8 Stocks Diamond Hill Capital Continues to Buy

Diamond Hill Capital bought shares of the following stocks in both the fourth quarter of 2019 and the first quarter of 2020.

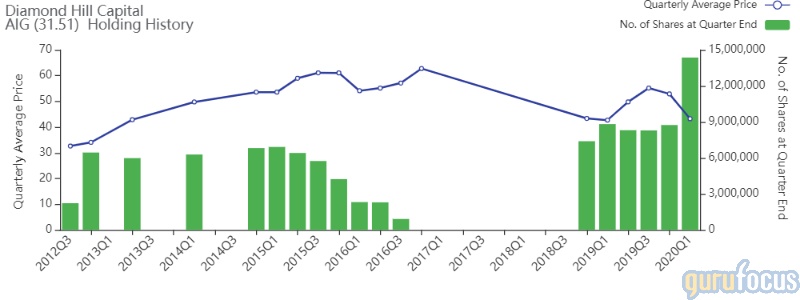

American International Group

The guru raised the American International Group Inc. (AIG) position by 5.44% in the fourth quarter and then added 64.29% in the first quarter. The stock has a weight of 2.37% in the portfolio.

The insurance and financial services firm has a market cap of $24.09 billion. Its revenue of $51.99 billion has risen 5.21% over the last five years.

HOTCHKIS & WILEY is the largest guru shareholder of the company with 2.99% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 1.84% and Diamond Hill Capital (Trades, Portfolio) with 1.67%.

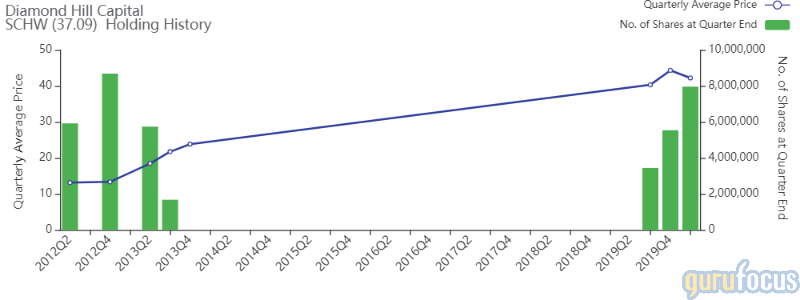

Charles Schwab

The firm increased the Charles Schwab Corp. (SCHW) stake by 60.76% in the fourth quarter and 43.69% in the first quarter. The stock has a weight of 1.82% in the portfolio.

The company, which is engaged in the brokerage, banking and asset-management businesses, has a market cap of $44.03 billion. Its revenue of $10.61 billion has risen at an average annual rate of 13% over the last five years.

The company's largest guru shareholder is Dodge & Cox with 7.86% of outstanding shares, followed by Al Gore (Trades, Portfolio) with 2.52% and PRIMECAP Management (Trades, Portfolio) with 2.26%.

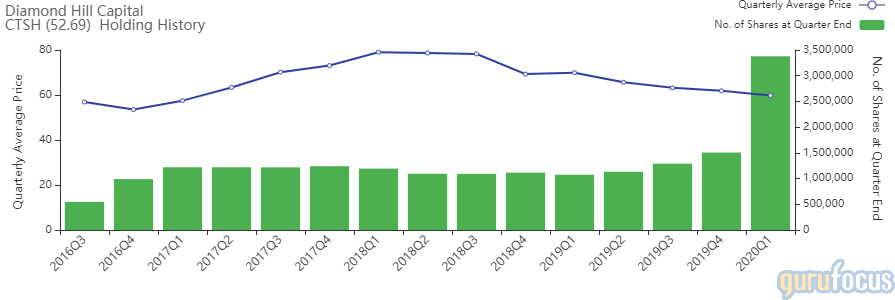

Cognizant Technology

The investor increased the Cognizant Technology Solutions Corp. (CTSH) holding by 16.78% in the fourth quarter and boosted it by 124.32% in the first quarter. The stock has a total weight of 1.07% in the portfolio.

The IT services provider has a market cap of $28.52 billion. Its revenue of $16.89 billion has grown 12% over the last five years.

Dodge & Cox is the largest guru shareholder of the company with 4.38% of outstanding shares, followed by Al Gore (Trades, Portfolio) with 2.96% and Pzena with 1.64%.

Franklin Resources

In the fourth quarter, the guru increased the Franklin Resources Inc. (BEN) position by 9.55%, then raised it another 67.07% in the first quarter. The stock has a total weight of 0.03% in the portfolio.

The investment services provider has a market cap of $9.08 billion. Its revenue of $5.68 billion has fallen at an average annual rate of 3.02% over the last five years.

Other notable guru shareholders of the company include David Abrams (Trades, Portfolio) with 1.96% of outstanding shares, T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.80% and Prem Watsa (Trades, Portfolio)'s Fairfax Financial Holding with 0.20%.

Noble Energy

The firm bolstered the Noble Energy Inc. (NBL) position by 12.3% in the fourth quarter and then raised it by 681.33% in the first quarter. The stock has a weight of 0.09% in the portfolio.

The independent oil and gas producer has a market cap of $4.52 billion. Its revenue of $4.40 billion has fallen at an average annual rate of 2.50% over the last five years.

The largest guru shareholder of the company is Steven Cohen (Trades, Portfolio)'s Point72 Asset Mangement with 1.13% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.76%.

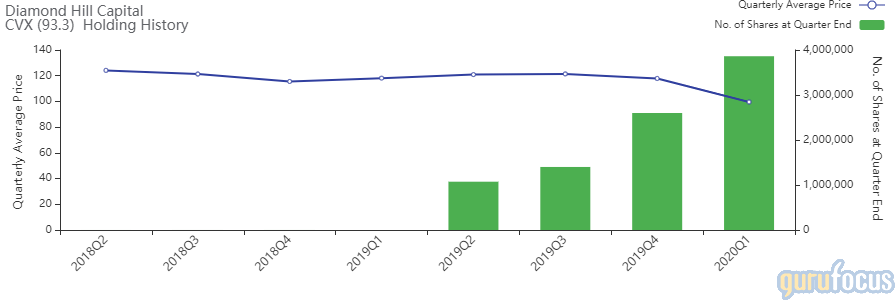

Chevron

In the fourth quarter, the guru added to the Chevron Corp. (CVX) position by 85.58%, then raised it by 48.53% in the first quarter. The stock has a weight of 1.90% in the portfolio.

The energy company has a market cap of $174.19 billion. Its revenue of $135.38 billion has fallen at an average annual rate of 3.10% over the last five years.

The largest guru shareholder of the company is Ken Fisher (Trades, Portfolio) with 0.27% of outstanding shares, followed by Diamond Hill Capital (Trades, Portfolio) with 0.21% and Barrow, Hanley, Mewhinney & Strauss with 0.20%.

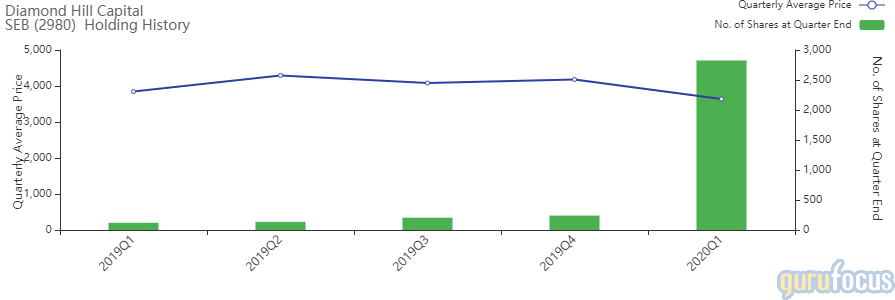

Seaboard

The firm boosted the Seaboard Corp. (SEB) stake by 17.07% in the fourth quarter and 1,077% in the first quarter. The stock has a weight of 0.05% in the portfolio.

The conglomerate has a market cap of $3.46 billion and an enterprise value of $3.87 billion. Its revenue of $6.98 billion has risen 2.60% over the last five years.

The company's largest guru shareholder is Kahn Brothers (Trades, Portfolio) with 1.10% of outstanding shares, followed by Renaissance Technologies with 0.63% and Third Avenue Management (Trades, Portfolio) with 0.15%.

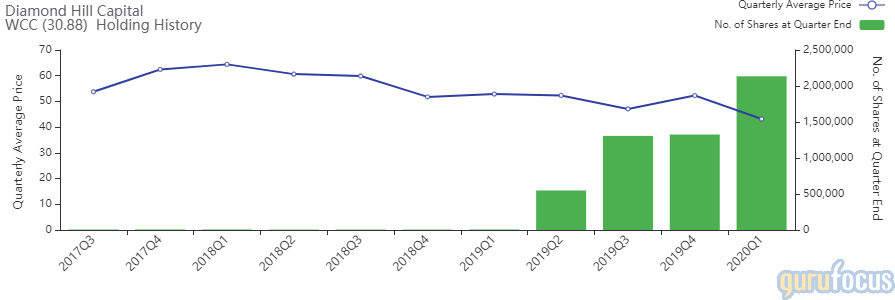

WESCO

The investor increased the WESCO International Inc. (WCC) holding by 1.45% in the fourth quarter and raised it by 61.01% in the first quarter. The stock has a total weight of 0.33% in the portfolio.

The company, which operates in the industrial distribution industry, has a market cap of $1.29 billion. Its revenue of $8.366 billion has risen 5.30% over the last five years.

Other notable shareholders include Robert Olstein (Trades, Portfolio) with 5.10% of outstanding shares, Simons' firm 0.67% and Bernard Horn (Trades, Portfolio) with 0.25%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Lone Pine Capital Exits Salesforce, Union Pacific

Point72 Asset Management Buys Micron Technology, Baxter

Gotham Asset Management Trims Apple, Bristol-Meyers

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance