4 Top-Ranked Tech Stocks Under $20 That Promise Gains in 2H20

Optimism over a potential vaccine for coronavirus, unprecedented government stimulus and an uptick in economic activities, with lockdown measures starting to ease, are mainly driving the U.S. stock market. While the coronavirus outbreak has had a sector-wide impact economically, the U.S. tech sector has been more resilient compared with others so far this year.

The Technology Select Sector SPDR XLK has rallied 14% so far this year. The ETF has outperformed the gains of all three major U.S. indices. The Nasdaq Composite has gained 12.1% year to date, while the Dow Jones and the S&P 500 have lost 9.5% and 4%, respectively.

The coronavirus outbreak has opened up newer avenues of growth for tech companies, particularly cloud computing, Internet services and cybersecurity providers, which are expected to benefit from the ongoing work from home, web-based learning and remote health diagnosis trends. Rising incidences of coronavirus infections is a tailwind for these companies.

Shift in consumer preference for Internet-based services attributable to the work-and-learn-from-home necessity will likely increase demand for smartphones, PCs, notebooks and peripheral accessories. There has also been an increase in demand for cloud storage. Therefore, data-center operators are enhancing their capacities to accommodate the demand spike for cloud services.

Additionally, the sector’s resiliency can be attributed to the impressive long-term growth prospects of tech companies owing to continuous digital transformations. Rapid adoption of cloud computing, and the ongoing integration of AI and machine learning have been major growth drivers.

Moreover, growing demand for e-commerce, contactless delivery through drones and digital payment highlight the urgency for accelerated 5G network development.

Meanwhile, blockchain, IoTs, smartphones, autonomous vehicles, storage solutions, AR/VR and wearables, networking and connectivity solutions — including Wi-Fi as well as Wi-Fi/Bluetooth integrated SOCs — and the need for high-speed data in both communications networks and data centers offer significant growth opportunities.

Our Picks

Per the Zacks’ proprietary methodology, stocks with the combination of a Growth Score of A or B and a Zacks Rank #2 (Buy) offer solid investment opportunities.

Based on this, here we pick four technology stocks currently trading for less than $20 a share that have strong fundamentals and are well-poised for further growth in the rest of 2020. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Moreover, the highly oversold market offers some cheap stocks with stellar prospects. While these stocks trade under $20 and can be more volatile than their costlier peers, strong bottom-line projections and positive estimate revisions in recent times point toward momentum in the mid-term, especially after the coronavirus crisis dissipates.

Rambus RMBS is gaining on the growing momentum of tokenization solutions. In addition to mobile payments and retail, the company has expanded tokenization offerings in markets like account-based payments, e-commerce and blockchain. Rambus has also rolled out Vaultify Trade that provides bank-grade tokenization for blockchain.

Currently, Rambus has a market cap of $1.66 billion and a Growth Score of A. The stock is currently priced at $15.2 per share. Notably, the consensus mark for 2020 earnings have increased 7.7% to 98 cents per share over the past 60 days.

Rambus, Inc. Price and Consensus

Rambus, Inc. price-consensus-chart | Rambus, Inc. Quote

KT Corporation KT is likely to roll out enhanced data and services for customers as it focuses on harnessing 5G capabilities. Its edge-cloud architecture has powered edge-computing telecom centers in major cities across South Korea, lowering 5G latency to a 5-millisecond level.

KT Corporation has a market cap of $4.76 billion and also has a Growth Score of B. The stock is currently priced at $9.74 per share. Notably, the Zacks Consensus Estimate for 2020 earnings have increased 0.9% to $1.16 per share over the past 60 days.

KT Corporation Price and Consensus

KT Corporation price-consensus-chart | KT Corporation Quote

Digital Turbine, Inc. APPS offers products and solutions for mobile operators, device OEMs and third parties based in Austin, TX.

Digital Turbine has a market cap of $1.04 billion. The company also has a Growth Score of B. The stock is currently priced at $12.5 per share. Notably, the Zacks Consensus Estimate for 2020 earnings has increased 8.1% to 40 cents per share over the past 60 days.

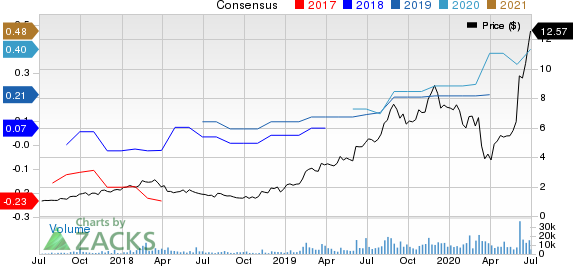

Digital Turbine, Inc. Price and Consensus

Digital Turbine, Inc. price-consensus-chart | Digital Turbine, Inc. Quote

SK Telecom Co., Ltd SKM is not only leading innovations in the field of mobile network but is also creating unprecedented value in areas such as media, security and commerce.

SK Telecom has a market cap of $13.7 billion and a Growth Score of B. The stock is currently priced at $19.3 per share. Notably, the Zacks Consensus Estimate for 2020 earnings have increased 0.7% to $1.46 per share over the past 60 days.

SK Telecom Co., Ltd. Price and Consensus

SK Telecom Co., Ltd. price-consensus-chart | SK Telecom Co., Ltd. Quote

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Click to get this free report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

SK Telecom Co., Ltd. (SKM) : Free Stock Analysis Report

KT Corporation (KT) : Free Stock Analysis Report

Technology Select Sector SPDR ETF (XLK): ETF Research Reports

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance