4 Reasons to Invest in FB Financial (FBK) Stock Right Now

It seems to be a wise idea to add FB Financial Corporation FBK stock to your portfolio now. The company’s fundamental strength and growth prospects make it a good investment option.

Analysts are optimistic regarding its earnings growth potential. Over the past 30 days, the Zacks Consensus Estimate for FB Financial’s 2024 earnings has been revised 7.4% upward. Thus, the company currently sports a Zacks Rank #1 (Strong Buy).

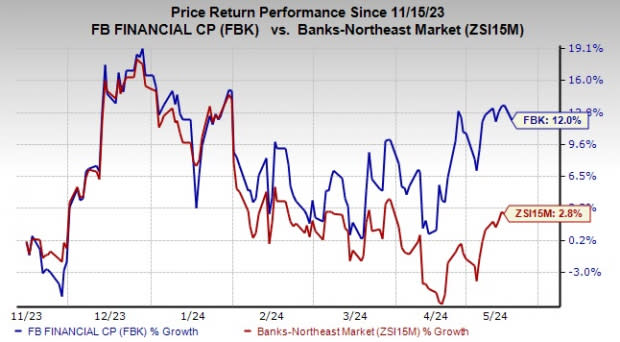

Its price performance also seems impressive. The stock has gained 12% over the past six months compared with the industry’s growth of 2.8%.

Image Source: Zacks Investment Research

Some other factors mentioned below make FB Financial a solid pick right now.

Earnings Growth: In the last three to five years, the company’s earnings witnessed a CAGR of 2.5%. Earnings will likely continue to grow in the near term. In 2024 and 2025, FBK’s earnings are projected to grow 1.3% and 2.9%, respectively.

Also, the company has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three and matched in one of the trailing four quarters, the average beat being 11.6%.

Revenue Strength: Driven by continued growth in net interest income, FB Financial’s revenues witnessed a CAGR of 7.2% over the last four years (2019-2023). Revenues declined in the first three months of 2024 mainly because of lower non-interest income. While total revenues are projected to decline 1.6% this year, the trend will reverse post that. In 2025, revenues are expected to increase 7.8%.

Strong Leverage: Currently, FB Financial’s debt/equity ratio is 0.00, while that for the industry is 0.36. This shows that FBK uses no debt to finance its operations. Thus, it will be financially stable even in adverse economic conditions.

Superior Return on Equity (ROE): The company currently has an ROE of 10.20%, higher than the industry average of 8.75%. This reflects that it is more efficient than peers in using shareholder funds.

Other Stocks Worth a Look

A couple of other top-ranked stocks from the finance space are T. Rowe Price Group, Inc. TROW and Artisan Partners Asset Management Inc. APAM.

Earnings estimates for TROW have been revised 12.9% upward for the current year over the past 60 days. The company’s share price has increased 14.5% over the past six months. TROW currently flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Artisan Partners presently carries a Zacks Rank #2 (Buy). Its earnings estimates have been revised upward by 3.4% for the current year over the past 60 days. In the last six months, APAM’s share price increased 18.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

FB Financial Corporation (FBK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance