4 Tech Stocks Likely to Outpace Estimates This Earnings Season

The overall April-June 2022 quarter earnings for the Zacks Computer and Technology sector have been relatively better so far than what the market had expected earlier.

Most companies in the space beat consensus EPS and revenue estimates backed by accelerated digital transformation initiatives adopted by organizations and strong IT spending. However, continued supply-chain disruptions, inflationary pressure and labor market constraints remained major headwinds that hurt the top and bottom-line growth of tech companies.

Per the latest Earnings Trends report, as of Aug 10, 80.3% of the tech companies in the S&P 500 list, constituting nearly 86.2% of the sector’s market capitalization, reported earnings. While 83.6% of the companies beat on earnings, 73.8% surpassed revenue estimates. Revenues increased 1.5% year over year, while earnings declined 9.3%.

Overall, second-quarter earnings of the Computer and Technology sector are expected to decline 8%, while revenues are projected to increase 2.4%.

Zeroing in on Winners

As the Q2 earnings season is drawing to a close, a few tech companies are yet to report their quarterly figures. Here, with the help of the Zacks proprietary methodology, we have highlighted four tech stocks — Intuit Inc. INTU, Box, Inc. BOX, Science Applications International Corporation SAIC and Guidewire Software, Inc. GWRE — that are expected to deliver a beat in their upcoming quarterly results.

With the presence of several industry participants, finding the right tech stocks with the potential to beat on earnings can be daunting. Our proprietary methodology, however, makes this task fairly simple.

You could narrow down your choices by looking at stocks that have the perfect combination of two key elements: a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold).

Earnings ESP is our proprietary methodology for determining stocks that have maximum chances of beating estimates in their next earnings announcement. It is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Our research shows that for stocks with this favorable mix of ingredients, the odds of a positive earnings surprise are as high as 70%.

4 Tech Stocks That Match the Criteria

Intuit is slated to report fourth-quarter fiscal 2022 results on Aug 23. The company currently has an Earnings ESP of +1.92% and a Zacks Rank #2. The Zacks Consensus Estimate for revenues and earnings is pegged at $2.35 billion and 99 cents per share, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuit’s fourth-quarter revenues are likely to reflect solid growth in the Online Ecosystem, driven by an expanding subscriber base for Quickbooks Online and ARPC. The gradual recovery in the Small Business and Self-Employed segments might have contributed to the top line during the quarter under review. The solid momentum of the company’s leading product, QuickBooks Capital, and improving customer retention rates might have acted as tailwinds in the fiscal third quarter.

However, the transition of Desktop Ecosystem offerings into a subscription model is anticipated to have hurt sales growth.

Intuit Inc. Price and EPS Surprise

Intuit Inc. price-eps-surprise | Intuit Inc. Quote

Box is scheduled to report second-quarter fiscal 2023 results on Aug 24. The company currently has an Earnings ESP of +1.20% and a Zacks Rank #3. The consensus mark for revenues and earnings is pegged at $245 million and 28 cents per share, respectively.

Box’s performance in the fiscal second quarter is likely to have benefited from the growing adoption of its content cloud solutions by new and existing customers. Also, growth in the net retention rate is expected to have remained a tailwind. Increasing demand for hybrid working and online learning methods is anticipated to have driven the quarterly performance. Rising demand for digital transformation, data security, compliance and privacy in businesses is expected to have benefited the to-be-reported quarter.

Box, Inc. Price and EPS Surprise

Box, Inc. price-eps-surprise | Box, Inc. Quote

Science Applications is scheduled to report second-quarter fiscal 2023 results on Sep 1. The company carries a Zacks Rank #3 and has an Earnings ESP of +1.49%. The Zacks Consensus Estimate for revenues and earnings is pegged at $1.82 billion and $1.68 per share, respectively.

Science Applications’ second-quarter results are likely to reflect key contract wins, driven by a strong product portfolio. The higher demand for its technology solutions due to the ongoing digital transformation wave across the defense, space, intelligence and civilian markets is likely to have aided SAIC’s second-quarter performance.

The acquisition of Halfaker and Associates may have resulted in incremental revenues in the quarter under review. The acquisition of Koverse is expected to have continued aiding revenue growth in this quarter as well.

However, Science Applications’ supply-chain portfolio is likely to have been affected by the impacts of the pandemic and ongoing geopolitical issues worldwide. This is expected to have been an overhang on the top line during the quarter under review. Additionally, the rising component costs, along with increasing labor and logistics expenses, are anticipated to have negatively impacted SAIC’s bottom line in the second quarter.

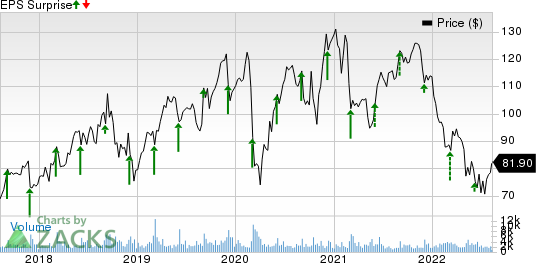

Science Applications International Corporation Price and EPS Surprise

Science Applications International Corporation price-eps-surprise | Science Applications International Corporation Quote

Guidewire Software is expected to report fourth-quarter fiscal 2022 results soon. It currently carries a Zacks Rank #3 and has an Earnings ESP +25.00%. The Zacks Consensus Estimate for revenues is pegged at $229 million while the same for the bottom line stands at a loss of 4 cents per share.

Guidewire’s fiscal fourth-quarter performance is likely to have gained from the pandemic-induced demand for cloud-based insurance software solutions. A solid uptick in multiple components of Guidewire’s InsurancePlatform, which included InsuranceSuite, digital, data and analytics, might have acted as a tailwind.

Although increasing expenses on product enhancements, especially cloud infrastructure and marketing initiatives, bode well over the long haul, it might have put pressure on margin expansion in the fiscal fourth quarter.

Guidewire Software, Inc. Price and EPS Surprise

Guidewire Software, Inc. price-eps-surprise | Guidewire Software, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuit Inc. (INTU) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

Science Applications International Corporation (SAIC) : Free Stock Analysis Report

Box, Inc. (BOX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance