5 Stocks to Watch on Their Recent Dividend Hike

U.S. stock markets have retreated in April after a sharp rally in the past 15 months. The euphoria surrounding equities evaporated as the yield on the benchmark 10-Year U.S. Treasury Note returned northward, trading above 4%. In the first week of April, the Dow tumbled 2.3%, posting its worst weekly performance in 2024. The S&P 500 slid 1% during the period, while the Nasdaq Composite fell 0.8%.

This was primarily owing to the uncertainty regarding the time when the Fed would initiate the first cut in the benchmark interest rate. Recently, a few key Fed FOMC members said that although they believe that the rate hike regime is over, they are yet to be convinced that the economic condition is conducive enough for an immediate rate cut.

Moreover, the labor market remains resilient. U.S. economy added 303,000 nonfarm jobs in March, well above the consensus estimate of 195,000. The unemployment rate in March was 3.8% compared with 3.9% in February.

Following the labor market data for March, the yield on the benchmark 10-Year U.S. Treasury increased to 4.4%. The yield on the short-term 2-Year U.S. Treasury rose to 4.75%. Similarly, the yield on the long-term 30-Year U.S. Treasury advanced to 4.551%.

Stocks to Watch

At this stage, dividend-paying stocks should be in demand as investors try to safeguard their portfolios. We believe one should consider stocks that have recently raised their dividend payments.

Five such companies are — Bank OZK OZK, The TJX Companies Inc. TJX, Cal-Maine Foods Inc. CALM, ChampionX Corp. CHX and Phillips 66 PSX.

Bank OZK provides various retail and commercial banking services. OZK accepts various deposit products, including non-interest-bearing checking, interest bearing transaction, business sweep, savings, money market, individual retirement, and other accounts, as well as time deposits.

OZK also offers real estate, consumer and business purposes, indirect recreational vehicle and marine, commercial and industrial, government-guaranteed, agricultural equipment, small business, lines of credit, homebuilder, and affordable housing loans, business aviation and subscription financing services, and mortgage and other lending products. OZK currently carries a Zacks Rank #3 (Hold).

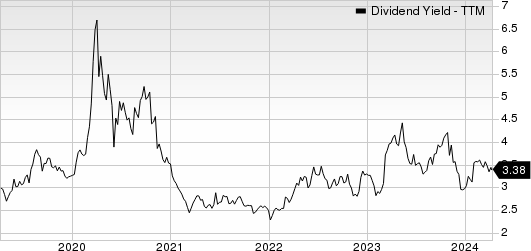

On Apr 1, 2024, Bank OZK declared that its shareholders would receive a dividend of $0.39 per share on Apr 19, 2024. It has a dividend yield of 3.5%. Over the past five years, OZK has increased its dividend 21 times, and its payout ratio presently stays at 25% of earnings. Check OZK’s dividend history here.

Bank OZK Dividend Yield (TTM)

Bank OZK dividend-yield-ttm | Bank OZK Quote

The TJX Companies’ off-price business model, strategic store locations, impressive brands and fashion products and supply-chain management have been working well. TJX is benefiting from its solid store and e-commerce growth efforts.

The Marmaxx segment of TJX is doing well, where comparable store sales grew in the fiscal third quarter, backed by improved customer traffic. Strength at TJX’s HomeGoods (U.S.) division bodes well. Also, TJX is boosting growth through effective marketing initiatives. TJX currently carries a Zacks Rank #3.

On Apr 2, 2024, The TJX Companies declared that its shareholders would receive a dividend of $0.375 per share on Jun 6, 2024. It has a dividend yield of 1.5%. Over the past five years, TJX has increased its dividend five times, and its payout ratio presently stays at 35% of earnings. Check TJX’s dividend history here.

The TJX Companies, Inc. Dividend Yield (TTM)

The TJX Companies, Inc. dividend-yield-ttm | The TJX Companies, Inc. Quote

Cal-Maine Foods is primarily engaged in the production, grading, packing and sale of fresh shell eggs, including conventional, cage-free, organic and nutritionally-enhanced eggs. CALM is the largest producer and distributor of fresh shell eggs in the United States.

Cal-Maine Foods sells the majority of its shell eggs in states across the southwestern, southeastern, mid-western and mid-Atlantic regions of the United States. CALM currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

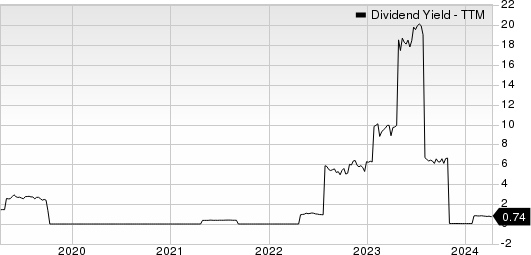

On Apr 2, 2024, Cal-Maine Foods declared that its shareholders would receive a dividend of $1 per share on May 16, 2024. It has a dividend yield of 6.6%. Over the past five years, CALM has increased its dividend eight times, and its payout ratio presently stays at 8% of earnings. Check CALM’s dividend history here.

Cal-Maine Foods, Inc. Dividend Yield (TTM)

Cal-Maine Foods, Inc. dividend-yield-ttm | Cal-Maine Foods, Inc. Quote

ChampionX provides chemistry solutions and engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. CHX’s Production & Automation Technologies offerings consist of artificial lift equipment and solutions. CHX currently carries a Zacks Rank #3.

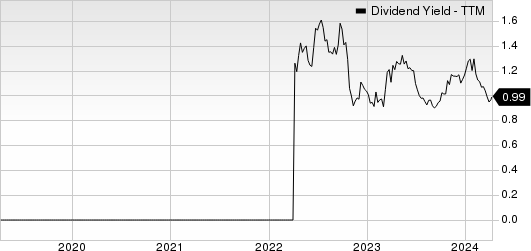

On Apr 3, 2024, ChampionX declared that its shareholders would receive a dividend of $0.095 per share on Apr 26, 2024. It has a dividend yield of 1.3%. Over the past five years, CHX has increased its dividend two times, and its payout ratio presently stays at 20% of earnings. Check CHX’s dividend history here.

ChampionX Corporation Dividend Yield (TTM)

ChampionX Corporation dividend-yield-ttm | ChampionX Corporation Quote

Phillips 66 is the leading player in each of its operations, like refining, chemicals and midstream, in terms of size, efficiency and strength. PSX is on track to enhance its potential in every business segment by streamlining its portfolio of assets and investing in growing developments. Additionally, Phillips 66 is well-positioned to capitalize on the higher demand for distillate fuels. PSX currently carries a Zacks Rank #3.

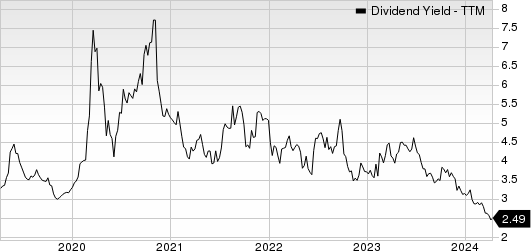

On Apr 3, 2024, Phillips 66 declared that its shareholders would receive a dividend of $1.15 per share on Jun 3, 2024. It has a dividend yield of 2.7%. Over the past five years, PSX has increased its dividend five times, and its payout ratio presently stays at 27% of earnings. Check PSX’s dividend history here.

Phillips 66 Dividend Yield (TTM)

Phillips 66 dividend-yield-ttm | Phillips 66 Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report

ChampionX Corporation (CHX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance