6 Reasons Why Investors Should Buy Golar LNG (GLNG) Stock

Golar LNG Limited GLNG is benefiting from an improved FLNG (Floating Liquefied Natural Gas) performance.

Let’s delve deeper to unearth the factors that make the stock an attractive investment opportunity.

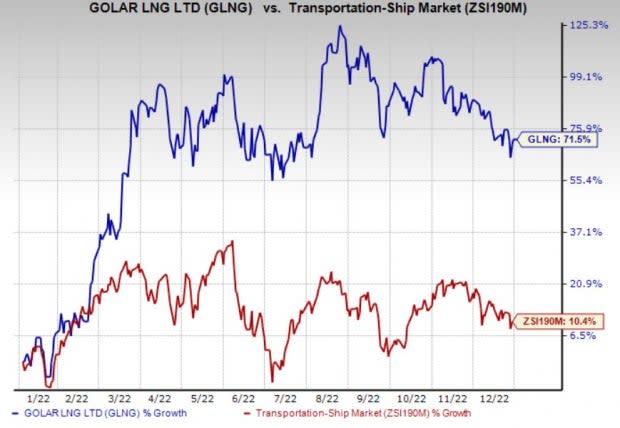

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run on the bourse over the past year. Shares of GLNG have gained 71.5% over the past year, outperforming 10.4% growth of its industry.

Image Source: Zacks Investment Research

Solid Zacks Rank: Golar LNG has a Zacks Rank #2 (Buy). Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2 offer the best investment opportunities. Thus, the company is a compelling investment proposition at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions:The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 90 days, the Zacks Consensus Estimate for Golar LNG’s first-quarter 2023 earnings has moved up 2.4% year over year. For 2023, the company’s earnings are expected to increase 6.7% year over year.

Positive Earnings Surprise History: Golar LNG has an impressive earnings surprise history. The company delivered an earnings surprise of 73.30% in the last four quarters, on average.

Earnings Expectations: Earnings growth and stock price gains often indicate a company’s prospects. For first-quarter 2023, Golar LNG’s earnings are expected to register 26.47% growth. For 2023, GLNG is expected to register more than 100% growth.

Other Tailwinds: Golar LNG is benefiting from an improved FLNG performance. The FLNG unit continues to perform well, aiding the company’s top line. The northward movement of Liquefied Natural Gas (LNG) freight rates is a positive for the company. Demand for LNG vessels is likely to get stronger owing to the Russia-Ukraine war as the European countries look for gas supplies outside Russia. Improved shipping performance is aiding the company. Efforts to reward its shareholders and reduce debt load are also encouraging.

Other Stocks to Consider

Some other top-ranked stocks from the broader Zacks Transportation sector are United Airlines Holdings, Inc. (UAL) and Teekay Tankers Ltd. (TNK), each currently carrying a Zacks Rank #1.

UAL has an expected earnings growth rate of 197.43% for the current year. UAL delivered a trailing four-quarter earnings surprise of 7.78%, on average.

The Zacks Consensus Estimate for UAL’s current-year earnings has improved 6.4% over the past 90 days. Shares of UAL have gained 6.7% over the past three months.

Teekay Tankers has an expected earnings growth rate of 143.11% for the current year. TNK delivered a trailing four-quarter earnings surprise of 42.23%, on average. Teekay Tankers has a long-term expected growth rate of 3%.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved more than 100% over the past 90 days. Shares of TNK have soared 14.4% over the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Golar LNG Limited (GLNG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance