6 Ways the First Presidential Debate Between Trump and Biden May Impact Your Wallet This Summer

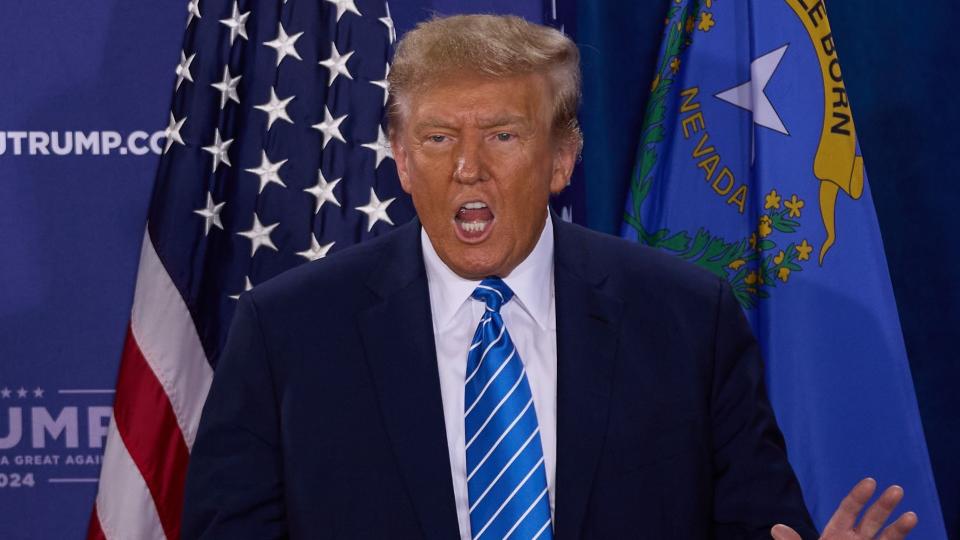

President Joe Biden and former President Donald Trump presented starkly different economic visions that could significantly impact households’ taxes, health care and financial lives over the next four years.

Check Out: How Much Is President Joe Biden Worth as He Seeks Reelection?

Read Next: 7 Reasons You Should Consider a Financial Advisor — Even If You’re Not Wealthy

“As a tax and estate planning attorney, I closely track policy changes that impact my clients’ financial well-being,” said David Brilliant, founder of Brilliant Law Firm.

He explained, “Voters must consider which policies they believe will most benefit their pocketbooks and long-term financial well-being. The outcome will shape economic policy for years to come.”

GOBanking Rates talked to personal finance experts to uncover the six ways the first Presidential Debate between Trump and Biden may impact your wallet this summer.

Wealthy people know the best money secrets. Learn how to copy them.

Tax Policy

Trump and Biden greatly disagree on tax policy.

The former president promised to extend the tax cuts that began during his administration and will end next year. Trump cut the corporate tax rate from 35% to 21% and nearly doubled the standard deduction and child tax credit.

Biden proposed raising the corporate tax rate to 28% and requiring billionaires to pay at least 25% of their income taxes to restore the child tax credit that was enacted during COVID but has since expired.

Both approaches have caveats. Biden’s emphasis on higher tax rates could slow economic growth, while Trump’s policies could increase the federal deficit.

National Debt

Both Trump and Biden seemed “ready and willing” to raise the national debt, said Dustin Siggins, a business writer and founder of Proven Media Solutions.

For example, the Trump administration borrowed $8.4 trillion during his time in office while Biden borrowed $4.3 trillion, according to an analysis by the Committee for a Responsible Federal Budget, a nonpartisan, Washington D.C.-based think tank.

Either way, increasing the national debt will result in higher inflation, lower economic growth, and higher taxes down the road, Siggins said.

Business Regulations

Trump prioritized deregulation and sought to reduce the regulatory burden on businesses to stimulate economic growth during his time in office. His administration also sparked efforts to reduce regulatory constraints on businesses and promote free-market principles.

Biden’s administration focuses on strengthening consumer protections, promoting competition, and advancing environmental and labor standards. He has also introduced stringent regulations aimed at the fossil fuels and technology industries.

Student Loans

Through executive actions, Biden has forgiven nearly $137 billion for more than 3.7 million student loan borrowers during the first three years of his presidency. In May, the Biden administration approved an additional $7.7 billion in debt relief for 160,000 borrowers.

“In the short term, this benefits consumers who receive money,” Siggins said. “In the long term, this increases the national debt.”

Trump suspended all federal loan student payments and temporarily set interest rates to 0% during COVID-19. His 2021 budget proposal sought to cut spending on student loan forgiveness by $170 billion.

Health Care

Health Care is essential to financial security, Klesinger said.

Biden recommended expanding the Affordable Care Act (ACA), a comprehensive health insurance reform passed in 2010, to reduce some premiums and out-of-pocket costs. Trump called for the repeal of the ACA and for reducing health care costs through private competition.

“My firm sees health care costs squeezing clients,” Klesinger said. “Biden’s plan may help more. However, the outcomes are complex.”

Trade

The differences in trade narrow between Trump and Biden, as both candidates appeal to working-class voters.

For example, Biden called for tripling tariffs on Chinese steel from 7.5% to 21%, which would protect U.S. producers from cheaper imports. Trump suggested imposing a 10% tariff on aluminum. In addition, Trump proposed phasing out Chinese imports of essential goods, including electronics, steel, and pharmaceuticals.

“Our analyses show tariffs raise consumer prices,” Klesinger said. “Alliances may curb this. However, the domestic production gains are unclear.”

What You Can Do Now

“Regardless of which candidate wins, consumers should always follow the best practices of building savings, eliminating debt, and investing early into retirement so they can be as flexible as possible no matter how the elections turn out,” Siggins said.

More From GOBankingRates

8 Rare Coins Worth Millions That Are Highly Coveted by Coin Collectors

Housing Market 2024: Home Prices Are Plummeting in 10 Formerly Overpriced Housing Markets

This is The Single Most Overlooked Tool for Becoming Debt-Free

This article originally appeared on GOBankingRates.com: 6 Ways the First Presidential Debate Between Trump and Biden May Impact Your Wallet This Summer

Yahoo Finance

Yahoo Finance