4 Transportation Stocks Likely to Top Q2 Earnings Estimates

The Zacks Transportation Sector, which houses airlines, railroads, shippers and truckers to name a few, has seen reports from quite a few participants so far in the ongoing Q2 earnings season. As expected, headwinds like declining shipping volumes, Boeing 737 Max groundings and the ongoing trade dispute between the United States and China have hurt Q2 results of transports, which have already disclosed their financial numbers.

As an evidence, key railroad operator Norfolk Southern Corporation NSC reported lower-than-expected earnings and revenues in Q2 mainly due to disappointing rail traffic volumes. Slowdown in global trade due to Sino-U.S. trade tensions and floods in the Midwest region negatively impacted volumes. Meanwhile, another key transportation player, C.H. Robinson CHRW, saw its Q2 results being hurt by unfavorable pricing across most transportation service lines.

On the other hand, multiple flight cancellations due to Boeing 737 Max groundings have hurt Q2 results of airlines, which have the above jets in their fleet. Moreover, with the jets not expected to return to action soon, some carriers have issued dim views for full-year 2019. For instance, American Airlines, with 24 Boeing 737 MAX jets, expects its current-year pre-tax income to be hurt to the tune of roughly $400 million due to the groundings. Another key transportation player, Ryder System issued a bleak view for the current year due to weakness pertaining to used vehicle sales.

Despite the above-mentioned headwinds, quite a few transports including the likes of Southwest Airlines, United Parcel Service UPS and Kansas City Southern have reported better-than-expected earnings per share in Q2. Investors interested in the sector would be hoping that the remainder of the current reporting cycle also sees quite a few bottom-line outperformances.

Let’s examine in detail the factors likely to influence Q2 results of the remaining transports.

We expect the trade issue to hurt results of most companies that are yet to report results. Expeditors International, which has significant exposure to China, is likely to have its results dampened by the ongoing trade squabble between the United States and China. Moreover, sluggish world trade is likely to impact results of shipping companies, which account for the bulk of Q2 reports still to come out.

However, the sector does have its share of positives. Results of car rental companies like Hertz Global HTZ may be boosted by factors like efficient fleet management and volume growth. Solid demand for travel in the corporate segment may aid results of airlines yet to report Q2 results.

How to Pick Winners?

The above write-up clearly suggests that despite some hiccups, there are quite a few positive for transports that might brighten their Q2 earnings picture.

However, given the existence of a number of industry players, finding the right transportation bets with the potential to beat on earnings can be a daunting task. This is where the Zacks methodology proves its mettle.

Our research shows that stocks with the combination of a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP have maximum chances — as high as 70% — of beating estimates. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Our Choices

Based on the above methodology, we have zeroed in on four transportation stocks that are likely to surpass the Zacks Consensus Estimate for earnings this season.

Hertz Global Holdings provides airport and off-airport vehicle rental and leasing services.Hertz Global, based in Estero, FL, has an Earnings ESP of +120.23% and a Zacks Rank #3. The company delivered positive earnings surprises in each of the trailing four quarters.

Hertz Global’s Q2 results, scheduled to be out on Aug 6, are expected to be aided by its U.S. Car Rental segment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hertz Global Holdings, Inc Price and EPS Surprise

Hertz Global Holdings, Inc price-eps-surprise | Hertz Global Holdings, Inc Quote

Textainer Group Holdings Limited TGH, based in Hamilton, Bermuda is a lessor of intermodal containers. Textainer has an Earnings ESP of +6.25% and a Zacks Rank #3. The company delivered positive earnings surprises in two of the trailing four quarters.

Textainer’s Q2 results, scheduled to be released on Aug 6, are expected to be aided by factors like high utilization, a stable container resale environment and favorable new container prices.

Textainer Group Holdings Limited Price and EPS Surprise

Textainer Group Holdings Limited price-eps-surprise | Textainer Group Holdings Limited Quote

Azul AZUL is one of the largest airlines in Brazil in terms of departures and destinations covered. Azul has an Earnings ESP of +55.56% and a Zacks Rank #1. The company delivered positive earnings surprises in three of the trailing four quarters.

Azul’s Q2 results, scheduled to be released on Aug 8, are expected to be aided by an uptick in passenger revenues owing to solid demand for air travel.

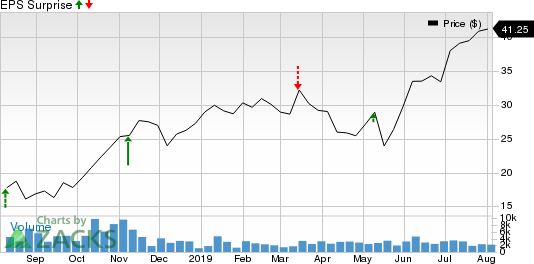

AZUL SA Price and EPS Surprise

AZUL SA price-eps-surprise | AZUL SA Quote

Seaspan Corporation SSW is a shipping company. Seaspan has an Earnings ESP of +12.68% and a Zacks Rank #2. The company delivered positive earnings surprises in three of the trailing four quarters.

Seaspan’s Q2 results, scheduled to be released on Aug 7, are expected to be aided by higher average charter rates.

Seaspan Corporation Price and EPS Surprise

Seaspan Corporation price-eps-surprise | Seaspan Corporation Quote

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Textainer Group Holdings Limited (TGH) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Seaspan Corporation (SSW) : Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW) : Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ) : Free Stock Analysis Report

United Parcel Service, Inc. (UPS) : Free Stock Analysis Report

AZUL SA (AZUL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance