839,000 savers left in limbo as Children's Bond scheme closes next month

The future of more than 800,000 children’s savings bonds is up in the air.

National Savings & Investments has confirmed that the scheme – which has about £500m invested in it by tens of thousands of grandparent, mums and dads – will no longer be available to new savers from September.

The Children’s Bond is being replaced by a Junior ISA – but it is not clear what will happen to the 839,000 accounts already opened.

MORE: 24% of parents have moved home to be in school catchment area, says survey

They will be maturing at different times but are typically fixed for a five-year term, most recently from April offering 2% tax-free fixed for that period.

Savers could renew the deal for a further term until five years after the child’s 16th birthday. However, NS&I has not revealed what happens now to existing bonds, whether they will be transferred to the new Junior ISA, can be cashed in or moved into other savings options.

The NS&I said: “After reviewing the accounts and investments we offer for children under 16, Children’s Bonds will be closing to new sales from September 2017.

MORE: Top fixed-rate bonds launched, but only for banking app customers

“Any existing customers holding Children’s Bonds will be able to keep the product until their current term matures.

“We will be writing to customers whose bonds are approaching maturity to explain what their options are.”

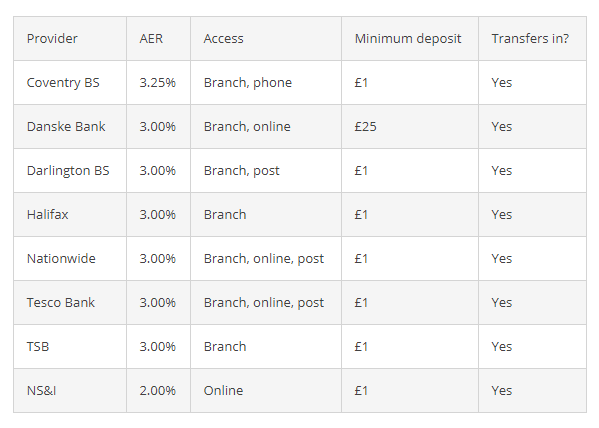

The cash Junior ISA went live last month offering a 2% tax-free/AER (variable) interest rate and has a maximum subscription limit of £4,128 for the 2017/18 tax year.

The Junior ISA comes with 100% capital security guarantee as NS&I is backed by HM Treasury.

However, it is only available online and can only be managed online – which again could hamper older people not up to speed with internet saving and banking.

MORE: Death of the commuter belt? Move back to London and save £11,000 a year

Jill Waters, acting retail director at NS&I, added: “More money is now deposited with NS&I online than any other individual sales channel and our Junior ISA offers parents a simple and modern account for their children’s savings.

“Our new Junior ISA will also allow third-parties to deposit into the product electronically, which means that grandparents and other relatives and friends of the child or family can add additional funds once the account has been opened.”

Yahoo Finance

Yahoo Finance