4 Top Dividend Aristocrats to Buy Now for a Big Upside

Inflation in the United States did cool off in July, thanks to plummeting gas prices. In fact, the consumer price index (CPI) increased 8.5% last month, a slower annual jump compared with June’s 9.1% gain, per the Bureau of Labor Statistics.

Thus, it’s widely expected that the Federal Reserve should ease its aggressive tightening of monetary policy as inflation has started to decelerate. But recently, Fed Chair Jerome Powell categorically mentioned that he is still searching for “compelling” evidence that inflation will go down toward the central bank’s target of 2%. At the same time, Fed minutes released yesterday showed that policymakers actually saw “little evidence” that inflationary pressures were easing and that they continued to remain steadfast in hiking interest rates in order to tame inflation.

However, an increase in interest rates pushes up the cost of borrowing, which impacts the economy and the stock market. Let us not forget that economic growth has already slowed down. There were two successive negative quarters of growth in GDP this year. Moreover, geopolitical concerns are now on the rise, which could easily derail the stock market’s upward movement.

Given such a volatile situation, it would be prudent to invest in dividend aristocrats such as Archer Daniels Midland ADM, W.W. Grainger GWW, Genuine Parts GPC and Albemarle ALB. This is because such companies have solid fundamentals and a better-quality business that help them stand out from dividend payers. They have been delivering profits for a long time and are undeniably unfazed by market gyrations. These stocks provide a steady flow of income and flaunt a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Archer Daniels Midland is one of the leading producers of food and beverage ingredients as well as goods made from various agricultural products. This Zacks Rank #2 company is known for having raised its dividend for over 47 consecutive years.

Archer Daniels Midland has a dividend yield of 1.85%. ADM’s payout ratio presently sits at 25% of earnings. In the past 5-year period, ADM’s payout has advanced 4.07%. Check Archer Daniels Midland’s dividend history here.

Archer Daniels Midland Company Dividend Yield (TTM)

Archer Daniels Midland Company dividend-yield-ttm | Archer Daniels Midland Company Quote

W.W. Grainger is a broad line, business-to-business distributor of maintenance, repair and operating products and services. This Zacks Rank #2 company is known for having raised its dividend for 50 years in a row.

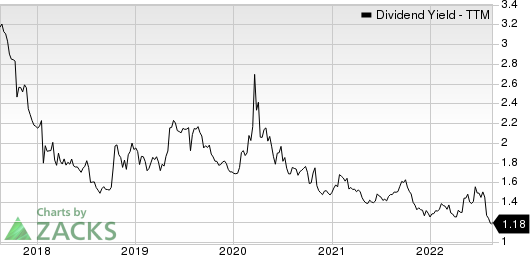

W.W. Grainger has a dividend yield of 1.18%. GWW’s payout ratio presently sits at 27% of earnings. In the past 5 years, GWW’s payout has advanced 6.05%. Check W.W. Grainger’s dividend history here.

W.W. Grainger, Inc. Dividend Yield (TTM)

W.W. Grainger, Inc. dividend-yield-ttm | W.W. Grainger, Inc. Quote

Genuine Parts distributes automotive and industrial replacement parts and materials. This Zacks Rank #2 company is known for having hiked its dividend for 66 consecutive years.

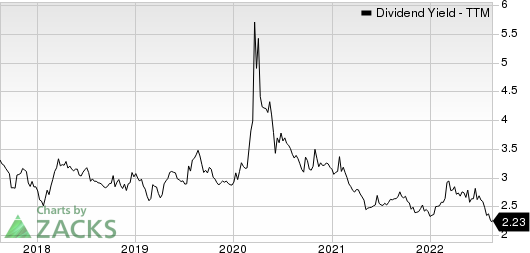

Genuine Parts has a dividend yield of 2.25%. GPC’s payout ratio presently sits at 46% of earnings. In the past 5-year period, GPC’s payout has advanced 5.14%. Check Genuine Parts’ dividend history here.

Genuine Parts Company Dividend Yield (TTM)

Genuine Parts Company dividend-yield-ttm | Genuine Parts Company Quote

Albemarle is a premier specialty chemicals company with leading positions in attractive end markets globally. This Zacks Rank #1 company is known for having raised its dividend for more than 25 years on the trot.

Albemarle has a dividend yield of 0.56%. ALB’s payout ratio presently sits at 20% of earnings. In the past 5-year period, ALB’s payout has advanced 4.81%. Check Albemarle’s dividend history here.

Albemarle Corporation Dividend Yield (TTM)

Albemarle Corporation dividend-yield-ttm | Albemarle Corporation Quote

Meanwhile, for the current year, the expected earnings growth rate for Archer Daniels Midland, W.W. Grainger, Genuine Parts and Albemarle are 30.3%, 40.3%, 15.3% and 405.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance