5 Large Retailers to Buy on Solid Sales in December

On Jan 17, the Department of Commerce reported that retail sales were up 0.6% month over month in December, beating the consensus estimate of 0.5%. Retail sales had increased 0.3% month over month in November. Year over year, retail sales increased 5.6% in December. For full-year 2023, retail sales increased 3.2% year over year.

Core retail sales (excluding auto) in December were up 0.4% month-over-month, beating the consensus estimate of 0.2%. Core retail sales in November also increased 0.2% month over month. Another measure of retail sales (excluding sales from auto dealers, building materials stores, gas stations, office suppliers, mobile homes and tobacco stores) climbed 0.8% month over month in December.

This so-called retail sales of the control group is an important component for the Department of Commerce to estimate U.S.GDP. Therefore, all measures of December retail sales clearly indicate an increasing in American consumer spending. This eliminates the possibility of any near-term recession.

On the other hand, strong retail sales data for December, along with significantly higher-than-expected nonfarm payrolls and hotter-than-expected inflation rate raise concerns that the Fed may delay its first rate cut.

Our Top Picks

We have narrowed our search to five retailers with good potential for 2024. All these stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

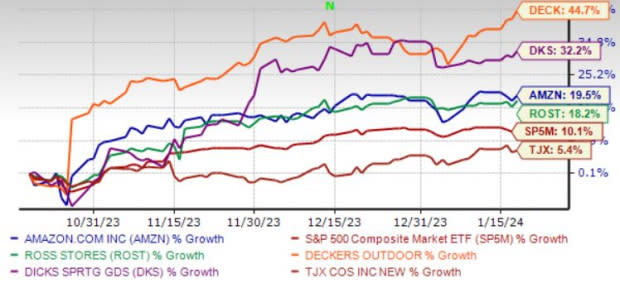

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Amazon.com Inc. AMZN has been benefiting from a strengthening AWS services portfolio and its growing adoption rate has contributed well. Ultrafast delivery services and an expanding content portfolio are positives for AMZN.

The strengthening relationship with third-party sellers is also encouraging. Its advertising business is also making a robust contribution. Improving Alexa skills along with robust smart home product offerings are tailwinds for AMZN.

Amazon has an expected revenue and earnings growth rate of 11.7% and 34%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 2% over the last 30 days.

Deckers Outdoor Corp. DECK has been benefiting from its strength in the UGG and HOKA brands. Solid gains from the direct-to-consumer channels, brand growth, a strong balance sheet and a stable operating model favor DECK.

Solid momentum in DECK’s global wholesale business, driven by robust consumer demand in both domestic and international markets, appears encouraging as well. DECK envisions fiscal 2024 net sales to increase 11% from the prior year.

Deckers Outdoor has an expected revenue and earnings growth rate of 11.7% and 21.9%, respectively, for the current year (ending March 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days.

Ross Stores Inc. ROST has benefited from positive customer response to its improved merchandise and strong value offerings. ROST has also gained from the execution of its store expansion plans over the years.

ROST operates a chain of off-price retail apparel and home accessories stores, which target value-conscious men and women, aged 25 to 54 in middle-to-upper middle-class households. ROST has a proven business model as the competitive bargains it offers continue to make its stores attractive destinations for customers in all economic scenarios.

Ross Stores has an expected revenue and earnings growth rate of 4.3% and 8.8%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 17.2% over the last 60 days.

The TJX Companies Inc. TJX is benefiting from its solid store and e-commerce growth efforts. TJX’s off-price business model, strategic store locations, impressive brands and fashion products and supply-chain management have been working well. TJX’s Marmaxx segment is doing particularly well, wherein comparable store sales (comps) increased in the first quarter of fiscal 2024, backed by improved customer traffic.

The TJX Companies has an expected revenue and earnings growth rate of 5.1% and 9.5%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last seven days.

DICK'S Sporting Goods Inc. DKS has been gaining from a strong back-to-school season and continued market share gains. This led to a robust top-line performance in third-quarter fiscal 2023. Also, strong comps and healthy transaction growth acted as tailwinds.

For fiscal 2023, DKS expects comps growth of 0.5-2%. In addition, DKS’ store expansion initiatives, driven by DICK'S House of Sport, Golf Galaxy Performance Center, Public Lands and Going, Going, Gone! Stores, bode well.

DICK'S Sporting Goods has an expected revenue and earnings growth rate of 1.7% and 3.8%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 3.8% over the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance