5 High-Yield Dividend Stocks to Watch

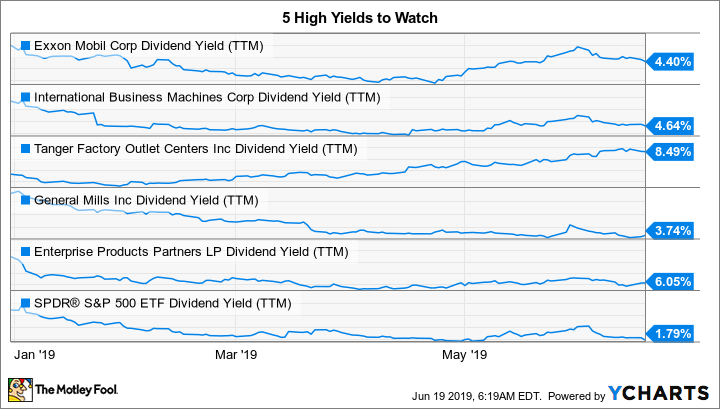

Finding high-yield dividend stocks when the stock market is near all-time highs can be difficult, but it can be done. Often, though, it requires buying stocks that have been facing headwinds of some sort. That doesn't mean they are bad companies -- just that they need to be watched a little more closely to ensure they are working through the rough patch in a reasonable fashion. Five high-yield dividend stocks worth looking at today are ExxonMobil (NYSE: XOM), General Mills (NYSE: GIS), International Business Machines (NYSE: IBM), Tanger Outlet Centers (NYSE: SKT), and Enterprise Products Partners (NYSE: EPD).

1. A turn for the better

The biggest driver of performance at Exxon are oil prices, which have been a little volatile lately. That's part of the reason why the stock has been bouncing around a bit this year. However, the longer-term issue facing Exxon is production, which has fallen in each of the last three years. That's the wrong direction for an oil company, and investors are worried the industry giant is falling behind its peers.

That's why it's so comforting that production turned for the better in the middle of 2018. Production rose between the second and third quarters and again between the third and fourth quarters. Although production was flat between the fourth quarter of 2018 and the first quarter of 2019, it was up 5% year over year. Most of this improvement was on the strength of Exxon's U.S. onshore drilling effort, just one of several big growth drivers.

Meanwhile, long-term debt remains around 10% of the company's capital structure, so it has ample financial flexibility on its balance sheet to keep funding growth projects no matter what oil prices do. With a yield of 4.9% and a streak of 37 consecutive annual dividend increases, Exxon is worth a look even for conservative investors willing to track production performance.

2. Shifting tastes

General Mills is a packaged food giant with a portfolio of iconic food brands, including Cheerios and Yoplait, among others. Consumers have been gravitating to foods that are perceived as fresh and healthy, which isn't the strong suit of packaged food companies. There have also been some self-inflicted wounds, like completely missing the Greek yogurt craze. Financial results haven't been great.

The food giant is working on the issue, including revamping older brands (Yoplait), jettisoning assets that don't resonate with current consumers (Green Giant), and buying brands that are more in demand (Annie's). That last one is a problem today, because one of the acquisitions, natural pet food maker Blue Buffalo, was a very expensive deal that materially increased General Mills' debt load. Worse, some have suggested the company overpaid for it, even though it was a desirable addition to the portfolio.

Investors have pushed the stock down and the dividend yield up (it currently sits around 4%). But General Mills hasn't cut its dividend in 100 years, raising it or holding the line regardless of the environment in which it is operating. And the current focus is on the integration of Blue Buffalo and paying down debt. Management knows what it needs to do because General Mills has been through periods of change before. And while it's possible that it will only muddle through this time around, history suggests it is highly likely to survive the current headwinds with the dividend intact. The key right now is to watch the company's long-term debt pile.

3. Technology changes

Next up is international tech giant IBM. The company's problems have been well documented in the press, with persistently weak sales as it attempts to shift from older technology niches (computer manufacturing) to newer ones (cloud, security, artificial intelligence). That's partly because the process has included selling mature businesses and replacing them with smaller but fast-growing businesses via acquisition. The transition has taken a long time, with Motley Fool contributor Danny Vena aptly describing the company's financial results in literary terms as "A Tale of Two Companies."

The thing with IBM is that it's wrong to think of it as tied to any specific technology. In its more than 100-year history, this tech giant has shifted its portfolio many times over. It hasn't always been pretty, and this time around is proof of that. But it always seems to successfully change with the times. The big question mark right now is the company's acquisition of Red Hat, an expensive deal that is supposed to help IBM gain traction in the hot cloud space.

Investors like Red Hat, but are worried that IBM will botch up the company's success. IBM promises it won't do that, but mergers have a habit of not working out as planned. And, most troubling, the Red Hat purchase was indeed costly. If things don't go as well, it could be trouble for IBM, which has been posting relatively weak results for years at this point. With a 24-year streak of annual dividend hikes under its belt and a fat 5% yield, however, more aggressive types might be interested here. Just keep an eye on the Red Hat deal.

4. The retail apocalypse

If you are looking for a really high yield, then real estate investment trust (REIT) Tanger Outlet Centers' 8.5% yield should be right up your alley. REITs tend to have high yields, but 8.5% suggests that investors are worried it can't support the payout. And there is good reason for that, since Tanger, as its name implies, operates in the retail space. Malls have been hit hard by store closures and retail bankruptcies (Sears), often overhyped as the retail apocalypse.

XOM dividend yield (TTM). Data by YCharts.

Tanger, however, is a little different. It owns outlet centers not enclosed malls. That keys into the low price concept, which is the one area of retail that has been doing well lately. Moreover, outlet malls cost less to run than indoor malls because they are outdoor structures with easy to change store spaces. And there are no anchor tenants to worry about. The big issue is working through the shifting buying habits of consumers, bringing in new tenants that better match with current trends. Tanger has done this before, and it just takes time. In the short term, that means weak results, including falling occupancy rates (the expectation for this year is around 94.5%, historically low for Tanger).

The big question mark appears to be whether Tanger can survive the changes taking shape in the retail sector. On that score, it has a rock-solid balance sheet on which to rebuild. Only 6% of its portfolio has mall-level debt attached to it (largely mortgages at joint venture assets). It is investment-grade rated and has roughly 97% of a revolving credit facility available to it. And it is well within all of its key debt covenants, including covering interest costs by more than five times. This is not a financially troubled company, and if history is any guide, it will find new tenants to fill the void left by the retail apocalypse. You'll want to watch closely, of course, but the negative sentiment here appears overdone. With an incredible 26-year history of annual dividend hikes, though, it might be worth the risk for more aggressive investors.

5. In the middle of things

Last up is energy midstream bellwether Enterprise Products Partners. This limited partnership helps move, store, and process oil and natural gas in North America. It is a vital link in the energy market with a business built on fee-based assets. So, unlike Exxon, oil and gas prices don't have as big an impact on its financial results. Instead, demand is the main driver.

On that score, domestic oil and gas production has increased dramatically in recent years with no signs that the trend is going to end. In fact, there isn't enough capacity in the midstream sector to handle all of the oil and gas being produced. So, the outlook for Enterprise is pretty good, with the company currently working on $5 billion in growth projects.

There are two problems here. First, investors appear to have soured on the midstream space in general despite the positive outlook for the industry. Second, Enterprise has been shifting its business model so that it can self-fund more of its own growth spending. That's led to a slowdown in its distribution growth rate. However, once this transition is complete (likely no later than 2020), investors should expect distribution growth to pick back up into the mid-single-digit range. And with leverage at the low end of the industry, there doesn't appear to be any need to worry about the 6.2% yield or the continuation of the company's 22-year streak of annual distribution increases. This one is a good choice for more conservative types, but still make sure to watch the self-funding push.

Watching the change

The key theme through this list is change. It can be hard at times, and the outcomes are often uncertain. But that presents opportunity for investors who can think long term. If that sounds like you, then Exxon, General Mills, IBM, Tanger, and Enterprise are worth a deep dive. Yes, you'll need to watch the progress they make along the way, but if things work out as planned, income investors should be well rewarded.

More From The Motley Fool

Reuben Gregg Brewer owns shares of ExxonMobil, General Mills, IBM, and Tanger Factory Outlet Centers. The Motley Fool is short shares of IBM. The Motley Fool recommends Enterprise Products Partners and Tanger Factory Outlet Centers. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance