5 Stocks From Top-Ranked Industries Ready to Explode in 2020

2019 has been a great year for Wall Street as major stock market indexes reached new highs and yielded solid returns on multiple occasions. While uncertainties surrounding the U.S.-China trade deal, global economic slowdown and Brexit worries were key concerns in 2019, macro-economic environment is likely to improve as we enter into a new decade.

Business sentiments and the prospects for a number of industries seem bright. Investors are likely to see changes from various macro factors, which include expected easing in monetary policy, rebound in oil markets and improving outlook in Europe.

The U.S.-China trade deal will continue to play a major role in 2020. The completion of the phase one of the deal is likely to improve business sentiments and expected to serve as a fundamental catalyst for global markets. The deal is expected to drive equity markets and will position the global economy on a growth trajectory.

After cutting its benchmark rates for the third time in October 2019, the U.S. Federal Reserve kept interest rates unchanged in its December meeting. Also, the central bank signaled that it may leave the rates on hold through next year. The Fed’s move augurs well for consumer confidence and expansion of economic activities in 2020.

Most importantly, the U.S. economy remains fundamentally stable. Courtesy of increasing consumer confidence, lower unemployment level and gradual wage growth, the economy and stock markets are well poised for growth in 2020.

Top-Ranked Industries Poised to Grow in 2020

A favorable job scenario, high consumer sentiment and easing monetary policy provides additional upside to a fundamentally sound U.S. economy. The momentum in the equity markets is also expected to continue next year.

Given these factors, it will be prudent for investors to add a few stocks in the portfolio that are fundamentally strong and belong to top-ranked industries. This is important because a rising tide will elevate all boats in an industry, as positive developments in the industry are likely to boost stocks across the board.

We have employed the Zacks Stocks Screener to filter five stocks from top-ranked industries (top 10%) that are poised to perform well in 2020. Our back-testing shows that the top 50% of the Zacks ranked industries outperforms the bottom 50% by a factor of more than two-to-one.

Moreover, we have refined the screening to include our style score system to single out the stocks that can potentially beat the market. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or #2 (Buy), offer the best upside potential. You can see the complete list of today’s Zacks #1 Rank stocks here.

Lastly, we targeted the stocks whose Zacks Consensus Estimate for 2020 earnings have been moving up lately.

Our Key Picks

FUJIFILM Holdings Corporation FUJIY: The Tokyo-based company is a leading global producer of photographic imaging products, healthcare and document solutions. It belongs to the Semiconductor Equipment - Photomasks industry, which currently ranks 1 out of more than 250 industries. The stock currently sports a Zacks Rank #1 and has a VGM score of A. Earnings estimates for fiscal 2020 have jumped 7.9% in the past 60 days to $3.67 per share. The company’s shares have gained 22.2% year to date.

Fujifilm Holdings Corp. Price and Consensus

Fujifilm Holdings Corp. price-consensus-chart | Fujifilm Holdings Corp. Quote

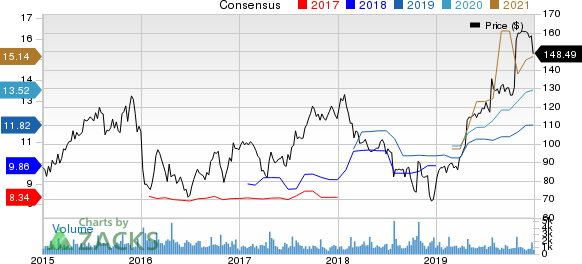

Lithia Motors, Inc. LAD: This Medford, OR-based company is one of the largest providers of personal transportation solutions in the United States. It belongs to the Automotive - Retail and Whole Sales industry, which ranks 8 (or top 3%). The stock currently sports a Zacks Rank #1 and has a VGM score of A. Earnings estimates for 2020 have jumped 4.2% in the past 60 days to $13.52 per share. The company’s shares have surged 94.5% year to date.

Lithia Motors, Inc. Price and Consensus

Lithia Motors, Inc. price-consensus-chart | Lithia Motors, Inc. Quote

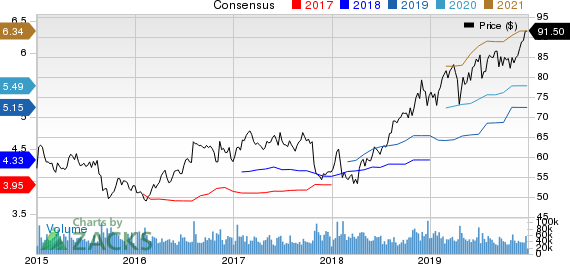

Merck & Co., Inc. MRK: The Kenilworth, NJ-based leading global biopharmaceutical company belongs to the Large Cap Pharmaceuticals industry, which currently ranks 14 (or Top 6%). The stock currently carries a Zacks Rank #2 and has a VGM score of A. Earnings estimates for 2020 have inched up 0.9% in the past 60 days to $5.49 per share. The company’s shares have gained 19.7% year to date.

Merck & Co., Inc. Price and Consensus

Merck & Co., Inc. price-consensus-chart | Merck & Co., Inc. Quote

Sally Beauty Holdings, Inc. SBH: The Denton, TX-based company is an international specialty retailer and distributor of professional beauty products. It belongs to the Retail - Miscellaneous industry, which currently ranks 25 (or Top 10%). The stock currently sports a Zacks Rank #1 and has a VGM score of B. Earnings estimates for fiscal 2020 rose 6.9% in the past 60 days to $2.33 per share. The company’s shares have gained 6% year to date.

Sally Beauty Holdings, Inc. Price and Consensus

Sally Beauty Holdings, Inc. price-consensus-chart | Sally Beauty Holdings, Inc. Quote

Acushnet Holdings Corp. GOLF: The Fairhaven, MA-based company is a global leader in the designing, developing, manufacturing and distributing performance-driven golf products. It belongs to the Leisure and Recreation Products industry, which currently ranks 12 (or Top 5%). The stock currently carries a Zacks Rank #2 and has a VGM score of A. Earnings estimates for 2020 rose 2.4% in the past 60 days to $1.69 per share. The company’s shares have gained 54.6% year to date.

Acushnet Holdings Corp. Price and Consensus

Acushnet Holdings Corp. price-consensus-chart | Acushnet Holdings Corp. Quote

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 top tickers for the entirety of 2020?

These 10 are painstakingly hand-picked from over 4,000 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Start Your Access to the New Zacks Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Acushnet Holdings Corp. (GOLF) : Free Stock Analysis Report

Fujifilm Holdings Corp. (FUJIY) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance