5 Dental Supplies Stocks to Buy Amid Recovering Prospects

The COVID-19 pandemic — an unprecedented biological crisis — altered the nature and dynamics of the healthcare industry. The Zacks Medical - Dental Supplies industry bore the brunt of the closure of dental practices and lower patient visits due to the risk of exposure to the virus. However, the dental market has experienced substantial recovery, primarily owing to the easing of prior restrictions and mass vaccinations. Apart from this, rising dependence on Artificial Intelligence (AI) and Robotics, teledentistry, and an increase in the number of patient visits are likely to help the industry thrive in the near term. Going by Market Research Future data available on GlobeNewswire, the global dental industry is expected to reach $60.37 billion by 2023, seeing a compound annual growth rate of 6.9% from 2022 to 2030.

However, inflationary, labor-shortage and supply-chain headwinds are hurting the margins of the industry players. These headwinds are likely to continue in 2023, subduing earnings growth. Industry participants like McKesson MCK, AmerisourceBergen ABC, Laboratory Corp. of America LH or LabCorp, Cardinal Health CAH and Merit Medical Systems MMSI have shown resiliency despite uncertain conditions and are likely to gain from the existing opportunities.

Industry Description

This industry primarily comprises designers, developers, manufacturers and marketers of dental consumables, dental laboratory products and dental specialty items. Some of the industry participants also provide practice management and clinical software, patient education systems, and office forms and stationery. Dental stocks have been gaining significant attention post the weakness witnessed during the pandemic-induced disruptions. This space has continued to show signs of recovery and held its ground. Notably, dental care is being delivered safely, following the guidance and recommendations of the American Dental Association (“ADA”) and CDC. Backed by the rebound witnessed by the companies in this space, patient volume continues to see an encouraging increase despite the COVID-19 uncertainty.

Major Trends Shaping the Future of the Medical Dental Supplies Industry

Rising Dependence on Teledentistry: Following the COVID-19 outbreak, most dental practices were unable to offer routine services in the office. Teledentistry, which is a provision to offer dental services through interactive video, audio or other electronic media to provide consultation, diagnosis and treatment, helped clinicians and patients amid this crisis. The dependence on teledentistry is expected to continue even as the pandemic subsides, as it enhances patient care. The introduction of digital solutions has helped dental professionals to conduct video consultations with existing patients, thereby enhancing treatment efficiency.

Digital Influence: The latest technologies help dentists in carrying out minimally-invasive procedures that ensure precision and efficiency, thereby reducing patients’ trauma. The industry players actively promote digital workflows for general dentistry and dental specialties. Further, dental 3D printers are revolutionizing dentistry. These reduce time and cost through efficient utilization of orthodontics and dental practices. Notably, dental 3D printers became mainstream in 2020.

AI & Robotics: AI has been shaping the dental industry for quite some time now. This decade is likely to see the rise of computing power, which has become more accessible and affordable for dental practitioners. It will transform the way dentists work, and patients receive treatment, especially with the introduction of robot dentists. Robots are now able to perform minimally-invasive dental work like filling cavities and extracting teeth. A report by National Business Capital & Services suggests that AI dentistry had already become mainstream by 2019-end.

Zacks Industry Rank

The Zacks Medical Dental Supplies industry falls within the broader Zacks Medical sector.

It carries a Zacks Industry Rank #99, which places it in the top 40% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few dental supply stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Performance

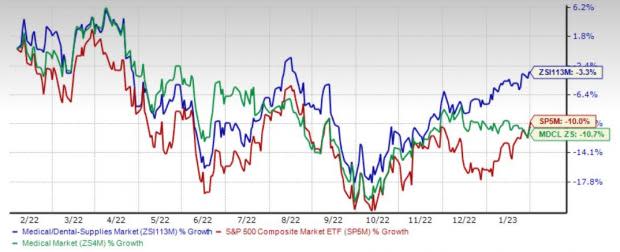

The industry has outperformed its sector in the past year, as well as the S&P 500 composite, in the same time frame.

Stocks in this industry have collectively declined 3.3% compared with the Zacks Medical sector’s dip of 10.7%. The S&P 500 has fallen 10% in the same time frame.

One-Year Price Performance

Industry's Current Valuation

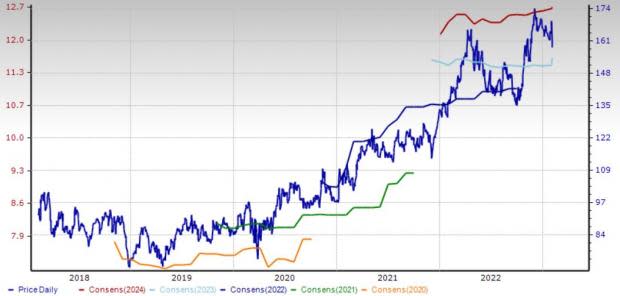

On the basis of the forward 12-month price-to-earnings (P/E) ratio, which is commonly used for valuing medical stocks, the industry is currently trading at 18.49X compared with the S&P 500’s 18.49X and the sector’s 21.94X.

Over the last five years, the industry has traded as high as 20.13X and as low as 13.39X, with the median being 17.56X, as the charts below show.

Price-to-Earnings Forward Twelve Months (F12M)

Price-to-Earnings Forward Twelve Months (F12M)

5 Promising Dental Supply Stocks

McKesson: It is a healthcare services and information technology company. McKesson operates through two segments. The Distribution Solutions segment distributes branded and generic pharmaceutical drugs, along with other healthcare-related products worldwide. The segment also provides practice management, technology, clinical support and business solutions to community-based oncology and other specialty practices. In addition, the segment provides specialty pharmaceutical solutions for pharmaceutical manufacturers. The Technology Solutions segment provides enterprise-wide clinical, patient care, financial, supply chain and strategic management software solutions.

Strong growth in the U.S. markets, especially for pharmaceutical and specialty solutions, drove McKesson’s top line by 5.4% year over year in the third quarter of fiscal 2023 ending December. An increase in the volume of specialty products and overall market growth aided the top-line improvement. However, inflationary pressure continues to hurt margins. The company projects adjusted EPS of $25.75-$26.15 for fiscal 2023.

For this San Francisco, CA-based company, the Zacks Consensus Estimate for fiscal 2023 revenues suggests growth of 4.4% from the year-ago reported figure, while the same for earnings indicates an increase of 4.6%. It has a trailing four-quarter earnings surprise of 3.42%, on average. Presently, the company carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: MCK

AmerisourceBergen: It is one of the world’s largest pharmaceutical services companies, which focuses on providing drug distribution and related services to reduce healthcare costs and improve patient outcomes. Per management, its position as the leader in global specialty logistics services drove compelling volume growth and overall performance for the company. Strong organic growth rates in the U.S. pharmaceutical market, improving patient access to medical care, enhanced economic conditions and population demographics are likely to favor the company in the quarters to come.

AmerisourceBergen’s top line gained 5.4% in the last reported quarter. It also beat the Zacks Consensus Estimate by 0.9%. An increase in specialty product sales, coupled with overall market growth, drove the top line. However, lower revenues from commercial COVID-19 treatments are hurting growth. The company expects total revenue growth of 5-7% for fiscal 2023 and adjusted earnings growth of 4-7%.

For this Chesterbrook, PA-based company, the Zacks Consensus Estimate for fiscal 2023 revenues and earnings suggests increases of 5.5% and 4.4%, respectively. Currently, the company carries a Zacks Rank of 2.

Price and Consensus: ABC

LabCorp: It is a leading healthcare diagnostics company providing comprehensive clinical laboratory services and end-to-end drug development support. The company has adopted a five-pillar strategy to achieve growth in its businesses. These five strategic pillars are — deploy capital to investments, enhance IT capabilities to improve physician and patient experience, improve efficiency to remain the most efficient and highest value provider of laboratory services, continue scientific innovation to offer tests at reasonable pricing, and development of alternative delivery models to improve patient outcome and reduce the cost of care.

In the third quarter of 2022, LabCorp Diagnostics performed well with year-over-year Base Business revenue growth of 3.7% and a 4% CAGR versus 2019. With Ascension being organic in the upcoming quarter, the company expects full-year revenue growth of 6-7%. Drug Development Base Business fundamentals remained strong in the third quarter. Further, LabCorp is accelerating the planned spin-off of its Clinical Development business (announced in July 2022). The company noted that it is managing inflationary headwinds and labor constraints through its LaunchPad initiatives.

For this Burlington, NC-based company, the Zacks Consensus Estimate for fiscal 2023 revenues and earnings suggests an increase of 0.1% and a decline of 11%, respectively. Although EPS is expected to decline year over year in 2023, the estimate for the metric has improved 0.7% in the past 30 days. Currently, the company carries a Zacks Rank of 2.

Price and Consensus: LH

Cardinal Health: It is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. Its Pharmaceutical segment’s products and services include pharmaceutical distribution, manufacturer and specialty services, and nuclear and pharmacy services, including specialty pharmaceutical products and services. The company’s Medical segment manufactures products such as single-use surgical drapes, gowns and apparel; exam and surgical gloves; and fluid suction and collection systems. The segment also offers sterile and non-sterile procedure kits.

Cardinal Health exited second-quarter fiscal 2023 with better-than-expected earnings and revenues. Upticks in the overall top line and pharmaceutical revenues were impressive. Cardinal Health’s plans to build a medical distribution center in the central Ohio area, partnership with Innara Health and Kinaxis, and the introduction of the first surgical incise drape in the fourth quarter of fiscal 2022 buoy optimism. The company anticipates adjusted earnings per share between $5.20 and $5.50 in fiscal 2023.

For this Dublin, OH-based company, the Zacks Consensus Estimate for fiscal 2023 revenues and earnings suggests year-over-year increases of 10.8% and 4.7%, respectively. Currently, the company carries a Zacks Rank #2.

Price and Consensus: CAH

Merit Medical: The company operates in two revenue segments — Cardiovascular and Endoscopy Devices. The Cardiovascular segment includes peripheral intervention, cardiac intervention, interventional oncology, spine, cardiovascular and critical care product groups. The Endoscopy Devices segment has the company’s flagship Merit Endotek integrates advanced non-vascular stent technology with balloon dilators, inflation devices, guide wires, procedure kits and other devices that are used by endoscopists in interventional gastroenterology, interventional pulmonology, and thoracic and general surgery.

Merit Medical exited the third quarter of 2022 with better-than-expected results. The year-over-year uptick in the top and bottom lines is impressive. The company saw revenue growth in both Cardiovascular and Endoscopy segments, and across the majority of its product categories within its Cardiovascular unit. Solid product sales are also promising. Robust performances in the United States and outside are impressive. Strong execution and improving customer demand trends boosted the overall top line, which is encouraging. The company stands to benefit from the execution of its global growth and profitability plan.

For this Dublin, OH-based company, the Zacks Consensus Estimate for 2023 revenues and earnings suggests increases of 4.8% and 9.9%, respectively. Currently, the company carries a Zacks Rank #2.

Price and Consensus: MMSI

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance