5 Engineering R&D Services Stocks to Watch Amid Industry Challenges

Supply chain constraints and input cost headwinds are taking a toll on the Zacks Engineering – R&D Services industry. Labor constraints are making things worse. Nonetheless, the U.S. administration’s focus on infrastructural enhancement has been creating the need for advanced construction and engineering solutions. Also, the companies’ shift toward digital transformation, mergers & acquisitions as well as operational efficiencies should lend support to the industry. Increasing investments in the decarbonization of energy efficiency and energy transition projects also appear to be growth drivers. Overall, the consistent focus on enhancing the infrastructure of the country’s defense, healthcare, communication and renewable energy is encouraging for prominent industry players like Quanta Services, Inc. PWR, KBR, Inc. KBR, ChampionX Corporation CHX, Sterling Infrastructure, Inc. STRL and Atlas Technical Consultants, Inc. ATCX.

Industry Description

The Zacks Engineering – R&D Services industry primarily consists of engineering and infrastructure service providers. The companies basically provide construction, technical, engineering and professional services to a number of industries worldwide, including oil and gas, chemical and petrochemicals, transportation, mining and metals, power, agriculture, consumer applications as well as manufacturing. The companies also make engineered power transmission and fluid power solutions as well as chemistry solutions along with engineered equipment and technologies for oil and gas companies worldwide.

3 Trends Shaping the Future of Engineering - R&D Services Industry

Focus on Defense, Healthcare, Communication & Renewable Energy: The federal government’s investment in defense and cyber security is conducive to the industry’s growth. Owing to the sensitivity of their jobs, the Department of Defense and Homeland Security have the maximum budgets for cyber security among the government agencies. Also, increasing public investments in transportation, water infrastructure, utility plants and the healthcare market are anticipated to be conducive to the industry’s growth. Additionally, the infrastructure services business of the industry players continues to thrive, supported by robust demand from the communications industry.

The companies are well-positioned to gain from the renewable energy drive of the pro-environmental Biden administration. The development and deployment of technology solutions across the full spectrum of decarbonization efforts, including carbon management mitigation and compliance consulting, as well as all facets of infrastructure for providing carbon-free energy solutions, should benefit the companies going forward. Also, the players are gaining from the rising global demand for alternative nuclear energy as they provide engineering, procurement, construction and maintenance services to nuclear power plants.

Need for State-Of-The-Art Services: Increasing construction activities in U.S. government projects, which require state-of-the-art construction and engineering services, are expected to benefit the construction and engineering services industry. Also, the rapid usage of advanced technologies to deliver smart buildings and mega-projects while identifying and checking margin contraction and costs are expected to be a major tailwind for the industry participants.

Supply-Chain Disruptions, Labor Shortage, Uncertain Economic Conditions & Competition: The companies continue to face high input costs and labor constraints. Apart from this, supply chain disruption is a major cause of worry. As the impact of the coronavirus outbreak continues, uncertain global economic conditions may put pressure on the demand for services provided by the industry players. Meanwhile, the companies face intense competition in the global engineering, procurement and construction industry, hurting their contract prices and profit margins. Volatility in commodity prices and the cyclical nature of the industry’s commodity-based business lines pose significant challenges too.

Zacks Industry Rank Indicates Dull Prospects

The Zacks Engineering – R&D Services industry is a 21-stock group within the broader Zacks Construction sector. The industry currently carries a Zacks Industry Rank #190, which places it at the bottom 24% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates gloomy near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of a tepid earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually losing confidence in this group’s bottom-line growth potential. Since May 2022, the industry’s earnings estimates for 2022 have been revised 8.3% downward.

Despite the industry’s dreary near-term view, we will present a few stocks that one may consider adding to their portfolio. Before that, it’s worth taking a look at the industry’s shareholder returns and current valuation.

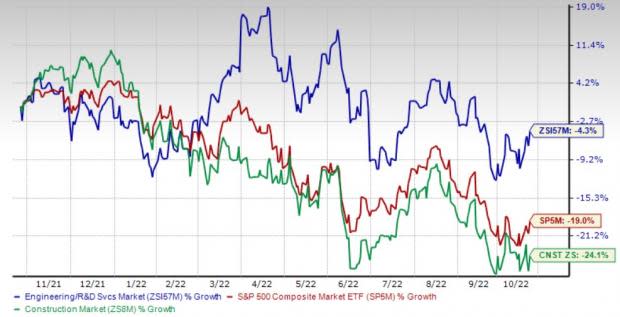

Industry Outperforms Sector, S&P 500

The Zacks Engineering – R&D Services industry has performed better than the Zacks Construction sector and the Zacks S&P 500 composite over the past year.

Over this period, the industry has declined 4.3% compared with the sector’s 24.1% decline. Meanwhile, the S&P 500 has declined 19% in the said period.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price-to-earnings ratio, which is a commonly used multiple for valuing Engineering – R&D Services stocks, the industry is currently trading at 18.2 versus the S&P 500’s 16.3 and the sector’s 10.6.

Over the past five years, the industry has traded as high as 24.7X, as low as 10.2X and at a median of 16.9X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

5 Engineering - R&D Services Stocks to Watch

Below, we have discussed five stocks from the industry that have solid earnings growth potential. The chosen companies currently carry a Zacks Rank #2 (Buy) or #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sterling Infrastructure: Based in The Woodlands, TX, this company specializes in E-Infrastructure, Building and Transportation Solutions principally in the United States, mainly across the Southern, Northeastern, Mid-Atlantic and the Rocky Mountain states, California and Hawaii. The company has been navigating the ongoing supply chain and inflation challenges well with growth in its E-Infrastructure Solutions (its largest segment), E-Infrastructure and Building Solutions. With continued demand for complex site development, STRL has been broadening its customer base with industrial and manufacturing opportunities in E-Infrastructure Solutions, thereby helping it to generate higher profits. Continued focus on the execution of strategic objectives also bodes well.

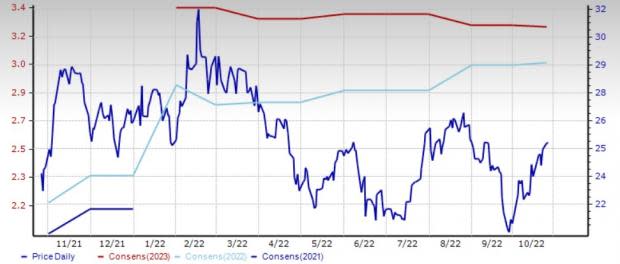

STRL’s earnings for 2022 and 2023 are expected to grow 41.4% and 7.2%, respectively. This Zacks Rank #2 stock has gained 6.3% over the past year, faring better than the industry’s 4.3% decline. STRL has seen a 0.3% upward estimate revision for 2022 earnings over the past 30 days, depicting analysts’ optimism over its prospects.

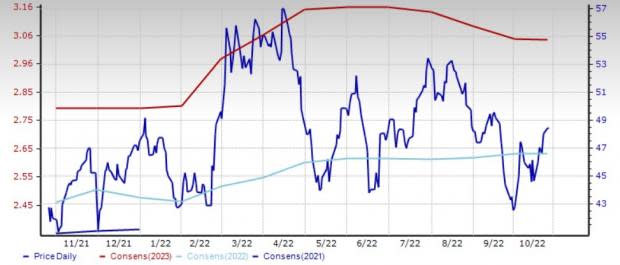

Price & Consensus: STRL

Atlas Technical Consultants: This Austin, TX-based company provides professional testing, inspection, engineering, environmental, and program management and consulting services in the United States. The company’s record backlog and robust new award pipeline reflect the business’ prospects. ATCX has become one of the largest providers of mission-critical technical services for infrastructure and environmental markets in the United States.

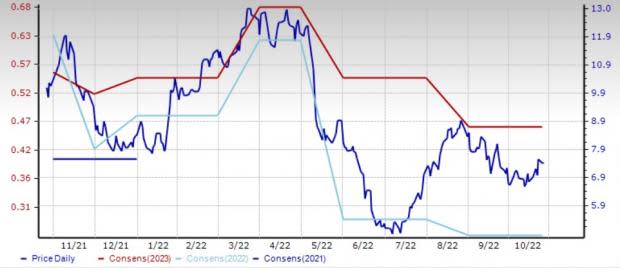

This Zacks Rank #2 stock has lost 26.9% over the past year. That said, ATCX’s earnings for 2023 are expected to grow 76.9%, which is encouraging.

Price & Consensus: ATCX

ChampionX: Based in The Woodlands, TX, this company offers chemistry solutions, and engineered equipment and technologies to oil and gas companies worldwide. The company is close to its second anniversary of a transformational merger between Apergy Corporation and ChampionX Holding Inc. (the former upstream energy business of Ecolab Inc.). The combined entity has a resilient organization with a broad geographic footprint, a high-quality customer base, and significant recurring revenues, given strong demand growth in both its international and North American markets. Also, the company has been successfully implementing price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector. The positive market fundamentals, along with solid top-line growth and pricing improvements, bode well for meaningful margin expansion and solid cash generation for the full year and beyond.

This Zacks Rank #3 stock has lost 4.6% over the past year. That said, CHX’s earnings for 2022 and 2023 are expected to grow 100% and 31.7%, respectively.

Price & Consensus: CHX

Quanta Services: Quanta is a Houston, TX-based leading national provider of specialty contracting services, and one of the largest contractors serving the transmission and distribution sector of the North American electric utility industry. The company remains uniquely positioned to capitalize on megatrends and opportunities to lead the energy transition and enable technological development, with initiatives such as electric vehicle charging infrastructure and undergrounding of electrical infrastructure gaining momentum. Increasing demand for infrastructure solutions that help support customers' energy-transition initiatives and modernization will continue to provide multi-year growth opportunities for Quanta.

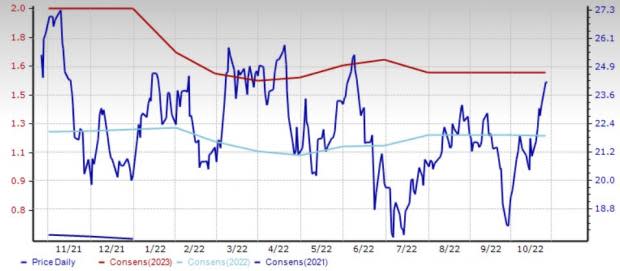

PWR’s stock has gained 14.8% over the past year. This Zacks Rank #3 company’s 2022 and 2023 earnings are likely to grow 27.2% and 11.5%, respectively.

Price & Consensus: PWR

KBR: Headquartered in Houston, TX, this company provides professional services and technologies across the asset and program life cycle within government services and hydrocarbon industries worldwide. Its mission-critical government services, high-end and differentiated government business work, strong margin performance, and proprietary technology solutions, along with a significant increase in backlog (particularly in Government Solution), are expected to boost earnings this year and beyond.

KBR’s stock has gained 12.4% over the past year. The company’s 2022 and 2023 earnings are likely to grow 8.7% and 15.6%, respectively. This Zacks Rank #3 company has seen a 0.4% upward estimate revision for 2022 earnings over the past 30 days.

Price & Consensus: KBR

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

KBR, Inc. (KBR) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Atlas Technical Consultants, Inc. (ATCX) : Free Stock Analysis Report

ChampionX Corporation (CHX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance