6 Key Metrics From Netflix Inc.'s Earnings Report

There may be room for many winners in the shift away from broadcast television, but right now most of the gains are flowing directly into Netflix's (NASDAQ: NFLX) coffers. The leading subscription streaming service this week beat its own aggressive growth guidance for the third straight quarter on healthy demand across its geographic markets.

Let's look at a few of the important numbers that jumped out in the report.

900,000: Membership surprise

Management missed the mark on their membership growth projection by just under 1 million users this quarter. The 5.3 million subscriber additions constituted a 49% improvement over the prior year compared to the 23% jump that CEO Reed Hastings and his team had forecast.

Image source: Netflix.

This growth surprise is a consistent theme in recent results. Through the first three quarters of 2017, Netflix has added 15.45 million users, or nearly 3 million subscribers above management's guidance.

30%: Revenue growth

The surging subscriber base combined with rising average spending per user to power Netflix's fifth straight quarter of over 30% revenue growth. Management sees that streak continuing into the fourth quarter, with a 32% sales spike leading to full-year revenue that, at $11 billion, would be double its annual result from just 3 years ago.

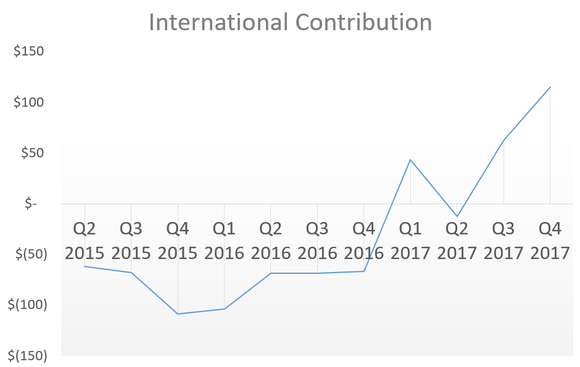

$62 million: International streaming profits

The international segment contributed $62 million toward profits to mark just the second time that division hasn't dragged overall results lower. The segment is on track to just barely break even for the year, but it's clear that it will begin to kick in serious profits in 2018 and beyond.

International segment quarterly contribution in millions. Q4 is management's forecast. Chart by author. Data source: Netflix filings.

$465 million: Cash burn

Cash outflow was $465 million and kept the company on pace to burn through between $2 billion and $2.5 billion for the year. Investors can count on a rising subscriber base, and higher average monthly prices, to lessen some of that cash pressure. Still, Netflix is likely to continue burning through cash (and taking on more debt) as it spends upfront on content investments that it can only monetize over time.

$17 billion: Content commitment

Netflix's content spending commitment jumped to $17 billion from $15.7 billion in the prior quarter. That might sound like a huge liability, but keep in mind that it represents many years of payments. Netflix should spend between $7 billion and $8 billion on content in 2018, for example.

Meanwhile, its portfolio of fully owned movies and TV shows sits at $2.5 billion. Between those two categories, management says they're happy with the assets they can use to keep users engaged. "We're quite comfortable with our ability to please our members around the world," Hastings said in his shareholder letter.

6.3 million: Subscriber growth forecast

Netflix's forecast for the seasonally strong fourth quarter calls for subscribers to rise by 6.3 million and pass 115 million worldwide. That result would mark a decline from the 7.05 million users that the company added in the prior year period, but investors shouldn't read too much into quarterly swings like that.

Zooming out, the company is on pace to complete its fourth consecutive year of accelerating growth by boosting member rolls by almost 22 million.

Annual member additions, in millions, based on Netflix's fourth-quarter forecast. Chart by author. Data source: Netflix filings.

Most of those gains are coming from international markets and they're being powered by Netflix's growing portfolio of original content. Executives took a moment to acknowledge that phenomenal growth as "a good head start" before admitting that they'll need to work tirelessly at defending that lead as competitors, including Disney, Amazon, Facebook and many others, pour resources into the on-demand streaming TV industry.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Demitrios Kalogeropoulos owns shares of Facebook, Netflix, and Walt Disney. The Motley Fool owns shares of and recommends Amazon, Facebook, Netflix, and Walt Disney. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance