Many U.S. Streaming Users Regularly Cancel and Resubscribe, But Bundles Reduce Churn

With the competitive streaming video business having matured in the U.S. and companies focusing more on profitability, subscriber retention has become at least as important as subscriber growth. Now, the latest data from research firm Ampere Analysis shows that a recent trend to pool together streaming services into bundles reduces customer churn rates.

Overall, 42 percent of U.S. streaming subscribers “regularly subscribe, cancel and resubscribe,” according to Ampere Consumer findings. However, its research also found “that Disney subscribers who had previously churned and then returned (aka ‘resubscribers’) to take the Disney+/Hulu/ESPN+ bundle are 59 percent less likely to churn within 12 months than those who take Disney+ alone.”

More from The Hollywood Reporter

Richard E. Grant, Tom Ellis Among Latest Stars to Join Cast of Netflix's 'The Thursday Murder Club'

Japanese Anime 'My Hero Academia: You're Next' Set for U.S. Theatrical Release

Amazon's Hit Australian Crime Comedy 'Deadloch' Renewed for Season 2

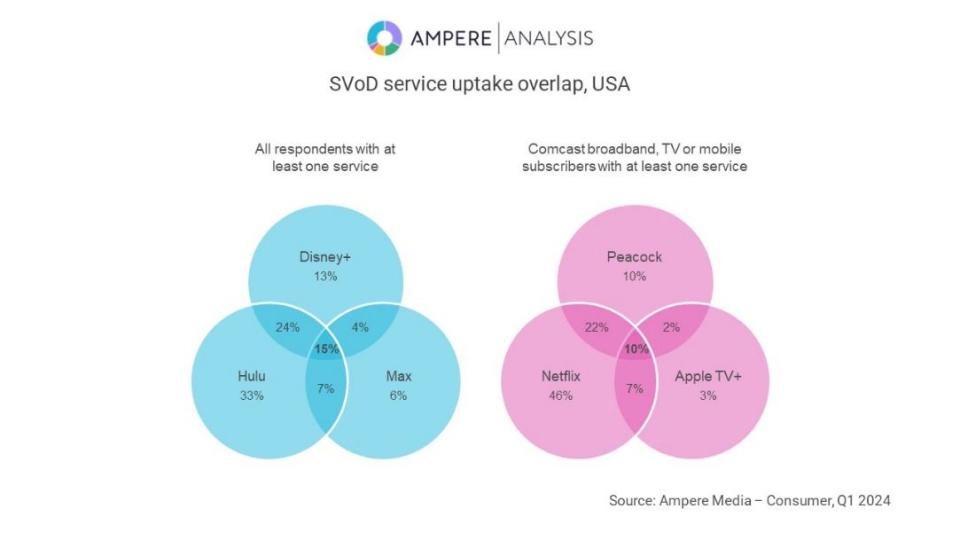

With Walt Disney/Warner Bros. Discovery (Disney+, Hulu and Max) and Comcast (Peacock, Netflix and Apple TV+) in recent weeks unveiling plans to offer multiple streaming services, Ampere data also indicates that there is currently “limited overlap” in user uptake between those services, “suggesting great upsell and churn mitigation potential.”

The firm’s first-quarter 2024 consumer data shows that just 15 percent of the subscriber base of either Disney+, Hulu or WBD’s Max currently take all three in the household, “and just 10 percent of Comcast mobile, broadband and TV customers subscribing to Peacock, Netflix or Apple TV+ currently take all three.”

That means that bundles should help user retention and help upsell consumers to additional services.

“As the SVOD market in the U.S. has become increasingly saturated, new subscribers are harder to find, which makes retention all the more important,” said Daniel Monaghan, research manager at Ampere Analysis. “There is a sizeable group of consumers who frequently subscribe to SVOD platforms, cancel and resubscribe. Reducing this behavior would boost platforms’ top and bottom lines,” meaning revenue and profitability.

Best of The Hollywood Reporter

Yahoo Finance

Yahoo Finance