These 4 Measures Indicate That Mission Group (LON:TMG) Is Using Debt Safely

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, The Mission Group plc (LON:TMG) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Mission Group

What Is Mission Group's Net Debt?

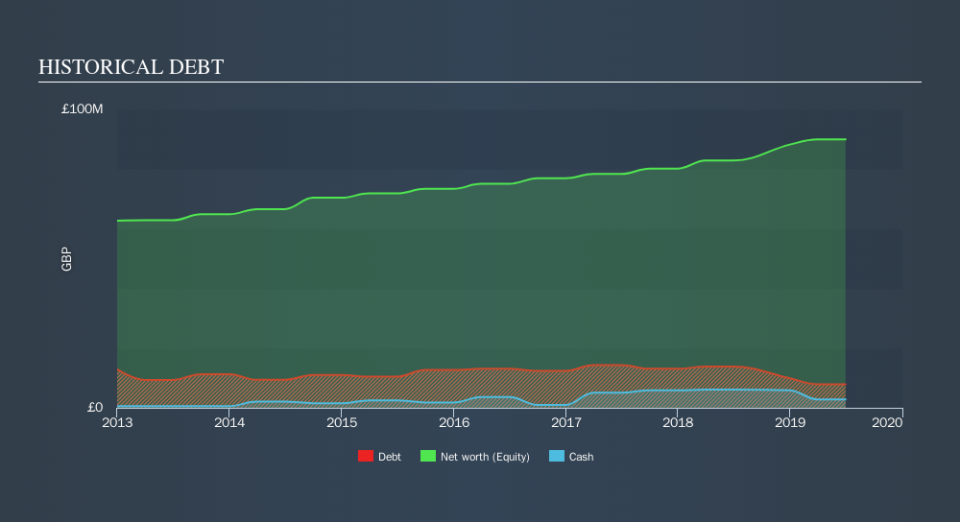

As you can see below, Mission Group had UK£7.82m of debt at June 2019, down from UK£13.9m a year prior. However, it does have UK£2.81m in cash offsetting this, leading to net debt of about UK£5.01m.

A Look At Mission Group's Liabilities

We can see from the most recent balance sheet that Mission Group had liabilities of UK£44.6m falling due within a year, and liabilities of UK£20.2m due beyond that. On the other hand, it had cash of UK£2.81m and UK£45.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£16.9m.

This deficit isn't so bad because Mission Group is worth UK£70.7m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Mission Group has a low net debt to EBITDA ratio of only 0.47. And its EBIT covers its interest expense a whopping 21.5 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Another good sign is that Mission Group has been able to increase its EBIT by 22% in twelve months, making it easier to pay down debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Mission Group can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Mission Group produced sturdy free cash flow equating to 76% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Mission Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Zooming out, Mission Group seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. We'd be very excited to see if Mission Group insiders have been snapping up shares. If you are too, then click on this link right now to take a (free) peek at our list of reported insider transactions.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance