Up 61% in a year! Should I buy this FTSE 250 growth stock as it rides the AI wave?

We’re not even two weeks into March and already Darktrace (LSE: DARK) shares have risen by nearly a quarter. This means the FTSE 250 cybersecurity stock has gone from 272p to 439p in just one year.

That’s a 61% rise! Not too shabby.

That said, investors who bought shares at 900p in late 2021 still need the stock to more than double to reach par.

Based on the tech company’s excellent H1 results though, that’s not beyond the realms of possibility.

A beat and a raise

In the six months to 31 December, Darktrace’s revenue rose 27.4% year on year to $330m. Net profit soared to $53m while its adjusted EBITDA margin expanded to 25.6% from 17.4%, beating analysts’ forecasts.

Also impressive was the company’s ability to keep adding customers in this difficult global economy. At the end of 2023, it had 9,232 customers, which was 12.9% more than the same period the year before.

Churn rates also remain low, reflecting customer satisfaction with the products.

Looking ahead, the company sees full-year revenue growing 23.5% to 25%. And it expects a minimum 21% adjusted EBITDA margin, up from its previous 18%-20% range.

From luxury to necessity

Clearly, Darktrace is operating in a huge growth industry. Gone are the days when cybersecurity was a nice but non-essential luxury for a company.

A single data breach today can cause huge reputation damage, legal liabilities and financial losses.

Indeed, according to Salford University, 60% of small and medium-sized enterprises (SMEs) that fall victim to a cyberattack go out of business within six months.

Unfortunately, such incidents are rising, with many aided by AI. I just did a quick search online for ‘cyber attack’ and Google returned these recent news stories:

Japan blames North Korea for major cyberattack

Leicester City Council IT systems crippled by cyberattack

French government hit with cyberattacks of “unprecedented” force

For companies, governments and organisations, the stakes couldn’t be higher. It’s little wonder then that Fortune Business Insights sees the global cybersecurity market growing from $172bn in 2023 to $424bn by 2030.

I’m interested

Now, one issue I’d highlight here is competition. Large cybersecurity firms like Palo Alto Networks and CrowdStrike aren’t going away, and there are dozens of smaller, innovative companies globally.

Many of these start-ups have achieved unicorn status and all are jockeying for market share. So Darktrace will have to keep innovating relentlessly.

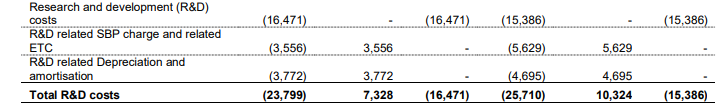

Given this, I was a little concerned to see absolute R&D spend drop by 7.4% during the first half. It went from $25.7m to $23.8m.

Still, the cybersecurity market is massive and the company has significant growth potential. And with generative AI tools lowering the cost of cyberattacks, further demand for protection from AI-powered companies like Darktrace is almost inevitable.

CEO Poppy Gustafsson noted: “In the months after the rollout of ChatGPT, we saw a 135% increase in… phishing emails that use more sophisticated grammar and language to make victims trust them. We believe attackers began using ChatGPT to make phishing harder to spot.”

Darktrace stock isn’t exactly cheap trading at 32 times forward earnings. But that’s actually a significant discount to US peers like Palo Alto (44 times).

I’m not ready to invest yet, but the FTSE 250 stock is on my watchlist.

The post Up 61% in a year! Should I buy this FTSE 250 growth stock as it rides the AI wave? appeared first on The Motley Fool UK.

More reading

Ben McPoland has positions in CrowdStrike. The Motley Fool UK has recommended CrowdStrike and Palo Alto Networks. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024

Yahoo Finance

Yahoo Finance