5 Wholesale Retailers to Buy Despite Weak Sales in April

On May 15, the Department of Commerce reported that retail sales in April remained flat month over month. However, the consensus estimate was for an increase of 0.4%. The data for March was revised downward to an increase of 0.6% from 0.7% reported earlier.

Year over year, retail sales increased 2.7% in April. However, these figures are adjusted for seasonality but not inflation. Meanwhile, the consumer price index — a key inflation gauge — increased 3.4% year over year in April. This clearly indicates that consumers did not keep up with the pace of price increases.

However, within this sector, the Zacks-defined Retail - Apparel and Shoes Industry is currently in the top 34% of the Zacks Industry Rank. In the past year, the industry has provided 45.6% returns, while its year-to-date return is 14.2%. Since it is ranked in the top half of Zacks Ranked Industries, we expect the consulting services industry to outperform the market over the next 3 to 6 months.

Positive Catalysts

Players in the industry have been benefiting from strong consumer demand for activewear/athleisure products and footwear, and the trend is expected to continue in 2024. Athletic goods and apparel companies offer products ranging from footwear, sweatshirts, leggings, pants, jackets and tops to yoga wear and running clothes for men and women. The increasing focus on fashion is boosting the demand for innovative clothes and footwear in the United States.

Industry participants have been focused on product innovations, active promotions, store expansion and enhancing e-commerce capabilities to gain market share. Favorable health and wellness trends have been the key to inspiring footwear manufacturers to expand their product portfolios.

The companies continue to innovate styles, materials and colors, and incorporate functional designs to grab a large share of the fast-growing market. Multi-functional shoes, which cater to casual and formal looks, have been gaining popularity.

E-commerce has been playing a crucial role in the athleisure market’s growth. The companies in the segment are looking to build a customer base through websites, social media and other digital channels.

As consumers continue to shop from home, the growth of athletic-inspired apparel and digital sales is likely to continue. Companies focused on expanding their athletic-based apparel lines and building on e-commerce capabilities are expected to witness growth in the long run.

Efforts to accelerate deliveries through investments in supply chains and order fulfillment avenues are likely to provide an edge to industry players. Simultaneously, companies are investing in renovations and improved checkouts, as well as mobile point-of-sale capabilities, to make stores attractive. Efforts to enhance experiences through multiple channels are likely to contribute significantly to improving traffic and transactions in stores and online.

Our Top Picks

We have narrowed our search to five retail – apparel and shoe industry stocks that have strong potential for 2024. These stocks have seen positive earnings estimate revisions within the last 60 days. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

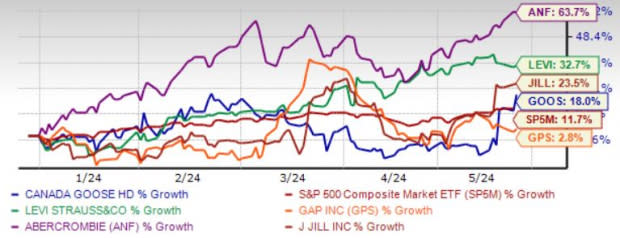

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Canada Goose Holdings Inc. GOOS designs, manufactures and sells performance luxury apparel for men, women, youth, children, and babies in Canada, the United States, Greater China, the rest of Asia Pacific, Europe, the Middle East, and Africa. GOOS operates through three segments: Direct-to-Consumer, Wholesale, and Other.

Canada Goose offers parkas, lightweight down jackets, rainwear, windwear, apparel, fleece, footwear, and accessories for the fall, winter, and spring seasons. GOOS operates through national e-commerce markets and directly operated retail stores.

Zacks Rank #1 Canada Goose has an expected revenue and earnings growth rate of 4% and 13.7%, respectively, for the current year (ending March 2025). The Zacks Consensus Estimate for current-year earnings has improved 6.4% over the last seven days.

Levi Strauss & Co. LEVI designs, markets, and sells apparels and related accessories for men, women, and children worldwide. LEVI offers jeans, casual and dress pants, activewears, tops, shorts, skirts, dresses, jumpsuits, shirts, sweaters, jackets, footwear, and related accessories under the Levi's, Dockers, Signature by Levi Strauss & Co., Denizen, and Beyond Yoga brands.

LEVI also licenses Levi's and Dockers trademarks for various product categories, including footwear, belts, wallets, bags, outerwear, sweaters, dress shirts, kids wear, sleepwear and hosiery.

Zacks Rank #1 Levi Strauss has an expected revenue and earnings growth rate of 2.9% and 15.5%, respectively, for the current year (ending November 2025). The Zacks Consensus Estimate for current-year earnings has improved 4.1% over the last 60 days.

The Gap Inc. GPS received a boost on the back of lower airfreight and improved promotions which aided its margins. GPS is on track with the execution of its Power Plan 2023. Lower advertising expenses and technology investments resulting from cost-saving actions also bode well for GPS. Gross margin expanded owing to gains from higher merchandise margins, lower commodity costs and better promotional activity.

Zacks Rank #1 The GAP has an expected revenue and earnings growth rate of 1.7% and 11.1%, respectively, for next year (ending January 2026). The Zacks Consensus Estimate for next-year earnings has improved 1.3% over the last seven days.

Abercrombie & Fitch Co. ANF has benefited from continued momentum across both brands, which bolstered its holiday sales. ANF has been witnessing strong sales growth for each of its brands. The company witnessed favorable margin trends mainly driven by reduced freight costs and improved average unit retail. For the first quarter of fiscal 2024, net sales are projected to be up low double-digits from $836 million reported in the year-ago period.

Zacks Rank #2 Abercrombie & Fitch has an expected revenue and earnings growth rate of 5.9% and 22.5%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 1.3% over the last seven days.

J.Jill Inc. JILL operates as an omnichannel retailer for women's apparel under the J.Jill brand in the United States. JILL offers apparel, footwear, and accessories, including scarves and jewelry. The company markets its products through retail stores, website and catalogs.

Zacks Rank #2 J.Jill has an expected revenue and earnings growth rate of 1.7% and 8%, respectively, for the current year (ending January 2025). The Zacks Consensus Estimate for current-year earnings has improved 4% over the last seven days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

J.Jill, Inc. (JILL) : Free Stock Analysis Report

Canada Goose Holdings Inc. (GOOS) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance