6 Reasons Why You Should Invest in Republic Services (RSG)

A prudent investment decision involves buying well-performing stocks at the right time while selling those that are at risk. A rise in share price and strong fundamentals signal a stock’s bullish run.

Republic Services, Inc. RSG is a waste removal services provider that has performed extremely well lately and has the potential to sustain the momentum in the near term. Consequently, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

What Makes Republic Services an Attractive Pick?

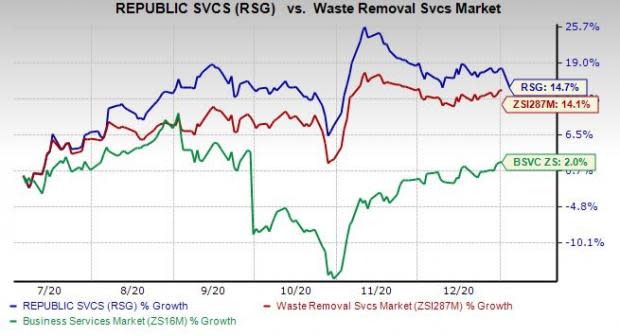

An Outperformer: A glimpse of the company’s price trend reveals that the stock has had an impressive run on the bourse in the past six months. Shares of Republic Services have returned 14.7%, outperforming the 14.1% rally of the industry it belongs to and 2% rise of the Zacks Business Services sector in the said time frame.

Solid Zacks Rank: Republic Services currently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank #1 or #2 (Buy) offer the best investment opportunities. Thus, the company is a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions:The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 30 days, the Zacks Consensus Estimate for Republic Services’ current-quarter earnings has increased 17.1% to 82 cents per share. Estimates for 2020 and 2021 have moved up 14.1% and 9.7%, respectively.

Positive Earnings Surprise History: Republic Services has an impressive earnings surprise history. The company has delivered a four-quarter earnings surprise of 15.1%, on average.

Earnings Expectations: Earnings growth and stock price gains often serve as indications of a company’s prospects. For 2020, Republic Services’ earnings are expected to register 0.9% growth. For 2021, earnings are expected to register 10.9% growth. Further, the company has an expected long-term (three to five years) earnings per share growth rate of 9.4%.

Growth Factors: Republic Services’ bottom line has been benefiting from improvement in operational efficiency, growth in adjusted free cash flow, higher recycled commodity prices and lower fuel costs.

Additionally, it has raised its full-year 2020 cash flow guidance. The company now anticipates generating $1.15 billion to $1.20 billion of adjusted free cash flow for the full year compared with the prior guidance of $1.1-$1.175 billion. It also plans to invest $850-$900 million in acquisitions for the full year.

The company remains focused on increasing its operational efficiency by shifting to compressed natural gas (“CNG”) collection vehicles and converting rear-loading trucks to automated-side loaders, which will reduce cost and improve profitability. The company is focused on enhancing its operations by streamlining the cost structure, improving revenue quality and seeking growth through profitable investment opportunities. In 2019, almost 13% of the replacement vehicle purchases were CNG vehicles. Meanwhile, the company is highly optimistic about the usage of CNG vehicles, which will help it compete effectively on grounds of maintaining a clean environment. Despite higher expenses, CNG reduces the company’s overall fleet operating costs through lower fuel expenses. As of Dec 31, 2019, Republic Services operated 39 CNG fueling stations. All these factors offer a solid investment proposition for the company.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are ManpowerGroup MAN, Insperity NSP and BG Staffing BGSF, each carrying a Zacks Rank #2.

The long-term expected earnings per share (three to five years) growth rate for ManpowerGroup, Insperity and BG Staffing is 3.5%, 15% and 20%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ManpowerGroup Inc. (MAN) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Insperity, Inc. (NSP) : Free Stock Analysis Report

BG Staffing Inc (BGSF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance