4 Reasons Why Interactive Brokers (IBKR) Stock is a Good Pick

Interactive Brokers IBKR stock looks like an attractive investment option right now. The company’s continuous efforts to develop proprietary software will likely aid financials. Moreover, an increase in emerging market customers amid the high interest rate environment is expected to aid the top line.

Analysts are bullish on IBKR’s earnings growth prospects. Over the past 60 days, the Zacks Consensus Estimate for its current-year earnings has moved 1% upward. Thus, the company currently carries a Zacks Rank #2 (Buy).

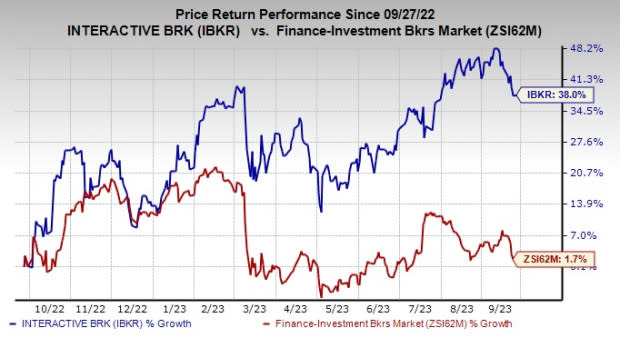

Looking at its price performance, shares of IBKR have gained 38% over the past year compared with 1.7% growth recorded by the industry.

Image Source: Zacks Investment Research

We have mentioned a few other factors below that make the IBKR stock a promising pick.

Earnings Growth: Interactive Brokers has witnessed earnings growth of 19% in the past three to five years, higher than the industry average of 13.6%. The uptrend is likely to continue in the near term. In 2023 and 2024, the company’s earnings are projected to grow 38.8% and 3.4%, respectively.

Revenue Strength: Driven by an increase in interest income, commissions and the company’s business restructuring efforts, its net revenues witnessed a compound annual growth rate (CAGR) of 12.5% over the last five years (2017-2022). The uptrend continued in the first half of 2023.

Given the steady improvement in Daily Average Revenue Trades, IBKR is expected to continue to witness a rise in the top line. For 2023 and 2024, the company’s revenues are projected to grow 38.5% and 2.2%, respectively. We anticipate IBKR’s total net revenues (GAAP) to witness a CAGR of 11.9% over the three years ended 2025.

Strong Leverage: Interactive Brokers does not use debt to finance its operations. It has a debt/equity ratio of nil compared with the industry average of 0.19. This highlights that IBKR is better positioned than its peers. The company will be more financially stable in adverse economic conditions.

Technological Advancement: Interactive Brokers processes trades in stocks, futures, options, and forex on more than 150 exchanges across several countries and currencies. Unlike many of its peers, IBKR has a very low level of compensation expenses relative to net revenues, primarily driven by its technological excellence.

The company has been undertaking several measures to enhance its presence. The launch of IBKR GlobalTrader is expected to enable investors around the world to trade stocks through mobile application. Also, Interactive Brokers was one of the first brokers to introduce Overnight Trading on U.S. stocks and ETFs nearly 24 hours a day, five days a week.

The launch of IBKR Lite has enabled investors to trade commission-free and is, thus, expected to improve the company’s market share. The launch of Impact Dashboard, an innovative sustainable investing tool, has made the company the first major brokerage firm to allow investors to easily align their portfolio with their values. IBKR has also launched cryptocurrency trading via Paxos Trust Company, charging commissions that are lower than other crypto exchanges.

Other Stocks Worth Considering

A couple of other top-ranked stocks from the same space are Morgan Stanley MS and Tradeweb Markets TW. MS and TW currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Over the past 30 days, the Zacks Consensus Estimate for Morgan Stanley’s current-year earnings has been unchanged. Over the past year, the MS stock has gained 4.5%.

Earnings estimates for TW have also been unchanged for the current year over the past 30 days. Over the past year, TW’s shares have rallied 40%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Tradeweb Markets Inc. (TW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance