and direct-to-home services. The solution reduces multiplex distribution costs by about 50% compared with the double satellite illumination method. It also enables broadcast operators to deliver regional channels with greater efficiency.

The consensus mark for HLIT’s 2022 earnings is pegged at 48 cents, moving up 7 cents over the past 90 days and indicating a 41.2% year-over-year rise. For 2023, the Zacks Consensus Estimate for earnings moved north at 70 cents per share from 65 cents over the past 90 days, indicating a 46.5% jump.

Bandwidth is a leading provider of a cloud-based communications platform. Its portfolio and accretive customer base are the cornerstones of long-term growth across diverse markets. The company is currently benefitting from significant growth in Communications Platform-as-a-Service revenues.

Bandwidth’s dynamic location routing technology enables enterprises to meet critical requirements for Enhanced 911 in the United States. In partnership with Pindrop, it offers enterprises a direct route to migrate their contact centers to the cloud. It has seen dramatic growth in the recent years, driven by its full-service support for Enhanced 911 regulations like Kari's Law and RAY BAUM's Act. Backed by an avant-garde software platform, the company monitors and resolves any network-related issues on a real-time basis.

Bandwidth follows a usage-based revenue model, which enables it to simultaneously augment its top-line growth and increase the subscriber base. It generates most of its revenues from the Communications Platform-as-a-Service (CPaaS) business in the United States. With two decades of experience, it is the sole CPaaS provider in the industry, with a diversified customer base ranging from communications service providers to small and medium-sized businesses.

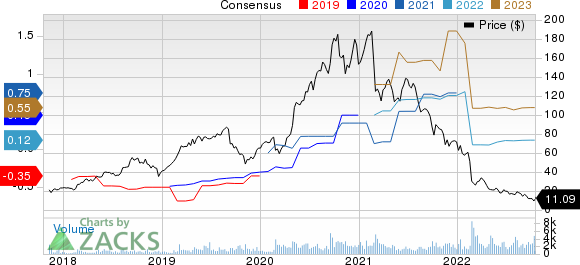

Bandwidth Inc. Price and Consensus

Bandwidth Inc. price-consensus-chart | Bandwidth Inc. Quote

Currently, Bandwidth has a Zacks Rank #2. It has a beta of 0.94. Shares of BAND have declined 84.6% year to date.

The Zacks Consensus Estimate for BAND’s 2022 earnings is pegged at 12 cents, moving upward by a penny over the past 90 days. The consensus estimate indicates an 87.6% slump from the year-ago reported quarter. For 2023, the company’s earnings estimates moved north by 3 cents to 55 cents over the past 90 days. The same indicates a 360% year-over-year hike.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Amdocs Limited (DOX) : Free Stock Analysis Report

TMobile US, Inc. (TMUS) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance