The 43-year low UK unemployment rate masks the real trouble in the jobs market

At first glance, it looks like Britain has got it good.

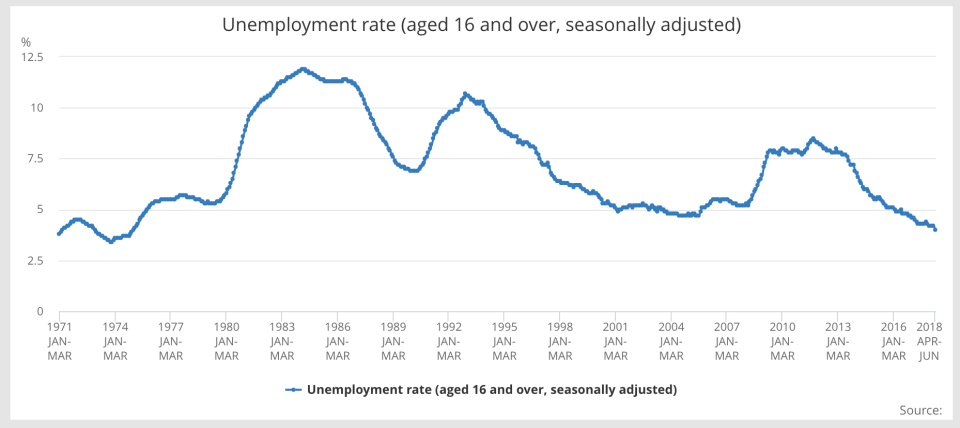

According to Office for National Statistics data, the unemployment rate dropped to 4%, hitting a new 43-year low in the three months through June. This was even lower than what consensus predicted at 4.2%. Over 32 million people in Britain are in work, which is 42,000 more than for January to March 2018. This also equates to 313,000 more than for a year earlier.

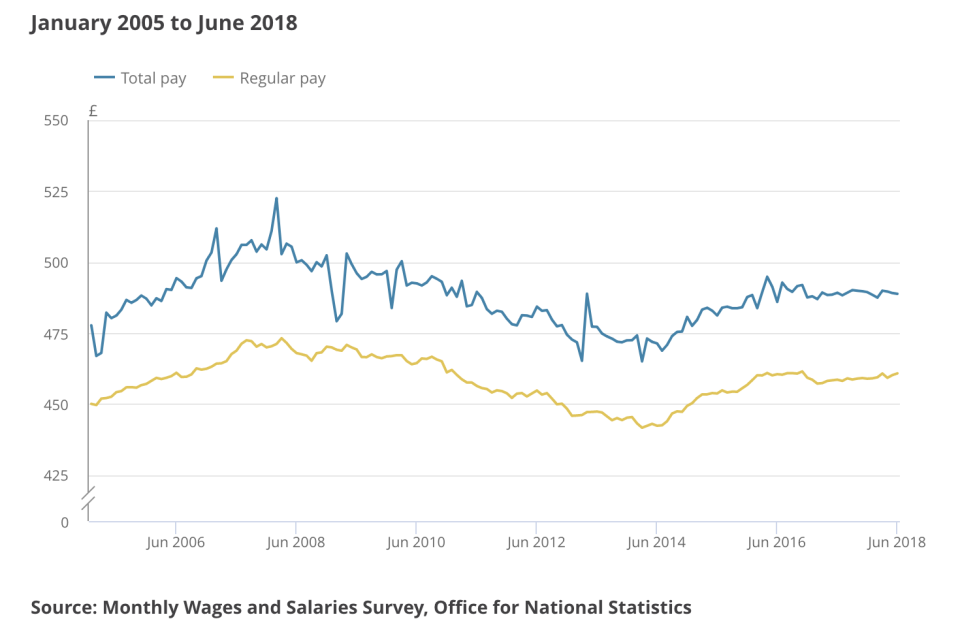

But that number masks the real health of the UK workforce. While more people than ever have a job, the pace of wage growth eased, remaining at just 2.7% in the year to June. While it is still ahead of the 2.4% rate of inflation, it’s the weakest since January this year. That means that if wage growth continues to remain stagnant, it could eventually see salaries not keeping up with the cost of living.

Furthermore, markets are punishing the pound by dragging it back below the $1.28 (GBP/USD) range because of disappointing wage growth.

Meanwhile, Britain faces an impending jobs crisis where companies are finding it difficult to fill vacancies. The Chartered Institute of Personnel and Development (CIPD), the professional body for HR staff and recruitment firm Adecco (Swiss: ADEN.VX news) is calling it a “supply shock.”

According to data from their survey of 2,000 employees, the number of applicants per vacancy had fallen across all levels of skilled jobs since last summer. At the heart of the problem is the fact that fewer citizens from the European Union are coming to the UK.

And Brexit is going to make this much worse because unless there is a deal that ensures the free movement of people or at least makes immigration less onerous than it currently is for non-EU citizens, then it will exacerbate the problem in finding staff.

“With (Other OTC: WWTH) skills and labour shortages set to worsen further against the backdrop of rising talk of a ‘no deal’ outcome with the EU, the need for the government to issue consistent, categorical assurances about the status of current and future EU citizens, whatever the outcome of the negotiations, is more important now than ever,” said Gerwyn Davies, senior labour market analyst at the CIPD.

This month, business lobby group Confederation of British Industry, which speaks for 190,000 businesses in the UK, said net migration targets should be scrapped after Brexit. It said that the contribution of EU workers to the UK economy was “profoundly important and will be needed in the future.”

EU citizens are already giving up on Britain. According to ONS today, it recorded the largest annual fall in the number of EU nationals working in the UK. Data shows that the number fell by 86,000 to 2.28 million between April and June compared to the same period last year.

Yahoo Finance

Yahoo Finance