5 High Dividend Stocks With an Insider Edge

- By

Stocks which are paying unusually high dividends are a bit scary because unusually high dividends typically mean the stock price has declined and the market does not believe that the payout is worth it.

To take a high dividend payer seriously, I look to see what else is going on. Is the chef eating his own cooking? As renowned investor Peter Lynch used to say, "Insiders might sell their shares for any number of reasons, but they buy them for only one, they think the price will rise."

While insiders don't always buy because they think the stock price will go up, that is the most common reason, so insider buying definitely means a stock could be worth a closer look. Thus, using the GuruFocus All-in-One screener, I looked for stocks with high dividends and substantial recent insider buys. Among the results, I selected the following five candidates for further exploration.

OneMain Holdings

OneMain Holdings Inc. (NYSE:OMF) is one of the largest non-prime consumer finance companies in the United States and one of only a few companies in the consumer installment lending industry. Its services include providing personal plans, credit and non-credit insurance, servicing loans, pursuing strategic acquisitions and dispositions of assets and businesses, and on occasion, establishing joint ventures or forming strategic alliances. In addition to hundreds of branches, the company also has a significant online business. Its main source of revenue is net interest income.

The dividend yield is impressive at over 10%.

Douglas Shulman, the President and CEO, recently spent about quarter of million dollars buying shares.

Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Cost($1000) | Price change since trade(%) | Share ownership details |

10% Owner | 2021-08-16 | Sell | 8,050,000 | 17,562,500 | 56.72 | 456,596 | +0.23 | See footnote(F1,):17,562,500 | |

President and CEO | 2021-08-06 | Buy | 8,575 | 245,313 | 58.32 | 500.09 | -2.52 | 245,313 (Direct) | |

10% Owner | 2021-08-03 | Sell | 10,925,000 | 25,612,500 | 58.36 | 637,583 | -2.57 | See Footnote(F1,):25,612,500 |

Apollo Management, a private equity giant which owns about 22% of the company, looks like it's in the process of cashing out. Miller Value Partners (Trades, Portfolio), a noted value investor, also owns this stock.

Given the above factors, I believe OneMain is worth looking at in more detail. These personal finance companies do very well when the economy is booming, but risk may show up when the government stimulus ends or if the economy begins to slow down. The CEO is certainly putting his money where his mouth is.

Universal Health Realty Income Trust

Universal Health Realty Income Trust (NYSE:UHT) is a health care real estate investment trust with a property portfolio spanning hospitals, acute care hospitals, rehabilitation hospitals, free-standing emergency departments, sub-acute facilities, medical office buildings and child care centers. Over half of the firm's properties are located in Arizona, Nevada and Texas.

In theory, this company should be recession-resistant. After shooting up in the past couple years, the stock seems to have come down to earth.

Insiders seem to be taking advantage of the low prices with CEO Alan Miller recently spending over a quarter of a million dollars to buy 4,500 shares, taking his share count up to 176,655.

Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Cost($1000) | Price change since trade(%) | Share ownership details |

MILLER ALAN B | President, and CEO | 2021-08-17 | Buy | 4,500 | 176,655 | 57.16 | 257.22 | +1.31 | 134,655 (Direct) By The Alan B. Miller Family Foundation:42,000 |

The dividend yield is 4.8%. The payout ratio is high, but that is not out of line for a triple net REIT.

Dividend Yield % | 4.8 |

Dividend Payout Ratio | 1.71 |

3-Year Dividend Growth Rate | 1.5 |

Forward Dividend Yield % | 4.84 |

The key metrics to track for REITs include Operating Cash Flow (OCF) and Funds from Operations (FFO) per share, and both metrics seem to be doing well, indicating dividend sustainability. Universal Health has been paying out a steadily rising dividend for 35 years.

Golub Capital BDC

Golub Capital BDC Inc. (NASDAQ:GBDC) is a closed-end investment company. Its investment objective is to generate current income and capital appreciation by investing in senior secured and one-stop loans in United States middle-market companies. It also invests in the second lien and subordinated loans, warrants and minority equity securities. The company generally invests in securities that have been rated below investment grade by independent rating agencies or that would be rated below investment grade if they were rated.

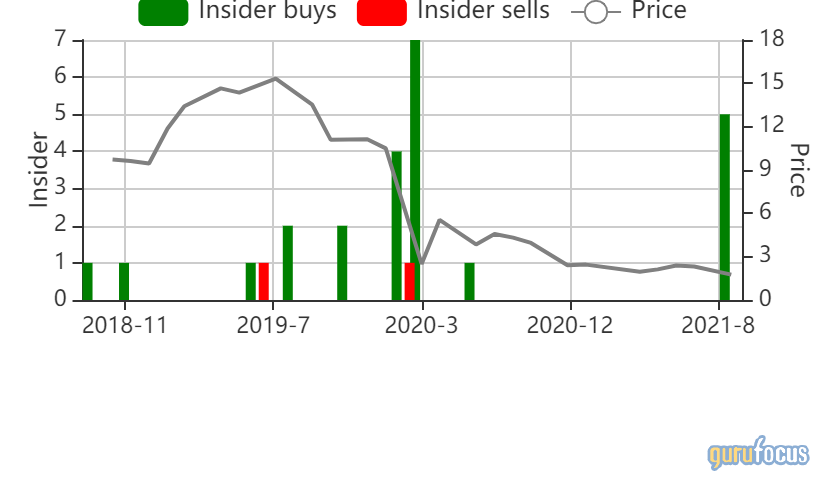

Golub got hit hard during the start of the 2020 Covid-19 crisis but now has mostly recovered.

The company's shares have been heavily bought by both the Chairman and the CEO. Between the two, they own about 8.7 million shares, or over 5% of the company.

Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Cost($1000) | Price change since trade(%) | Share ownership details |

Golub Lawrence E | Chairman | 2021-08-12 | Buy | 5,059 | 4,506,251.12 | 15.81 | 79.98 | -0.06 | By GGP Holdings, L.P.:2,427,547.062 By Whitehall Capital Investors N, LLC:430,177 By Polar Madison Holdings, LLC:274,518 By Golub Onshore GP, LLC:14,977.824 By GCOP LLC:1,359,031.232 |

Golub David | CEO | 2021-08-12 | Buy | 5,059 | 4,282,293.07 | 15.81 | 79.98 | -0.06 | 125,388.954 (Direct) By GGP Holdings, L.P.:2,427,547.062 By CDGPE, LLC:188,676 By CDGQ, LLC:166,672 By Golub Onshore GP LLC:14,977.824 By GCOP LLC:1,359,031.232 |

Golub pays a 7.34% dividend with a decently low payout ratio.

Dividend Yield % | 7.34 |

Dividend Payout Ratio | 0.52 |

3-Year Dividend Growth Rate | -0.2 |

Golub's stock is trading close to tangible book value and the graham number.

It is important to note that business development companies (BDC's) like Golub are inherently risky as they loan out money to smaller companies and their performance will depend largely on how the main street economy will do in the next few years. In the 2007-2009 recession, many BDC's went out of business. I consider them a good portfolio diversifier but certainly wouldn't depend on the income.

FS KKR Capital Corp (NYSE:FSK)

Like Golub, FS KKR Capital Corp is also a business development company based in the United States. It caters to middle market companies. It is also engaged in investing in senior secured debt and, to a lesser extent, the subordinated debt of private middle market U.S. companies.

It also took a big hit last year and has mostly recovered to pre-pandemic levels.

It pays a sweet 10.35% dividend yield.

Dividend Yield % | 10.35 |

Dividend Payout Ratio | 0.23 |

3-Year Dividend Growth Rate | -9.3 |

Forward Dividend Yield % | 11.22 |

5-Year Yield-on-Cost % | 7.52 |

Insiders have been quite active buying shares in the last few months, which could indicate a potential opportunity.

Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Cost($1000) | Price change since trade(%) | Share ownership details |

Hopkins Jerel A | Director | 2021-09-01 | Buy | 840 | 4,000.85 | 23.15 | 19.45 | +0.13 | 4,000.846 (Direct) |

Sandler Elizabeth | Director | 2021-08-30 | Buy | 1,250 | 2,140 | 22.95 | 28.69 | +1 | 2,140 (Direct) |

Gerson Brian | Co-President | 2021-08-26 | Buy | 5,000 | 5,000 | 22.95 | 114.75 | +1 | 5,000 (Direct) |

KROPP JAMES H | Director | 2021-08-18 | Buy | 1,000 | 13,477.16 | 22.78 | 22.78 | +1.76 | IRA:13,477.158 |

Goebel William Balke | Chief Accounting Officer | 2021-08-18 | Buy | 1,100 | 4,458.56 | 22.92 | 25.21 | +1.13 | 4,458.556 (Direct) |

Forman Michael C. | CEO | 2021-08-17 | Buy | 10,000 | 379,802.34 | 22.98 | 229.80 | +0.87 | In IRA account:13,119.081 By MCFDA SCV LLC:124,551.246 By FSH Seed Capital Vehicle I LLC:231,152 By Spouse:5,134.249 By Trust FBO Minor Children:1,290.654 In 401(k) account:4,555.11 |

Goldstein Richard I | Director | 2021-08-17 | Buy | 1,237 | 24,000.22 | 22.98 | 28.43 | +0.87 | IRA:24,000.223 |

Sypherd Stephen | VP & Secretary | 2021-08-16 | Buy | 2,500 | 9,623.89 | 22.99 | 57.48 | +0.83 | 9,623.894 (Direct) |

Builione Todd C. | Director | 2021-08-13 | Buy | 5,000 | 8,125 | 23.11 | 115.55 | +0.30 | 8,125 (Direct) |

Ford Brian R. | Director | 2021-08-12 | Buy | 1,731 | 7,776.67 | 22.72 | 39.33 | +2.02 | 7,776.667 (Direct) |

Pietrzak Daniel | Co-President and CIO | 2021-08-12 | Buy | 5,000 | 17,500 | 22.73 | 113.65 | +1.98 | 7,500 (Direct) IRA:10,000 |

Goldstein Richard I | Director | 2021-08-11 | Buy | 1,000 | 22,763.22 | 22.64 | 22.64 | +2.39 | IRA:22,763.223 |

Adams Barbara | Director | 2021-08-11 | Buy | 3,214 | 9,939 | 22.74 | 73.09 | +1.93 | 1,943 (Direct) IRA:7,996 |

IMASOGIE OSAGIE O | Director | 2021-08-11 | Buy | 39,825 | 48,488 | 22.74 | 905.62 | +1.93 | 48,488 (Direct) |

NGL Energy Partners LP

NGL Energy Partners LP (NYSE:NGL) is a U.S.-based publicly traded midstream Master Limited Partnership (MLP) that owns and operates a vertically integrated energy business. The company's operating segments include Crude Oil Logistics, Water Solutions and Liquids Logistics. It operates crude oil storage terminals, owns pipeline injection stations and offers services for the treatment and disposal of wastewater generated from crude oil and natural gas production. The firm also supplies natural gas liquids, propane and distillates to retailers, wholesalers, refiners and petrochemical plants.

The company's stock peaked in 2014 and has been declining continually ever since.

The company is paying out a mind-boggling dividend distribution of 16.85%.

Dividend Yield % | 16.85 |

3-Year Dividend Growth Rate | -31.6 |

5-Year Yield-on-Cost % | 5.28 |

3-Year Average Share Buyback Ratio | -2.2 |

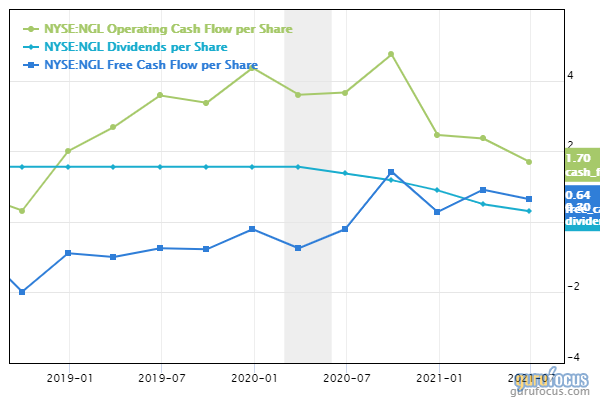

The company's business seems to be recovering based on the below chart, and Free Cash Flow has moved into the green.

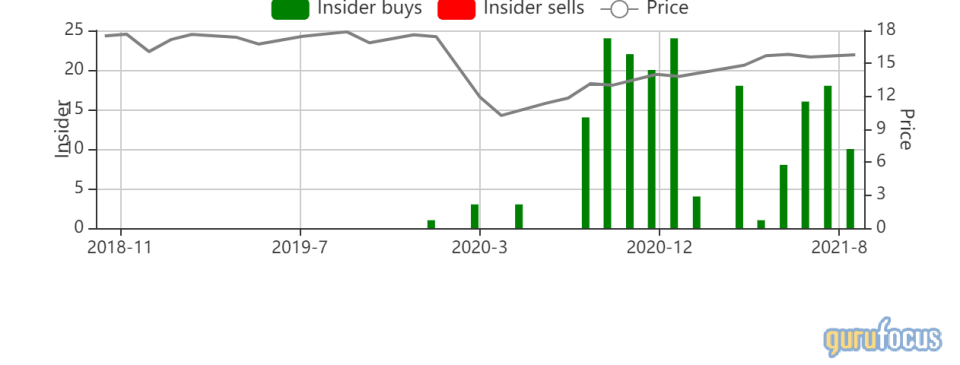

Insiders have been snapping up the stock recently.

Insider | Position | Date | Buy/Sell | Shares | Shares Owned | Trade Price($) | Cost($1000) | Price change since trade(%) | Share ownership details |

KRIMBILL H MICHAEL | CEO | 2021-08-27 | Buy | 200,000 | 2,392,170 | 1.50 | 300 | +18.67 | 2,028,615 (Direct) SEE FTN:363,555 |

COLLINGSWORTH JAMES M | Director | 2021-08-26 | Buy | 25,000 | 335,870 | 1.49 | 37.25 | +19.46 | 325,500 (Direct) SEE FOOTNOTE(F3,):9,500 SEE FOOTNOTE(F4,):870 |

Ciolek John | Executive Vice President | 2021-08-17 | Buy | 10,000 | 252,264 | 1.40 | 14 | +27.14 | 252,264 (Direct) |

KRIMBILL H MICHAEL | CEO | 2021-08-13 | Buy | 200,000 | 2,192,170 | 1.52 | 304 | +17.11 | 1,828,615 (Direct) SEE FTN:363,555 |

KRIMBILL H MICHAEL | CEO | 2021-08-12 | Buy | 150,000 | 1,992,170 | 1.55 | 232.50 | +14.84 | 1,628,615 (Direct) SEE FTN:363,555 |

Ciolek John | Executive Vice President | 2020-06-05 | Buy | 10,000 | 75,733 | 6.97 | 69.70 | -74.46 | 75,733 (Direct) |

COLLINGSWORTH JAMES M | Director | 2020-03-12 | Buy | 25,000 | 10,370 | 3 | 75 | -40.65 | 870 (Direct) See Footnote(F2,):9,500 |

KRIMBILL H MICHAEL | CEO | 2020-03-06 | Buy | 25,000 | 1,625,433 | 6.35 | 158.75 | -71.95 | 1,261,878 (Direct) SEE FTN:363,555 |

Karlovich Robert W III | CFO, Exec VP | 2020-03-06 | Buy | 10,000 | 125,382 | 6.49 | 64.90 | -72.57 | 125,382 (Direct) |

Conclusion

The companies listed above could be worthwhile to look into as potential investment opportunities, in my opinion. The two BDC's are cyclical and risky but are paying out big dividends. The finance company and the health care REIT appear to be of medium and low risk, respectively. The midstream company is speculative, but oil prices are recovering, so this could be a multi-bagger.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance