6.3% yield and down 25% in price! I rate this investment highly for generating a second income

I consider it quite difficult to find reliable investments that have good dividend income. Looking for a second income from shares comes with the risk of losing my asset value due to price drops.

So, I always look for companies that have a track record of appreciating in price. That means that I should be able to enjoy any healthy dividend payments that come along with that with more peace of mind.

A leading choice for dividends

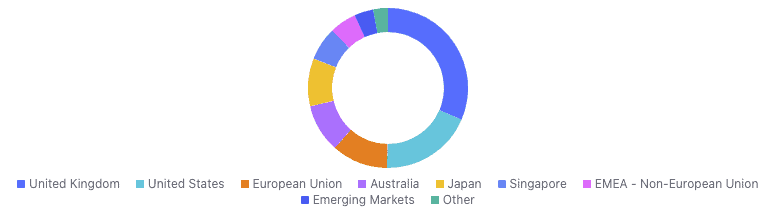

IG Group Holdings (LSE:IGG) is an online trading platform that derives revenue from customers around the world. It offers a range of different financial products, including exchange-traded funds, stocks, and derivatives.

Buying an investment when it’s selling at a discount from its all-time high is a great place to start, in my opinion. And IG Group is down 25% as I write.

Analyst estimates suggest its earnings should continue to grow over the next few years. Therefore, this could be an opportunity for me.

During the past eight years, its dividend yield, which is now 6.3%, has fluctuated. But the lowest it has been is 5%. That’s very good if you ask me.

One element that I love about this investment is that it’s considerably undervalued based on a valuation model called discounted earnings.

From my analysis, it has a margin of safety in price at the moment of around 30%, meaning it could be said to be on sale. But I don’t think it has any real reason to be so. I feel this is a mispricing by the stock market, which I could capitalise on.

Stable and profitable

I’ve noticed that the firm has a strong balance sheet. With much more equity than liabilities.

This is reflected in the firm’s enterprise value, which also shows much more cash than debt in the capital structure:

Also, at this time, the company has a net margin of 35%. This is slightly lower than what’s normal for the firm. Over the past 10 years it has commonly been around 36%. However, I have to remember it’s still incredibly high for its industry.

Operational risks

Any downsides? Of course there are. As IG Group operates in some niche corners of financial markets, including in contracts for difference, it’s under severe regulatory scrutiny. I think some of the markets it operates in could be inhibited quite severely by government intervention over the long term. The reason for this is that derivatives like those served by IG Group are much more likely to cause gambling behaviours than traditional share dealing.

Additionally, the firm is heavily dependent on its technology platform for revenue generation. In this new era of artificial intelligence, cyberattacks are becoming more sophisticated. IG Group is at specific risk of major reputational damage as it deals with financial accounts.

Great, but not for me

Overall, I feel this isn’t the type of business I’d like to own. I’m unsure how valuable its services are to customers’ well-being even though I can see big appeal for the high dividends.

If it was in a less risk-prone corner of the industry, I might consider investing in it to build a healthy passive income for myself.

The post 6.3% yield and down 25% in price! I rate this investment highly for generating a second income appeared first on The Motley Fool UK.

More reading

Oliver Rodzianko has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance