5 Market-Beating Construction Picks That Might Lose Steam in 2024

The Zacks Construction sector has shown signs of recovery in the past few months, as mortgage rates and inflationary pressure have started relieving the economy. Recently, the Federal Reserve’s monetary policy committee also decided to stabilize the federal funds rate at a top target of 5.5% and suggested three rate cuts next year.

The private residential construction market as well as repair and remodeling (R&R) activities has started improving recently. Increased government funding for infrastructure and carbon/ESG-related projects is an added bliss for the sector.

However, macroeconomic uncertainties, new product investments and rising raw material costs could squeeze margins. Additionally, the lack of existing homes for sale, which is increasing cycle times for homebuilders, and affordability issues are ultimately hurting housing and its related industries.

Weyerhaeuser Company WY and PotlatchDeltic Corporation PCH from the Zacks Building Products – Wood industry, ChampionX Corp. CHX from the Zacks Engineering - R and D Services industry, MasTec, Inc. MTZ from the Zacks Building Products - Heavy Construction industry and Hillman Solutions Corp. HLMN from the Zacks Building Products - Miscellaneous industry are a few construction players likely to be hurt more by the above-mentioned headwinds.

Will Improving Trends Sustain in 2024?

On Dec 18, the National Association of Home Builders (NAHB)/Wells Fargo reported a three-point month-over-month improvement in the builder confidence for December in its recent Housing Market Index (HMI). NAHB has also noted that as mortgage rates ran above 7% in November, many builders are still reducing home prices to boost sales. In December, 36% of builders reported reducing home prices, while 60% of builders providing sales incentives.

NAHB’s HMI noted that the component measuring sales expectations for the next six months increased six points to 45 from November. Although the price level of inputs to residential construction less energy (i.e., building materials) increased 0.2% in November, a slowdown in inflation and an improving job market are signaling hope.

Apart from the residential market, non-residential players are banking on strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply-chain investments. Also, they are experiencing higher funding for carbon/ESG-related projects to pursue carbon capture and storage work. Meanwhile, the R&R activity is showing a solid momentum of late.

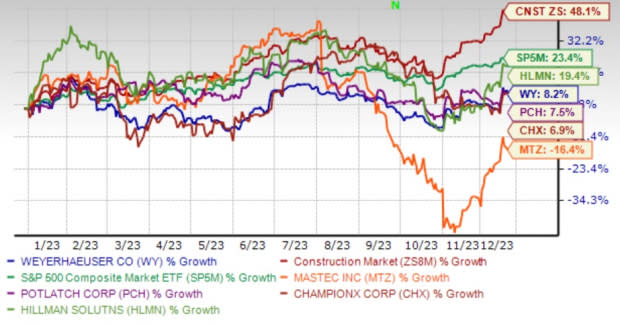

So far in 2023, the Zacks Construction sector has risen 48.1%, more than double the S&P 500 index’s 23.4% rally.

Image Source: Zacks Investment Research

However, the above-mentioned headwinds are major concerns for the whole sector. Let’s see which factors are ailing the aforesaid companies and impacting their earnings projection.

Stocks Worth Kicking off of Your Portfolio

With the help of Zacks Stock Screener, we have zeroed five high-profile construction stocks that have a market cap of more than 1 billion and currently carry a Zacks Rank of 4 or 5 (Sell-Rated). Also, none of these stocks have outperformed the broader sectors or the S&P 500 index year to date (YTD).

Weyerhaeuser: Based in Seattle, WA, this Zacks Rank #4 (Sell) company is one of the world's largest private owners of timberlands, with a market cap of $24.34 billion. It recently saw low contributions from the Timberlands and Wood Products segments mainly due to lower sales volumes in the Western and Southern markets, low average sales realizations, and high costs. Macroeconomic woes and a highly volatile lumber market are added risks. WY is also grappling with a tepid liquidity position.

Weyerhaeuser has gained 8.2% YTD. It has seen a downward estimate revision to $1.02 and $1.17 from $1.03 and $1.18 for 2023 and 2024 earnings per share (EPS), respectively, over the past seven days. Negative estimate revisions depict analysts' concerns over the company’s growth potential. WY has a VGM Score of D.

ChampionX: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that produce oil and gas. CHX is experiencing lower contribution from its Reservoir Chemical Technologies segment due to the exit of the friction reducer product line. A decrease in the Production Chemical Technologies segment contribution, which was mainly associated with the decision to exit its CT Russia business, and a decline in revenues derived from the Cross Supply and Product Transfer Agreement with Ecolab Inc. are added negatives. The company also experienced a decrease in revenues from the Drilling Technologies segment due to lower U.S. rig count and customer activity, as well as higher labor costs and general inflation.

ChampionX, currently carrying a Zacks Rank #5 (Strong Sell), has a market cap of $6.03 billion. The Zacks Consensus Estimate for 2023 and 2024 EPS has reduced to $1.77 and $2.08 from $1.87 and $2.25, respectively, in the past 60 days. YTD, the stock has gained 6.9%. CHX currently has a Value Score of C.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MasTec: Based in Coral Gables, FL, this is a leading infrastructure construction company operating mainly throughout North America, with a market cap of $5.75 billion. MasTec has been witnessing continued delays on certain Clean Energy and Infrastructure segment project start dates and lower-than-expected revenues from the Communications and Power Delivery segments. Notably, MTZ lowered its earnings and revenue expectations for 2023. It expects to generate revenues of $12 billion for 2023, down from the earlier mentioned $12.7-$13 billion. Earnings are now projected to be $1.75 per share, significantly down from the $3.75-$4.19 stated earlier.

MasTec, currently carrying a Zacks Rank #5, has declined 16.4% YTD. The consensus estimate for 2023 and 2024 EPS has declined to $1.76 and $2.49 from $3.92 and $5.65, respectively, in the past 60 days. It has a VGM Score of C.

PotlatchDeltic: Headquartered in Spokane, WA, PotlatchDeltic is a leading Real Estate Investment Trust (REIT). The company has a market cap of $3.73 billion. PCH has been witnessing declines in lumber and Northern sawlog prices, fewer rural real estate acres sold, and lower real estate development sales in Chenal Valley. Higher manufacturing, logging and hauling costs are added negatives.

PotlatchDeltic, a Zacks Rank #4 stock, has gained 7.5% YTD. PCH has seen a downward estimate revision for 2023 and 2024 EPS to 47 cents and 78 cents from 80 cents and $1.30, respectively, over the past 60 days. It has a VGM Score of D.

Hillman Solutions: Based in Cincinnati, OH, this company provides hardware-related products and merchandising services in North America. This Zacks Rank #4 company has a market cap of $1.68 billion. HLMN’s Protective equipment has been experiencing lower volumes due to difficult comparable COVID-19 sales. Also, decreases in full-service key and engraving volume are hurting Robotics and Digital Solutions unit. Currency woes, and higher shipping and product costs are other major concerns for the company.

HLMN has gained 19.4% YTD. That said, HLMN’s 2023 and 2024 EPS estimate has decreased to 36 cents and 41 cents from 39 cents and 47 cents, respectively, over the past 60 days. It has a Momentum Score of D.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Potlatch Corporation (PCH) : Free Stock Analysis Report

MasTec, Inc. (MTZ) : Free Stock Analysis Report

ChampionX Corporation (CHX) : Free Stock Analysis Report

Hillman Solutions Corp. (HLMN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance