The 9.4% return this week takes Aclaris Therapeutics' (NASDAQ:ACRS) shareholders one-year gains to 510%

Some Aclaris Therapeutics, Inc. (NASDAQ:ACRS) shareholders are probably rather concerned to see the share price fall 30% over the last three months. But that isn't a problem when you consider how the share price has soared over the last year. In that time, shareholders have had the pleasure of a 510% boost to the share price. So the recent fall isn't enough to negate the good performance. The real question is whether the fundamental business performance can justify the strong increase over the long term. We love happy stories like this one. The company should be really proud of that performance!

Since the stock has added US$77m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Aclaris Therapeutics

Given that Aclaris Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Aclaris Therapeutics grew its revenue by 20% last year. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 510% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Aclaris Therapeutics.

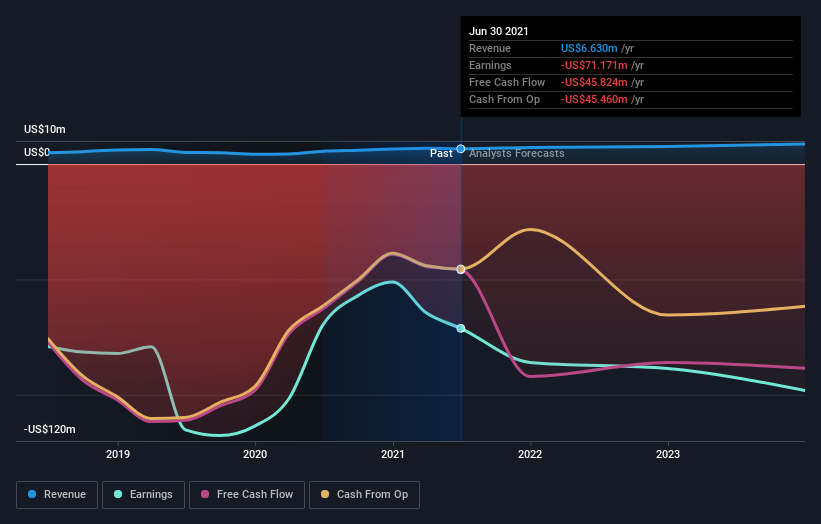

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Aclaris Therapeutics shareholders have received a total shareholder return of 510% over the last year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 5 warning signs for Aclaris Therapeutics you should be aware of, and 1 of them is concerning.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance